Region:Global

Author(s):Geetanshi

Product Code:KRAD4858

Pages:100

Published On:December 2025

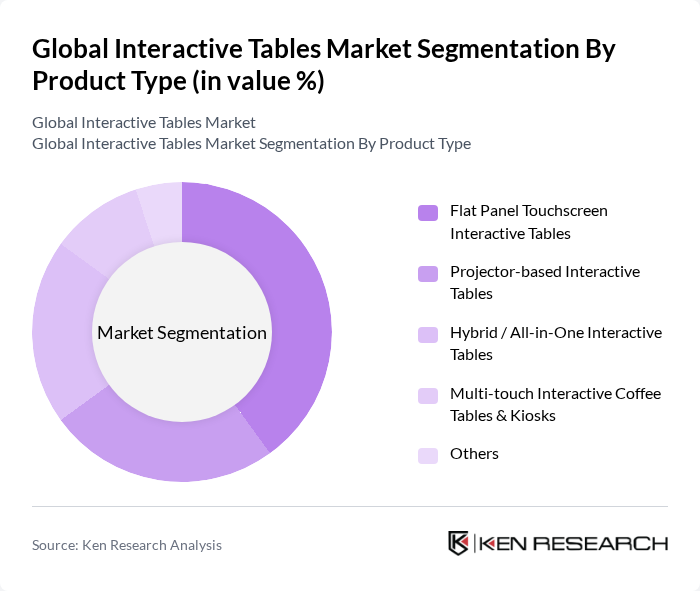

By Product Type:The product type segmentation includes various categories such as Flat Panel Touchscreen Interactive Tables, Projector-based Interactive Tables, Hybrid / All-in-One Interactive Tables, Multi-touch Interactive Coffee Tables & Kiosks, and Others. Flat panel touchscreen interactive tables account for the largest share of deployments, reflecting the broader dominance of flat?panel, large?format displays and interactive whiteboard–style products in education and corporate environments, due to their thin form factor, higher resolution, and easier integration with existing AV and IT infrastructure. Their user?friendly interface, multi?touch support, and versatility across classrooms, meeting rooms, retail, hospitality, and public installations have significantly boosted their adoption compared with projector?based systems, which are more niche and often used where large projected surfaces or lower upfront hardware costs are prioritized.

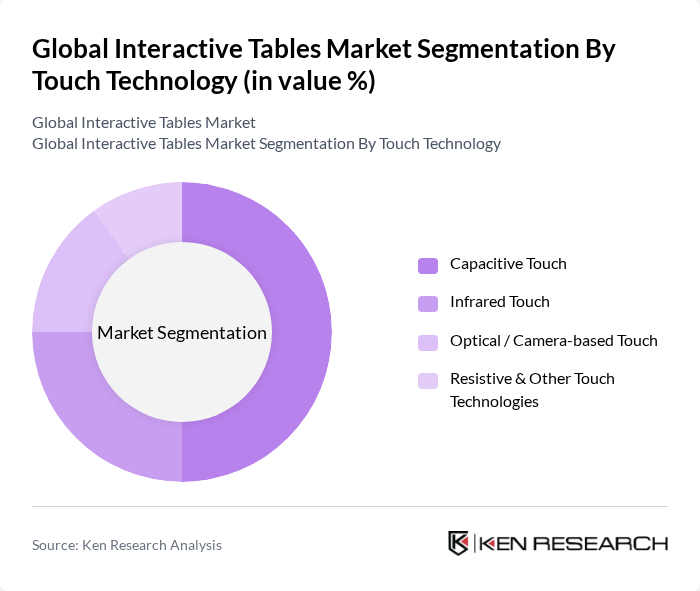

By Touch Technology:The touch technology segmentation encompasses Capacitive Touch, Infrared Touch, Optical / Camera-based Touch, and Resistive & Other Touch Technologies. Capacitive touch has become the most widely adopted technology in modern interactive tables and related large?format touch displays due to its high responsiveness, multi?touch accuracy, and compatibility with familiar smartphone?like gestures, which improves the user experience and reduces training needs in education and corporate environments. Infrared and optical/camera?based technologies remain important, particularly for very large surfaces and specialized multi?user tables where bezel?mounted or overhead sensors can be advantageous, while resistive and other legacy technologies are gradually declining as end users migrate toward more durable, high?clarity capacitive?based solutions.

The Global Interactive Tables Market is characterized by a dynamic mix of regional and international players. Leading participants such as SMART Technologies ULC, Promethean World Ltd, SMART kapp / Nureva Inc., TableConnect GmbH, Digital Touch Systems, Inc., Ideum, Inc., SMARTdesks (Datum Filings LLC), eyefactive GmbH, Vertigo Systems GmbH, PresTop BV, Horizon Display, Inc., ZaagTech Intelligent Technology Co., Ltd., PQ Labs, Inc., Newsan SA (TELACC Interactive Tables), Advantech Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space, offering solutions that span education, corporate collaboration, public installations, retail, and hospitality.

The future of interactive tables appears promising, driven by increasing investments in educational technology and corporate training. As organizations prioritize digital transformation, the integration of interactive tables into learning environments is expected to accelerate. Furthermore, the growing trend of hybrid learning models will likely enhance the demand for these solutions, fostering collaboration and engagement. Companies that innovate and adapt to user needs will thrive, positioning themselves favorably in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Flat Panel Touchscreen Interactive Tables Projector-based Interactive Tables Hybrid / All-in-One Interactive Tables Multi-touch Interactive Coffee Tables & Kiosks Others |

| By Touch Technology | Capacitive Touch Infrared Touch Optical / Camera-based Touch Resistive & Other Touch Technologies |

| By Screen Size | Up to 32 Inches –55 Inches Above 55 Inches |

| By End-User | Education (K-12 and Higher Education) Corporate & Enterprises Healthcare & Medical Facilities Retail & Showrooms Museums, Exhibitions & Public Spaces Hospitality & Entertainment Others |

| By Application | Training and Education Business Presentations & Meeting Rooms Interactive Gaming & Entertainment Wayfinding, Information & Self-Service Product Visualization & Sales Enablement Collaborative Workspaces & Design Studios Others |

| By Distribution Channel | Direct Sales (OEMs & System Integrators) Online (E-commerce & Vendor Portals) Offline (Value-Added Resellers & Retail) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Educational Institutions | 120 | IT Directors, Educational Technologists |

| Corporate Training Departments | 100 | Training Managers, Learning & Development Heads |

| Event Management Companies | 80 | Event Coordinators, Venue Managers |

| Hospitality Sector | 70 | Operations Managers, Guest Experience Directors |

| Retail Environments | 60 | Store Managers, Marketing Executives |

The Global Interactive Tables Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the increasing adoption of interactive technologies across various sectors, including education, corporate, retail, and healthcare environments.