Region:Asia

Author(s):Dev

Product Code:KRAC2044

Pages:100

Published On:October 2025

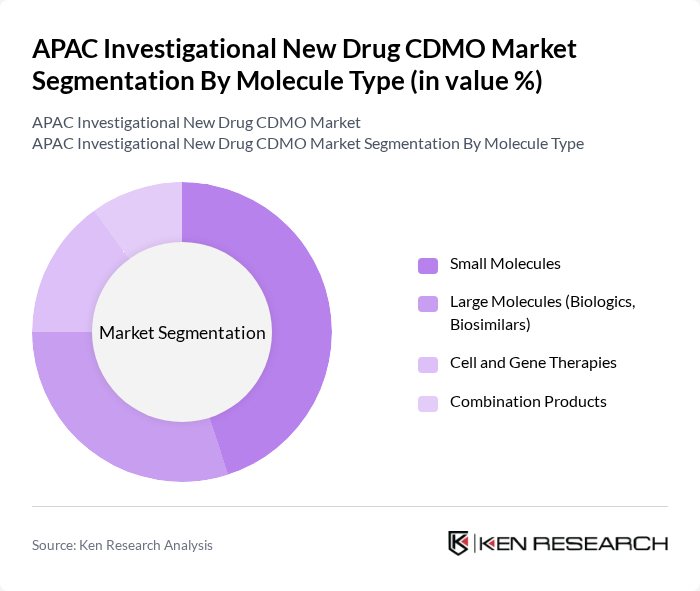

By Molecule Type:The market is segmented into four primary categories: Small Molecules, Large Molecules (Biologics, Biosimilars), Cell and Gene Therapies, and Combination Products. Among these, Small Molecules hold the largest share, supported by their established therapeutic use and extensive pipeline in oncology, infectious diseases, and metabolic disorders. Demand for biologics and biosimilars is rising rapidly, driven by advancements in biotechnology, increased prevalence of chronic and rare diseases, and growing adoption of monoclonal antibodies and recombinant proteins. Cell and gene therapies represent a fast-growing segment, reflecting expanding clinical trial activity and regulatory support for advanced therapies. Combination products are gaining traction in targeted and personalized medicine approaches.

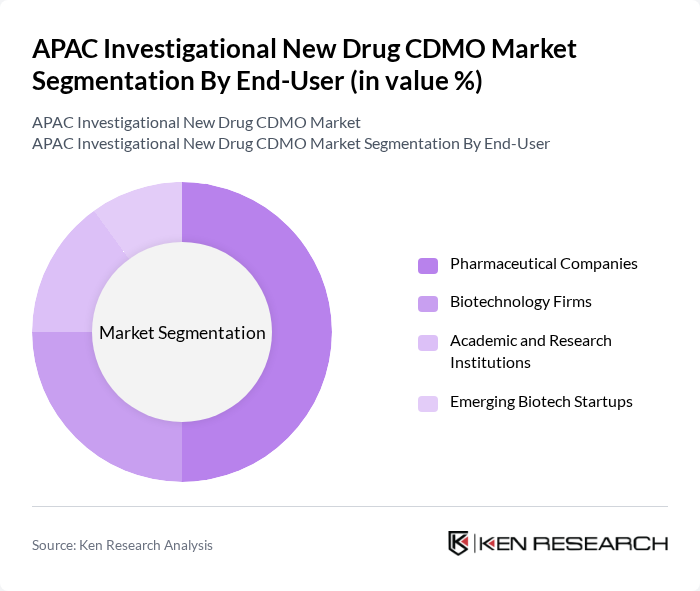

By End-User:The end-user segmentation includes Pharmaceutical Companies, Biotechnology Firms, Academic and Research Institutions, and Emerging Biotech Startups. Pharmaceutical Companies account for the largest share, leveraging extensive resources, established regulatory expertise, and robust clinical trial pipelines. Biotechnology Firms are significant contributors, driving innovation in biologics, biosimilars, and advanced therapies. Academic and research institutions play a crucial role in early-phase research, translational medicine, and collaborative projects with industry. Emerging biotech startups are increasingly active, supported by venture capital, incubator programs, and strategic alliances, particularly in cell and gene therapy development.

The APAC Investigational New Drug CDMO Market is characterized by a dynamic mix of regional and international players. Leading participants such as WuXi AppTec, Samsung Biologics, Pharmaron, Asymchem Laboratories, Lonza Group AG, Catalent, Inc., Patheon (Thermo Fisher Scientific), Recipharm AB, Jubilant Biosys Limited, Syngene International Limited, AGC Biologics, GenScript Biotech Corporation, BioDuro-Sundia, STA Pharmaceutical (WuXi STA), Celltrion, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC Investigational New Drug CDMO market is poised for transformative growth driven by technological advancements and an increasing focus on personalized medicine. As the region continues to embrace integrated service models, CDMOs are expected to enhance their offerings, providing end-to-end solutions. Additionally, the rise of cell and gene therapies will create new avenues for collaboration and innovation, positioning APAC as a leader in the global biopharmaceutical landscape. The interplay of these factors will shape the future dynamics of the market.

| Segment | Sub-Segments |

|---|---|

| By Molecule Type | Small Molecules Large Molecules (Biologics, Biosimilars) Cell and Gene Therapies Combination Products |

| By End-User | Pharmaceutical Companies Biotechnology Firms Academic and Research Institutions Emerging Biotech Startups |

| By Service Type | Drug Discovery & Preclinical Services Process Development & Optimization Clinical Trial Material Manufacturing Regulatory Submission & Consulting Analytical & Bioanalytical Services |

| By Therapeutic Area | Oncology Infectious Diseases Cardiovascular Neurology Rare Diseases Others |

| By Clinical Phase | Preclinical Phase I Phase II Phase III Others |

| By Country/Region | China Japan South Korea India Australia Southeast Asia Rest of APAC |

| By Pricing Model | Fixed Pricing Cost-Plus Pricing Value-Based Pricing Risk-Sharing/Performance-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Development Services | 120 | R&D Directors, Project Managers |

| Biologics Manufacturing | 100 | Quality Control Managers, Production Supervisors |

| Regulatory Affairs Consulting | 80 | Regulatory Affairs Specialists, Compliance Officers |

| Clinical Trial Supply Management | 70 | Clinical Operations Managers, Supply Chain Coordinators |

| Formulation Development Services | 90 | Formulation Scientists, Product Development Managers |

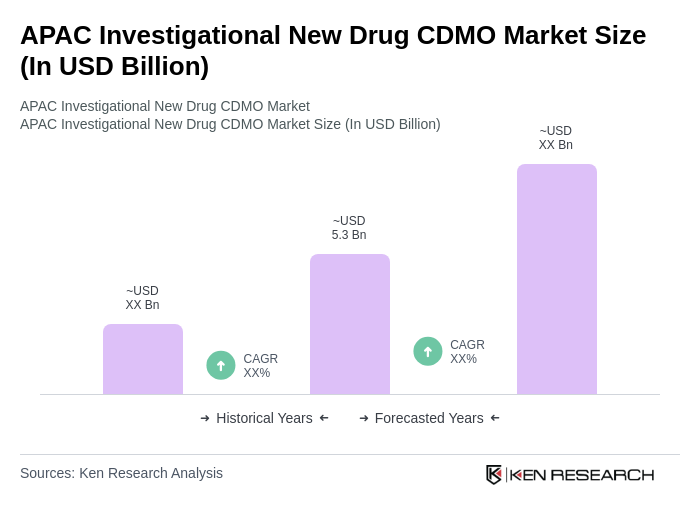

The APAC Investigational New Drug CDMO Market is valued at approximately USD 5.3 billion, reflecting a significant growth trend driven by increased demand for innovative drug development and rising investments in biotechnology across the region.