Region:North America

Author(s):Rebecca

Product Code:KRAA2154

Pages:82

Published On:August 2025

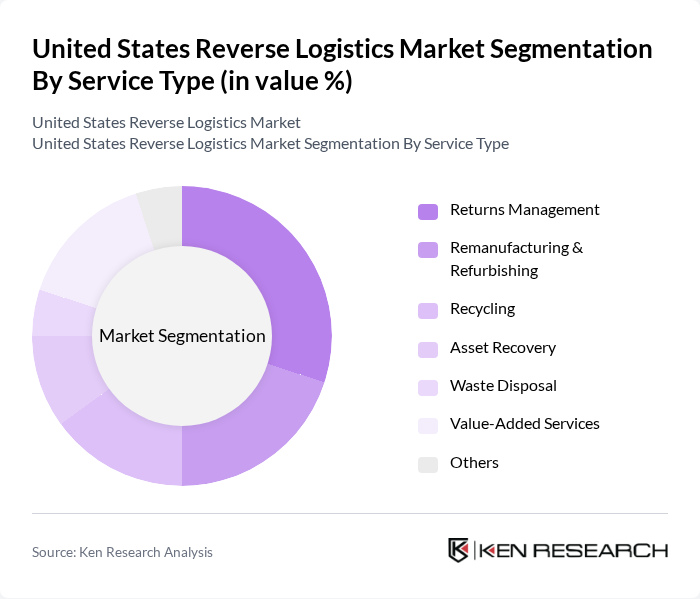

By Service Type:The service type segmentation includes various subsegments such asReturns Management, Remanufacturing & Refurbishing, Recycling, Asset Recovery, Waste Disposal, Value-Added Services, and Others. Each of these services plays a crucial role in the reverse logistics process, addressing different aspects of product returns and waste management. Returns Management is increasingly supported by automation and AI, while Remanufacturing & Refurbishing focus on restoring products to usable condition. Recycling and Asset Recovery enable value extraction from returned goods, and Waste Disposal ensures regulatory compliance. Value-Added Services include data analytics, customer support, and process optimization.

TheReturns Managementsubsegment is currently dominating the market due to the exponential growth of e-commerce, which has led to an increase in product returns. Retailers are focusing on streamlining their returns processes to enhance customer satisfaction and reduce operational costs. The demand for efficient returns management solutions is driven by consumer expectations for easy and quick return processes, making it a critical component of reverse logistics. The integration of omnichannel returns and physical return points is further strengthening this segment.

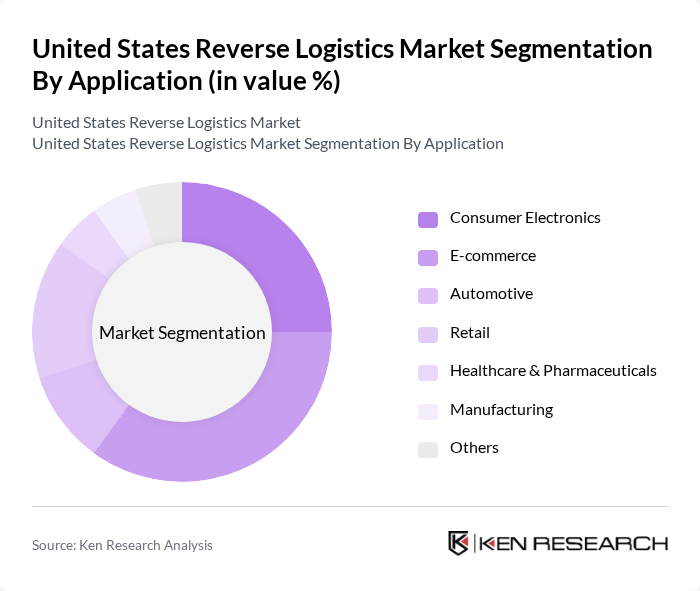

By Application:The application segmentation encompassesConsumer Electronics, E-commerce, Automotive, Retail, Healthcare & Pharmaceuticals, Manufacturing, and Others. Each application area has unique requirements and challenges that influence the reverse logistics strategies employed by businesses. E-commerce leads due to high return volumes, while Consumer Electronics and Automotive segments focus on value recovery and regulatory compliance. Retail, Healthcare & Pharmaceuticals, and Manufacturing segments emphasize process optimization and safe disposal.

TheE-commerceapplication is leading the market due to the rapid growth of online shopping, which has significantly increased the volume of returns. E-commerce companies are investing heavily in reverse logistics to manage returns efficiently, ensuring customer satisfaction and loyalty. The convenience of online shopping has made returns a critical aspect of the customer experience, driving the demand for robust reverse logistics solutions. The adoption of omnichannel return strategies and integration of physical return points further enhance the efficiency and appeal of reverse logistics in this segment.

The United States Reverse Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as UPS Supply Chain Solutions, FedEx Corporation, DHL Supply Chain, XPO Logistics, Ryder System, Inc., Reverse Logistics Group, Inmar Intelligence, Optoro, C.H. Robinson, Genco (A FedEx Company), Returnly, B-Stock Solutions, Liquidity Services, Inc., Happy Returns (A PayPal Company), Reconomy Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. reverse logistics market appears promising, driven by the increasing focus on sustainability and technological integration. As companies adopt more circular economy practices, the demand for efficient reverse logistics solutions will rise. Additionally, advancements in automation and AI will enhance operational efficiency, enabling businesses to manage returns more effectively. The evolving consumer expectations for seamless return experiences will further shape the market, pushing companies to innovate and adapt their reverse logistics strategies.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Returns Management Remanufacturing & Refurbishing Recycling Asset Recovery Waste Disposal Value-Added Services Others |

| By Application | Consumer Electronics E-commerce Automotive Retail Healthcare & Pharmaceuticals Manufacturing Others |

| By End-User | Retail & E-commerce Automotive Electronics Pharmaceuticals Manufacturing Others |

| By Distribution Channel | Direct Sales Online Platforms Third-Party Logistics (3PL) Retail Partnerships Others |

| By Product Type | Electronics Apparel Furniture Automotive Parts Pharmaceuticals Others |

| By Region | Northeast Midwest South West Others |

| By Customer Segment | B2B B2C Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 80 | Operations Managers, Customer Service Managers |

| Automotive Parts Recovery | 60 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 50 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 70 | eCommerce Managers, Fulfillment Center Supervisors |

The United States Reverse Logistics Market is valued at approximately USD 175 billion, driven by the growth of e-commerce, consumer expectations for easy returns, and a focus on sustainability and waste reduction.