Region:Global

Author(s):Rebecca

Product Code:KRAC3233

Pages:81

Published On:October 2025

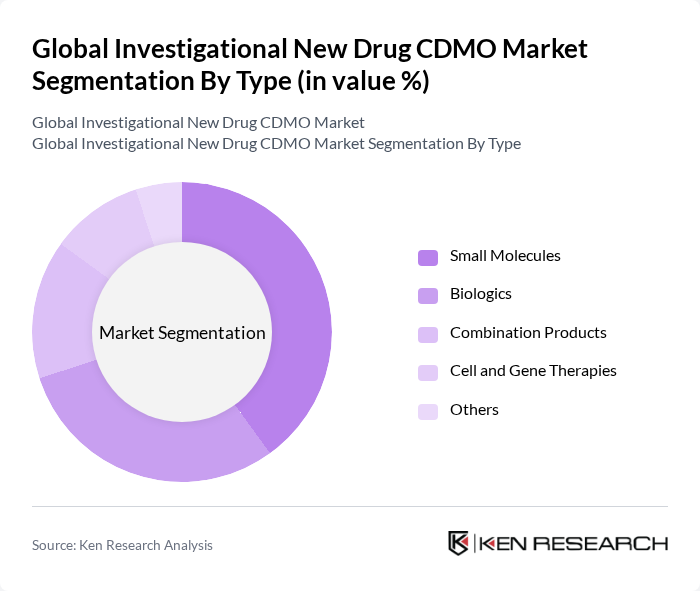

By Type:The market is segmented into various types, including Small Molecules, Biologics, Combination Products, Cell and Gene Therapies, and Others. Each of these segments plays a crucial role in the overall market dynamics, with specific applications and demand drivers.

The Small Molecules segment dominates the market due to its extensive use in various therapeutic areas, including oncology and cardiovascular diseases. The established manufacturing processes and lower production costs associated with small molecules make them a preferred choice for many pharmaceutical companies. Additionally, the increasing prevalence of chronic diseases and the need for effective treatments further drive the demand for small molecules in the CDMO market .

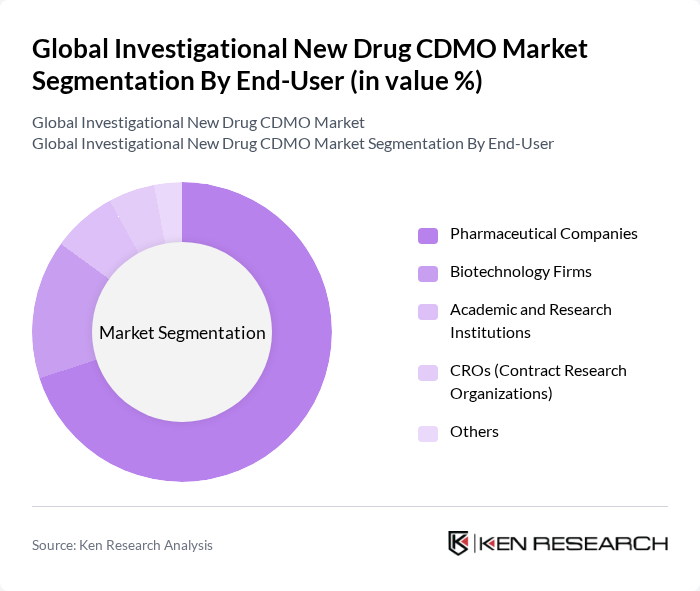

By End-User:The market is segmented by end-users, including Pharmaceutical Companies, Biotechnology Firms, Academic and Research Institutions, CROs (Contract Research Organizations), and Others. Each segment has unique requirements and contributes differently to the market landscape.

Pharmaceutical Companies represent the largest end-user segment, driven by their need for efficient and cost-effective drug development and manufacturing solutions. The increasing complexity of drug formulations and the rising number of clinical trials necessitate the expertise and capabilities offered by CDMOs. The trend towards outsourcing non-core activities allows pharmaceutical companies to focus on their core competencies while leveraging the specialized services of CDMOs. Biotechnology firms are also increasing their reliance on CDMOs for advanced therapies, while academic and research institutions contribute to early-stage development and innovation .

The Global Investigational New Drug CDMO Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lonza Group AG, Catalent, Inc., WuXi AppTec, Thermo Fisher Scientific Inc., Recipharm AB, Samsung Biologics, Patheon N.V., Evonik Industries AG, Aenova Group, Siegfried Holding AG, CordenPharma, Jubilant Pharmova Limited, Cambrex Corporation, Syngene International Limited, Charles River Laboratories International, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the investigational new drug CDMO market appears promising, driven by technological advancements and an increasing focus on personalized medicine. As companies continue to invest in digital technologies and artificial intelligence, the efficiency of drug development processes is expected to improve significantly. Furthermore, the ongoing expansion of clinical trials, particularly in emerging markets, will create new opportunities for CDMOs to enhance their service offerings and cater to diverse therapeutic needs, ensuring sustained growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Small Molecules Biologics Combination Products Cell and Gene Therapies Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Academic and Research Institutions CROs (Contract Research Organizations) Others |

| By Service Type | Drug Development Services Manufacturing Services Analytical & Quality Services Regulatory Services Process Optimization Others |

| By Therapeutic Area | Oncology Cardiovascular Neurology Infectious Diseases Rare Diseases Others |

| By Clinical Phase | Phase I Phase II Phase III Preclinical Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Pricing Model | Fixed Pricing Cost-Plus Pricing Value-Based Pricing Risk-Sharing Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Development Services | 120 | R&D Directors, Project Managers |

| Biologics Manufacturing | 100 | Biotech Executives, Quality Control Managers |

| Small Molecule Production | 80 | Production Managers, Supply Chain Analysts |

| Regulatory Affairs Consulting | 70 | Regulatory Affairs Specialists, Compliance Officers |

| Packaging and Labeling Services | 60 | Packaging Engineers, Marketing Managers |

The Global Investigational New Drug CDMO Market is valued at approximately USD 5.7 billion, reflecting a significant growth trend driven by the increasing demand for outsourcing drug development and manufacturing processes in the pharmaceutical industry.