Region:Global

Author(s):Geetanshi

Product Code:KRAA2784

Pages:95

Published On:August 2025

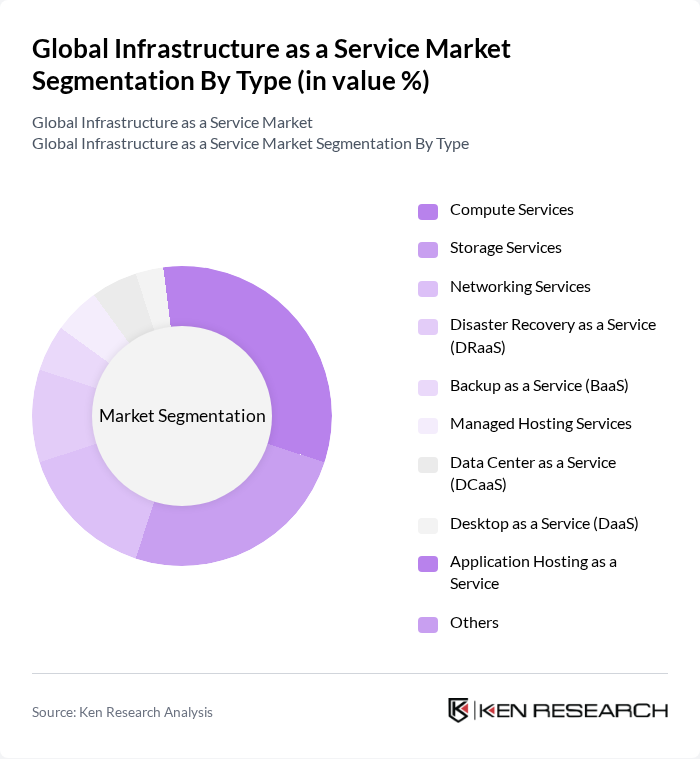

By Type:The market is segmented into Compute Services, Storage Services, Networking Services, Disaster Recovery as a Service (DRaaS), Backup as a Service (BaaS), Managed Hosting Services, Data Center as a Service (DCaaS), Desktop as a Service (DaaS), Application Hosting as a Service, and Others. Among these, Compute Services and Storage Services are the most prominent segments, driven by the increasing need for processing power, data storage, and rapid scalability to support digital business models and AI-driven workloads .

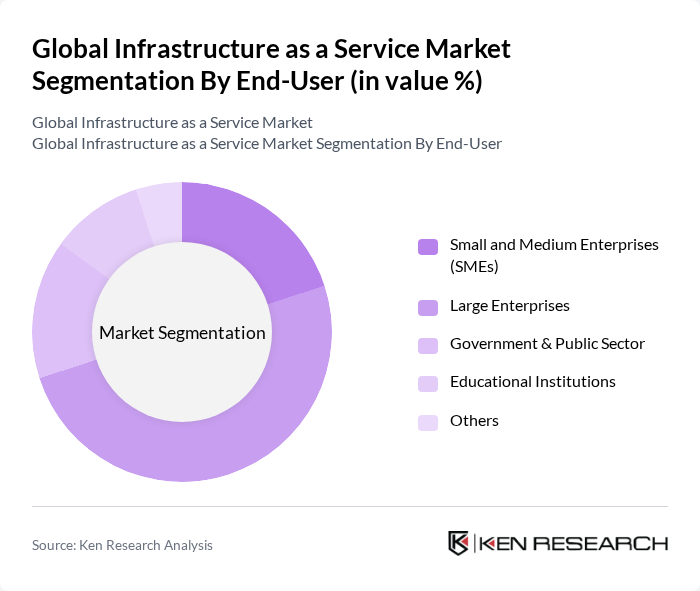

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government & Public Sector, Educational Institutions, and Others. Large Enterprises dominate the market due to their extensive IT requirements, need for scalable solutions to manage vast amounts of data and applications, and early adoption of hybrid and multi-cloud strategies .

The Global Infrastructure as a Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services, Inc., Microsoft Corporation (Azure), Google Cloud Platform (Google LLC), IBM Cloud (International Business Machines Corporation), Oracle Corporation, Alibaba Cloud (Alibaba Group Holding Limited), DigitalOcean, LLC, Rackspace Technology, Inc., VMware, Inc., Salesforce, Inc., Linode, LLC (an Akamai Company), OVHcloud, Tencent Cloud (Tencent Holdings Limited), Huawei Cloud (Huawei Technologies Co., Ltd.), Vultr Holdings Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the IaaS market appears promising, driven by technological advancements and evolving business needs. As organizations increasingly adopt multi-cloud strategies, the demand for integrated solutions will rise. Additionally, the focus on sustainability will push providers to innovate greener cloud solutions. The integration of AI and machine learning into cloud services will enhance operational efficiency, enabling businesses to leverage data-driven insights for better decision-making and competitive advantage.

| Segment | Sub-Segments |

|---|---|

| By Type | Compute Services Storage Services Networking Services Disaster Recovery as a Service (DRaaS) Backup as a Service (BaaS) Managed Hosting Services Data Center as a Service (DCaaS) Desktop as a Service (DaaS) Application Hosting as a Service Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government & Public Sector Educational Institutions Others |

| By Industry Vertical | IT and Telecommunications Banking, Financial Services, and Insurance (BFSI) Healthcare Retail & E-commerce Manufacturing Media & Entertainment Government & Education Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Service Model | IaaS (Infrastructure as a Service) PaaS (Platform as a Service) SaaS (Software as a Service) |

| By Geographic Presence | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Pricing Model | Pay-as-you-go Subscription-based Reserved Instances Spot Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise IaaS Adoption | 120 | IT Managers, Cloud Architects |

| SME Cloud Utilization | 90 | Business Owners, IT Consultants |

| Public Sector Cloud Strategies | 60 | Government IT Officials, Policy Makers |

| Healthcare Cloud Solutions | 50 | Healthcare IT Directors, Compliance Officers |

| Financial Services Cloud Integration | 70 | Chief Technology Officers, Risk Management Heads |

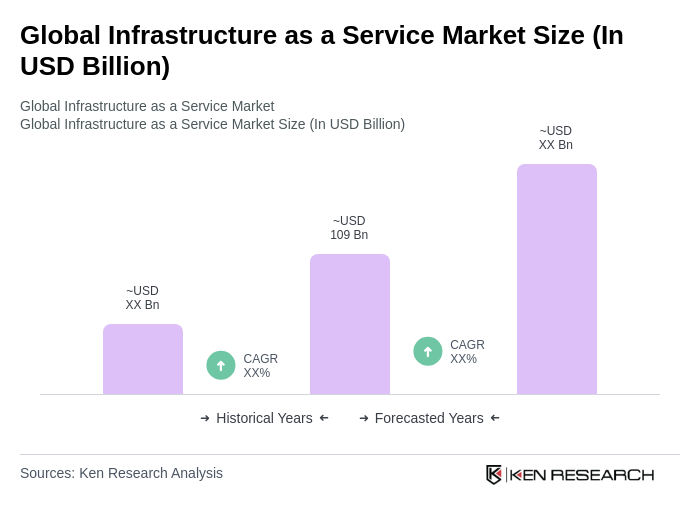

The Global Infrastructure as a Service Market is valued at approximately USD 109 billion, reflecting significant growth driven by the increasing adoption of cloud computing and digital transformation initiatives across various industries.