Region:Global

Author(s):Dev

Product Code:KRAA2528

Pages:98

Published On:August 2025

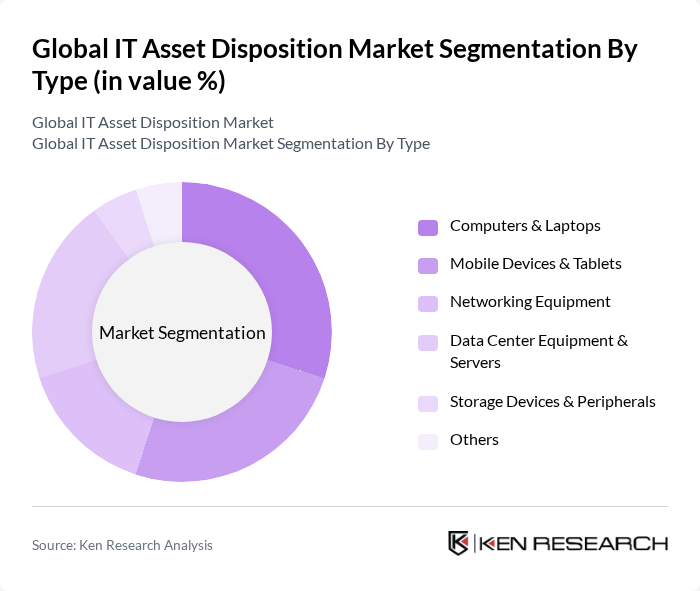

By Type:The market is segmented into various types of IT assets that require disposition services. The primary subsegments include Computers & Laptops, Mobile Devices & Tablets, Networking Equipment, Data Center Equipment & Servers, Storage Devices & Peripherals, and Others. Each of these subsegments plays a crucial role in the overall market dynamics, driven by the specific needs of businesses and consumers for secure and efficient asset disposal .

The Computers & Laptops subsegment dominates the market due to the high turnover rate of these devices in both corporate and consumer sectors. As organizations upgrade their technology, the need for secure disposal of old devices becomes paramount to prevent data breaches. Additionally, the increasing awareness of environmental sustainability and regulatory compliance drives the demand for responsible disposal methods, making this subsegment a key player in the IT asset disposition landscape .

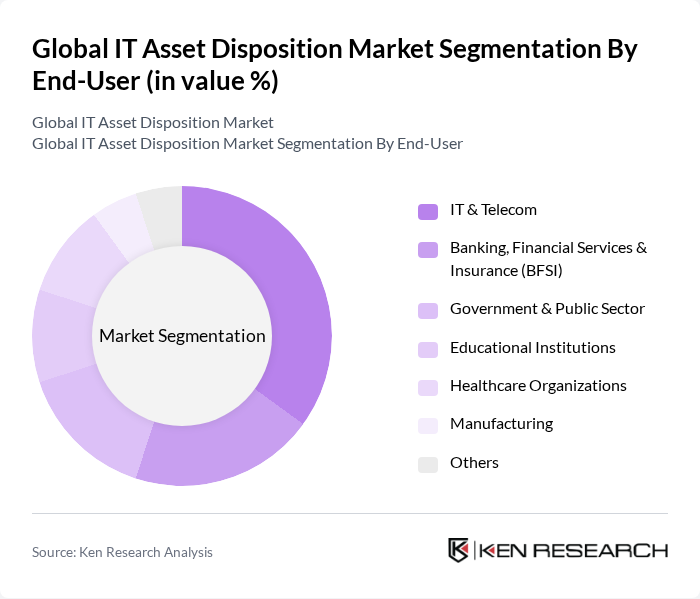

By End-User:The market is segmented by end-users, which include IT & Telecom, Banking, Financial Services & Insurance (BFSI), Government & Public Sector, Educational Institutions, Healthcare Organizations, Manufacturing, and Others. Each end-user segment has unique requirements and regulatory pressures that influence their IT asset disposition strategies .

The IT & Telecom sector leads the market due to its rapid technological advancements and the constant need for upgrading equipment. This sector is particularly sensitive to data security, making secure IT asset disposition a critical component of their operations. The high volume of electronic devices in this sector necessitates efficient and compliant disposal methods, further solidifying its dominance in the market .

The Global IT Asset Disposition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Iron Mountain Incorporated, Sims Lifecycle Services, Dell Technologies Inc., Hewlett Packard Enterprise, Apto Solutions Inc., CloudBlue, TES (SK Ecoplant Co Ltd), ITRenew, GEEP (Global Electric Electronic Processing), ERI (Electronic Recyclers International), LifeSpan International Inc., Cascade Asset Management, Arrow Electronics, Veolia Environmental Services, CompuCom Systems Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the IT asset disposition market appears promising, driven by technological advancements and a heightened focus on sustainability. As organizations increasingly adopt cloud solutions, the need for efficient asset management will grow, leading to innovative disposal methods. Additionally, the integration of artificial intelligence in asset tracking and management is expected to enhance operational efficiency. These trends will likely foster a more robust market environment, encouraging businesses to prioritize responsible asset disposition practices while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Computers & Laptops Mobile Devices & Tablets Networking Equipment Data Center Equipment & Servers Storage Devices & Peripherals Others |

| By End-User | IT & Telecom Banking, Financial Services & Insurance (BFSI) Government & Public Sector Educational Institutions Healthcare Organizations Manufacturing Others |

| By Service Type | Data Destruction/Data Sanitization De-Manufacturing & Recycling Remarketing & Value Recovery Logistics Management & Reverse Logistics Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Compliance Standards | ISO 14001 R2 Certification e-Stewards Certification HIPAA Compliance Others |

| By Asset Condition | Functional Assets Non-Functional Assets Obsolete Assets Others |

| By Sales Channel | Direct Sales Online Sales Third-Party Resellers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate IT Asset Management | 100 | IT Asset Managers, CIOs |

| Regulatory Compliance in ITAD | 60 | Compliance Officers, Legal Advisors |

| ITAD Vendor Insights | 40 | Operations Managers, Business Development Managers |

| Sector-Specific ITAD Practices | 50 | Sector Analysts, Sustainability Officers |

| Emerging Technologies in ITAD | 45 | Technology Officers, R&D Managers |

The Global IT Asset Disposition Market is valued at approximately USD 25 billion, driven by the increasing need for secure data destruction, stricter environmental regulations, and the rising volume of electronic waste.