Region:Middle East

Author(s):Dev

Product Code:KRAA8318

Pages:91

Published On:November 2025

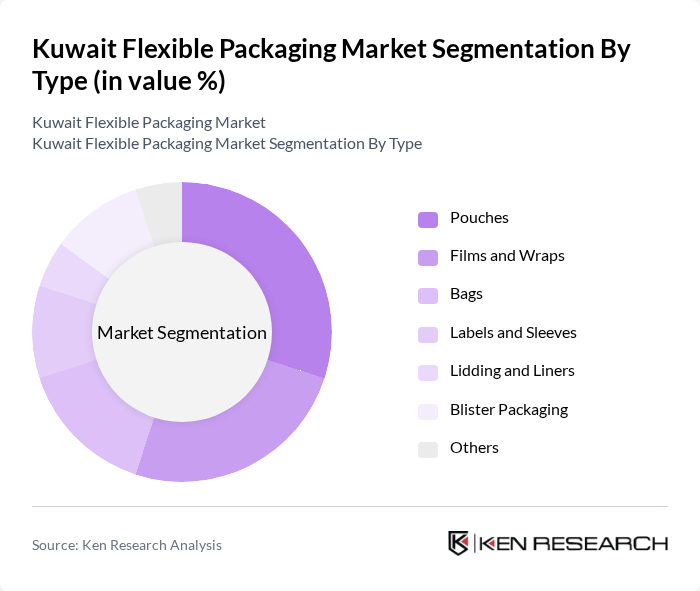

By Type:The flexible packaging market in Kuwait is segmented into pouches, films and wraps, bags, labels and sleeves, lidding and liners, blister packaging, and others. Pouches and films and wraps are particularly popular due to their versatility, lightweight nature, and convenience for packaging a wide range of products, especially in the food, beverage, and pharmaceutical sectors. The adoption of stand-up pouches and resealable films is rising, driven by consumer demand for convenience and product freshness.

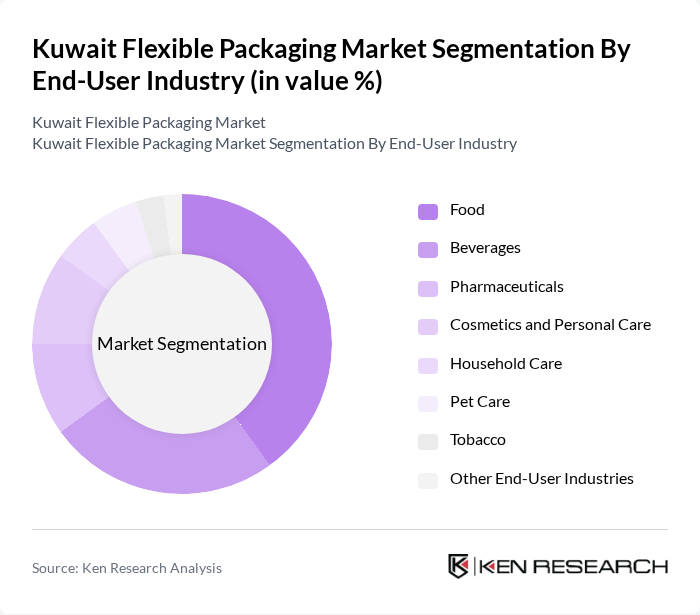

By End-User Industry:The flexible packaging market serves a diverse range of end-user industries, including food, beverages, pharmaceuticals, cosmetics and personal care, household care, pet care, tobacco, and other sectors such as electronics and chemicals. The food and beverage sectors are the largest consumers of flexible packaging, supported by the growing demand for convenience foods, ready-to-eat meals, and processed products. The pharmaceutical industry is also experiencing increased adoption of flexible packaging formats, such as blister packs and sachets, due to stringent hygiene and safety requirements.

The Kuwait Flexible Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Plastic Industries Co. (Kuwait), Al Ahlia Plastic Industries Co., Kuwait Packing Materials Manufacturing Co. (K-PAK), Flex Pack Kuwait, United Packaging Industries Co., Al Rawan Printing Press Co., Al Watania Plastics (Kuwait), Al Qurain Plastic Industries Co., Al Mulla Group (Packaging Division), Al Babtain Plastic Industries, Al Sayer Franchising Co. (Packaging Division), Al Jazeera Packaging Co., Al Sabah Plastic Industries Co., Al Qatami Plastic Industries, Al Mahmoud Plastic Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the flexible packaging market in Kuwait appears promising, driven by ongoing innovations and a strong consumer shift towards sustainable practices. As the demand for eco-friendly and smart packaging solutions grows, companies are likely to invest in advanced technologies to enhance product offerings. Additionally, the expansion of e-commerce will further boost the need for flexible packaging, as businesses seek to optimize their supply chains and meet consumer expectations for convenience and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Pouches Films and Wraps Bags Labels and Sleeves Lidding and Liners Blister Packaging Others |

| By End-User Industry | Food Beverages Pharmaceuticals Cosmetics and Personal Care Household Care Pet Care Tobacco Other End-User Industries (Electronics, Chemicals, Agriculture, etc.) |

| By Material | Plastics (Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Others) Paper Aluminum Foil Compostable/Bioplastics (PLA, PBS, PHA, PBAT, etc.) Others |

| By Application | Food Packaging Beverage Packaging Pharmaceutical Packaging Cosmetic and Personal Care Packaging Household and Industrial Packaging Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Convenience Stores Direct Sales Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Mubarak Al-Kabeer Governorate Jahra Governorate Others |

| By Sustainability Level | Biodegradable Packaging Recyclable Packaging Compostable Packaging Conventional Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 120 | Packaging Managers, Product Development Leads |

| Pharmaceutical Packaging Solutions | 60 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Consumer Goods Packaging | 80 | Brand Managers, Supply Chain Coordinators |

| Industrial Packaging Applications | 50 | Operations Managers, Procurement Specialists |

| Sustainability Initiatives in Packaging | 40 | Sustainability Officers, Environmental Compliance Managers |

The Kuwait Flexible Packaging Market is valued at approximately USD 170 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for packaged food and beverages, along with advancements in packaging technology.