Region:Global

Author(s):Geetanshi

Product Code:KRAD7934

Pages:81

Published On:December 2025

By Material Type:The material type segmentation includes various subsegments such as Polyethylene (PE) Liners, Polypropylene (PP) Liners, Nylon Liners, Polyethylene Terephthalate (PET) Liners, and Composite Liners. Among these, Polyethylene (PE) Liners dominate the market due to their excellent chemical resistance, flexibility, and cost-effectiveness, making them the preferred choice for a wide range of applications. The increasing demand for lightweight and durable packaging solutions further supports the growth of this subsegment.

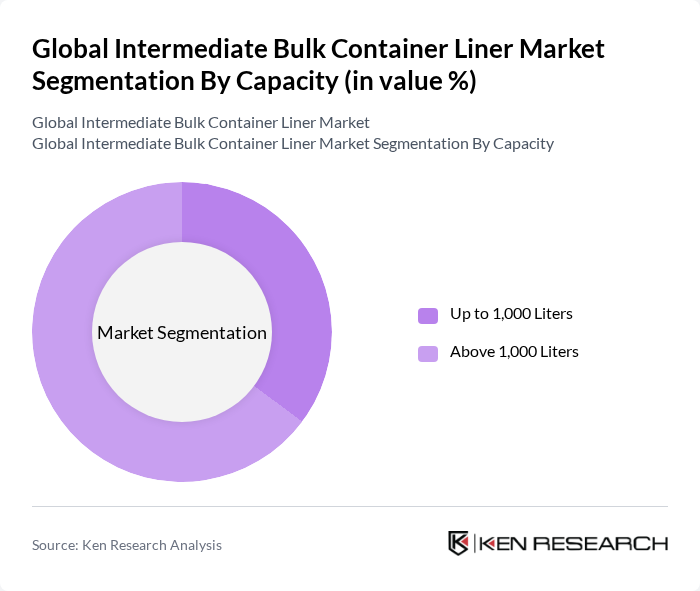

By Capacity:The capacity segmentation includes up to 1,000 Liters and above 1,000 Liters. The above 1,000 Liters capacity segment is currently leading the market with approximately 64.8% market share, driven by its versatility and suitability for transporting large volumes of bulk liquids and semi-liquids across long distances. This capacity range is particularly favored in industries such as chemicals, food and beverages, and pharmaceuticals, where efficient handling and storage are critical. Industries rely on high-capacity containers to improve logistics efficiency, reduce handling time, and maintain product purity while reducing contamination risks.

The Global Intermediate Bulk Container Liner Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Sealed Air Corporation, CHEP (Commonwealth Handling Equipment Pool), Arena Products, Scholle IPN, Liquibox Corporation, ILC Dover, Greif, Inc., Smurfit Kappa Group, Steripac Group Limited, Schütz GmbH & Co. KGaA, Mauser Packaging Solutions, Hoover Container Solutions, Myers Industries, Inc., Mondi Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the intermediate bulk container liner market appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt eco-friendly materials and innovative designs, the market is likely to witness significant transformations. Additionally, the integration of smart technology into liners is expected to enhance functionality and efficiency, catering to the evolving needs of various industries. This dynamic landscape will create new opportunities for growth and collaboration among stakeholders in the logistics and packaging sectors.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Polyethylene (PE) Liners Polypropylene (PP) Liners Nylon Liners Polyethylene Terephthalate (PET) Liners Composite Liners |

| By Capacity | Less than 500 Liters 500 to 1,000 Liters 1,000 to 2,000 Liters More than 2,000 Liters |

| By Design Type | Open-Top Liners Closed-Top Liners Drum Liners Cube Liners |

| By Application | Chemicals and Petrochemicals Food and Beverages Pharmaceuticals Agriculture Industrial Liquids |

| By Discharge Mechanism | Bottom Discharge Top Discharge Valved Discharge Gravity Discharge |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Usage Type | Single-use Liners Reusable Liners |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chemical Industry Applications | 120 | Procurement Managers, Operations Directors |

| Food and Beverage Sector | 100 | Quality Assurance Managers, Supply Chain Coordinators |

| Pharmaceutical Packaging | 90 | Regulatory Affairs Specialists, Production Managers |

| Logistics and Transportation | 110 | Logistics Coordinators, Fleet Managers |

| Environmental Sustainability Initiatives | 80 | Sustainability Officers, Product Development Managers |

The Global Intermediate Bulk Container Liner Market is valued at approximately USD 1.3 billion. This growth is driven by the increasing demand for safe and efficient transportation of bulk liquids and powders across various industries, including chemicals, food and beverages, and pharmaceuticals.