Region:Global

Author(s):Shubham

Product Code:KRAA2691

Pages:94

Published On:August 2025

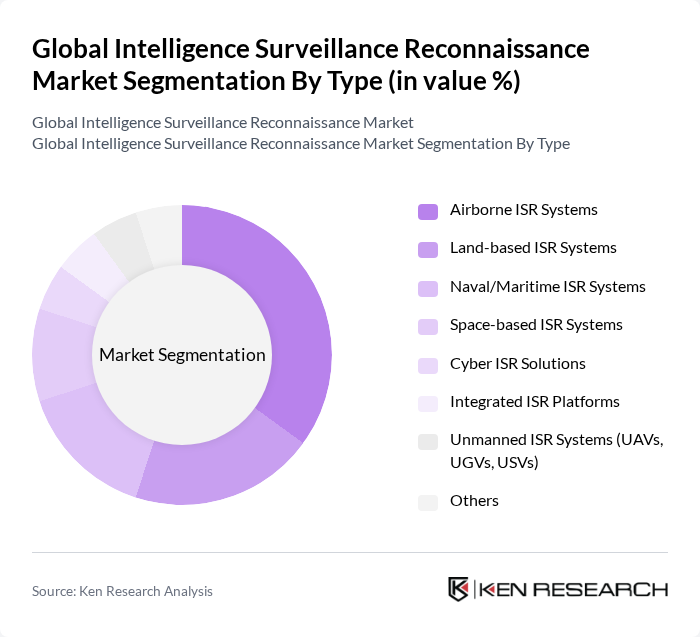

By Type:The market is segmented into various types of ISR systems, including Airborne ISR Systems, Land-based ISR Systems, Naval/Maritime ISR Systems, Space-based ISR Systems, Cyber ISR Solutions, Integrated ISR Platforms, Unmanned ISR Systems (UAVs, UGVs, USVs), and Others. Among these, Airborne ISR Systems are leading due to their versatility, rapid deployment, and effectiveness in gathering intelligence over extensive and hard-to-reach areas. The increasing deployment of drones, advanced aircraft, and persistent surveillance platforms is driving this segment's growth, with a growing emphasis on multi-domain ISR integration and AI-powered analytics.

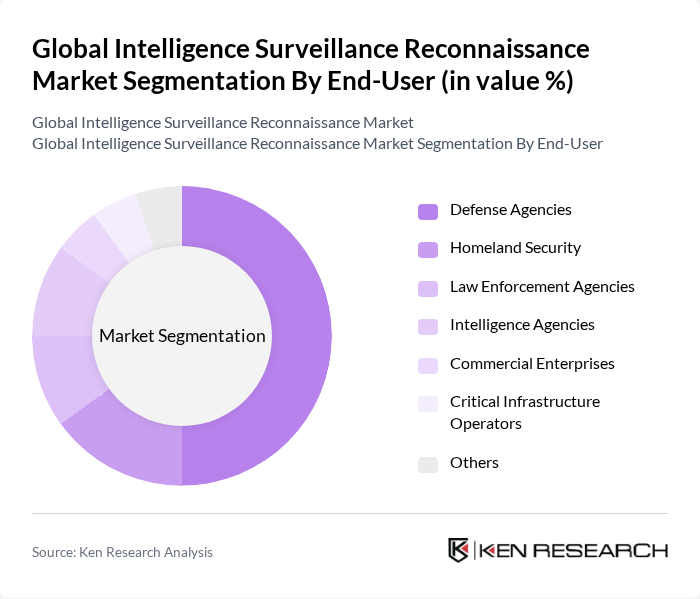

By End-User:The end-user segmentation includes Defense Agencies, Homeland Security, Law Enforcement Agencies, Intelligence Agencies, Commercial Enterprises, Critical Infrastructure Operators, and Others. Defense Agencies dominate this segment due to their substantial budgets, modernization priorities, and the critical need for advanced ISR capabilities to ensure national security. The increasing focus on counter-terrorism, border security, and multi-domain operations further drives demand from this sector, while public safety and critical infrastructure operators are expanding adoption for threat detection and incident response.

The Global Intelligence Surveillance Reconnaissance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Northrop Grumman Corporation, Lockheed Martin Corporation, The Boeing Company, RTX Corporation (formerly Raytheon Technologies Corporation), Thales Group, Elbit Systems Ltd., General Dynamics Corporation, BAE Systems plc, L3Harris Technologies, Inc., Leonardo S.p.A., Saab AB, Textron Inc., Teledyne FLIR LLC (formerly FLIR Systems, Inc.), Airbus S.A.S., Rheinmetall AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ISR market in the None region appears promising, driven by ongoing technological innovations and increasing defense budgets. As nations prioritize national security, the integration of AI and machine learning into surveillance systems will enhance operational capabilities. Additionally, the shift towards cloud-based solutions will facilitate real-time data sharing and analytics, improving decision-making processes. These trends indicate a robust growth trajectory for ISR technologies, positioning the market for significant advancements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Airborne ISR Systems Land-based ISR Systems Naval/Maritime ISR Systems Space-based ISR Systems Cyber ISR Solutions Integrated ISR Platforms Unmanned ISR Systems (UAVs, UGVs, USVs) Others |

| By End-User | Defense Agencies Homeland Security Law Enforcement Agencies Intelligence Agencies Commercial Enterprises Critical Infrastructure Operators Others |

| By Application | Border Security Maritime Surveillance Military Operations Public Safety Critical Infrastructure Protection Disaster Management Urban Surveillance Counter-Terrorism Environmental Monitoring Others |

| By Component | Hardware (Sensors, Radars, Cameras, Sonars, Communication Systems) Software (Data Analytics, AI/ML, Cybersecurity) Services (System Integration, Maintenance, Data Analysis, Consulting) |

| By Platform | Land Airborne Naval Space |

| By Deployment | On-premises Cloud-based Hybrid |

| By Technology | Artificial Intelligence Machine Learning Big Data Analytics Internet of Things (IoT) Quantum Computing Blockchain Cybersecurity Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military ISR Program Managers | 100 | Program Directors, Defense Analysts |

| Commercial ISR Technology Providers | 80 | Product Managers, Business Development Executives |

| Government Defense Procurement Officials | 70 | Procurement Officers, Policy Advisors |

| Research Institutions Focused on ISR | 50 | Research Scientists, Technology Analysts |

| Operational Commanders Utilizing ISR | 60 | Field Commanders, Tactical Operations Officers |

The Global Intelligence Surveillance Reconnaissance Market is valued at approximately USD 50 billion, driven by increasing border security concerns, advancements in unmanned aerial vehicles, and the demand for real-time situational awareness in defense and public safety sectors.