Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8246

Pages:87

Published On:November 2025

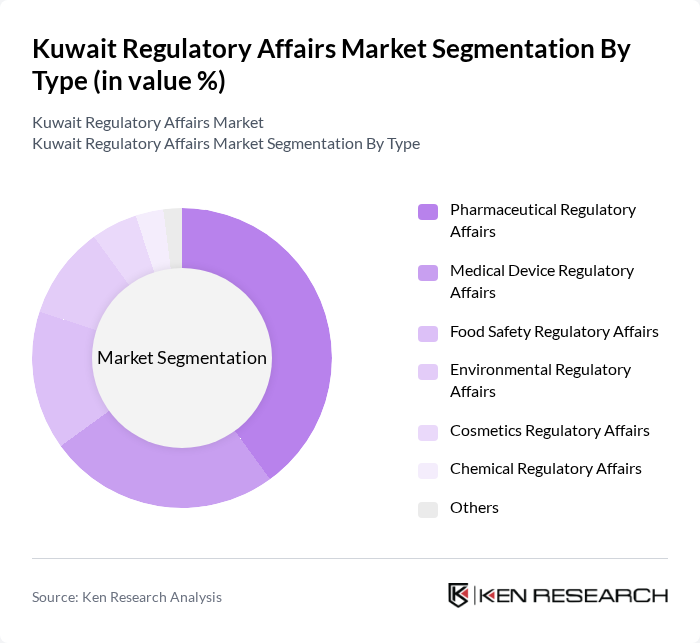

By Type:

The regulatory affairs market in Kuwait is segmented into various types, including Pharmaceutical Regulatory Affairs, Medical Device Regulatory Affairs, Food Safety Regulatory Affairs, Environmental Regulatory Affairs, Cosmetics Regulatory Affairs, Chemical Regulatory Affairs, and Others. Among these, Pharmaceutical Regulatory Affairs is the leading segment, driven by the increasing number of pharmaceutical companies operating in the region and the growing demand for compliance with international standards. The rise in healthcare expenditure, adoption of digital regulatory platforms, and the need for innovative therapies further bolster this segment's dominance .

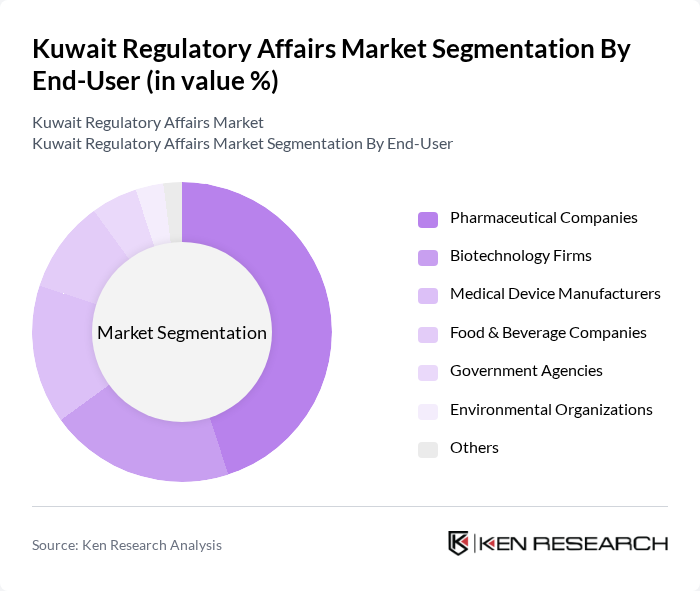

By End-User:

The end-user segmentation of the regulatory affairs market includes Pharmaceutical Companies, Biotechnology Firms, Medical Device Manufacturers, Food & Beverage Companies, Government Agencies, Environmental Organizations, and Others. Pharmaceutical Companies dominate this segment, driven by the increasing number of drug approvals, the need for compliance with stringent regulations, and the growing focus on research and development. The adoption of advanced regulatory management solutions and the expansion of local manufacturing capacity also contribute to the demand for regulatory services among these end-users .

The Kuwait Regulatory Affairs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Pharmaceutical Industries Company (Kuwait Pharma), Freyr Solutions, SGS Gulf Limited, Al-Dar Medical Regulatory Consultants, Kuwait Food and Nutrition Authority, BioKuwait Consulting, Ministry of Health – Kuwait (MOH), PharmaLex Kuwait, Kuwait Life Sciences Company (KLSC), Gulf Compliance Solutions, Environment Public Authority (EPA) Kuwait, Kuwait Quality Assurance Authority, Kuwait National Petroleum Company (KNPC), Kuwait Institute for Scientific Research (KISR), Kuwait University – Regulatory Affairs Program contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait regulatory affairs market appears promising, driven by ongoing government initiatives and the expansion of key sectors. As regulatory frameworks continue to evolve, businesses will increasingly seek expert guidance to navigate compliance challenges. The integration of digital solutions and AI technologies is expected to streamline regulatory processes, enhancing efficiency. Furthermore, collaboration with international regulatory bodies will likely facilitate knowledge transfer and best practices, positioning Kuwait as a regional hub for regulatory affairs expertise.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceutical Regulatory Affairs Medical Device Regulatory Affairs Food Safety Regulatory Affairs Environmental Regulatory Affairs Cosmetics Regulatory Affairs Chemical Regulatory Affairs Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Medical Device Manufacturers Food & Beverage Companies Government Agencies Environmental Organizations Others |

| By Sector | Healthcare Food and Beverage Cosmetics Chemicals Oil & Gas Others |

| By Service Type | Regulatory Consulting Services Regulatory Submissions & Registrations Compliance Audits & Inspections Training and Education Regulatory Intelligence & Monitoring Others |

| By Compliance Level | Full Compliance Partial Compliance Non-Compliance Others |

| By Geographic Focus | Local Market Regional Market International Market Others |

| By Regulatory Framework | National Regulations International Standards (e.g., ICH, WHO, GCC) Industry-Specific Regulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Regulatory Compliance | 60 | Regulatory Affairs Managers, Quality Assurance Directors |

| Food Safety Regulations | 50 | Food Safety Officers, Compliance Managers |

| Environmental Compliance in Manufacturing | 40 | Environmental Managers, Operations Directors |

| Healthcare Product Registration | 45 | Product Managers, Regulatory Specialists |

| Consumer Goods Regulatory Affairs | 42 | Compliance Officers, Legal Advisors |

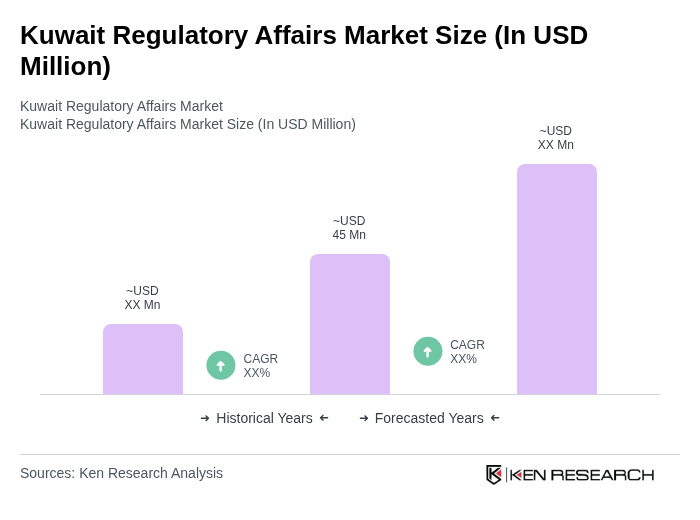

The Kuwait Regulatory Affairs Market is valued at approximately USD 45 million, reflecting a significant growth trend driven by increasing regulatory complexities and healthcare expenditures, alongside the expansion of the pharmaceutical and biotechnology sectors.