Region:Global

Author(s):Shubham

Product Code:KRAA3115

Pages:87

Published On:August 2025

Market.png)

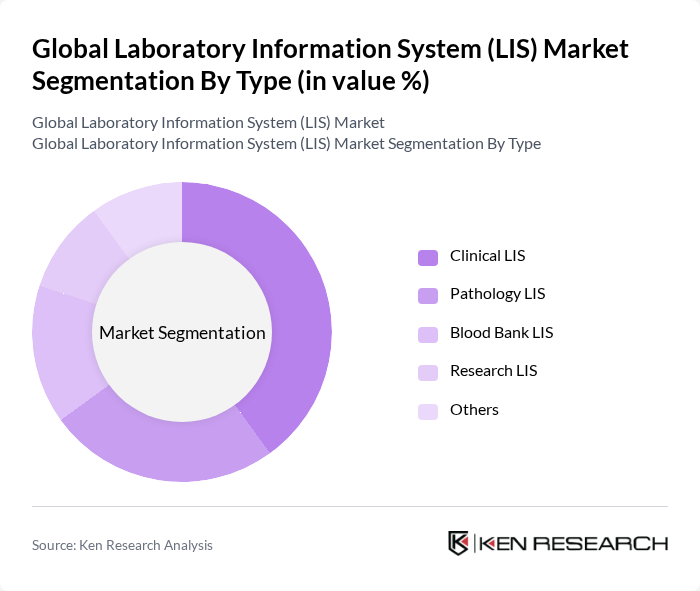

By Type:The market is segmented into Clinical LIS, Pathology LIS, Blood Bank LIS, Research LIS, and Others. Clinical LIS remains the leading segment, attributed to its pivotal role in managing patient data, streamlining laboratory workflows, and ensuring regulatory compliance. The increasing adoption of electronic health records (EHR), demand for integrated healthcare solutions, and the need for real-time data access and analytics are further driving the uptake of Clinical LIS .

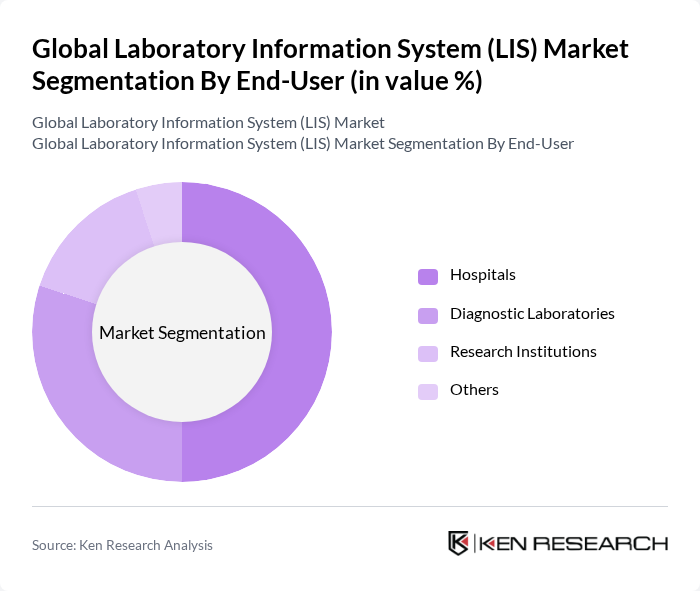

By End-User:The end-user segmentation includes Hospitals, Diagnostic Laboratories, Research Institutions, and Others. Hospitals represent the largest segment, driven by the increasing number of hospital admissions, the need for efficient laboratory management systems to handle high test volumes, and the widespread adoption of integrated solutions to improve patient care and operational efficiency. Diagnostic laboratories are also rapidly adopting LIS to support high-throughput testing and regulatory compliance .

The Global Laboratory Information System (LIS) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cerner Corporation, Epic Systems Corporation, McKesson Corporation, Siemens Healthineers, LabWare, Sunquest Information Systems, Agilent Technologies, Roche Diagnostics, Abbott Laboratories, Sysmex Corporation, Thermo Fisher Scientific Inc., InterSystems Corporation, CliniSys, LabVantage Solutions, Orchard Software Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the LIS market appears promising, driven by technological advancements and increasing healthcare demands. The integration of artificial intelligence and machine learning is expected to enhance data analytics capabilities, improving laboratory efficiency. Additionally, the shift towards cloud-based solutions will facilitate remote access and collaboration, making LIS more accessible. As healthcare systems continue to evolve, the focus on interoperability will be crucial for seamless data exchange, ultimately leading to improved patient care and operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Clinical LIS Pathology LIS Blood Bank LIS Research LIS Others |

| By End-User | Hospitals Diagnostic Laboratories Research Institutions Others |

| By Component | Software Services Hardware |

| By Deployment Mode | On-Premise Cloud-Based |

| By Application | Patient Management Laboratory Workflow Management Data Management |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 100 | Laboratory Managers, IT Directors |

| Diagnostic Centers | 80 | Operations Managers, Quality Assurance Officers |

| Research Laboratories | 60 | Research Scientists, Lab Technicians |

| Public Health Laboratories | 50 | Public Health Officials, Laboratory Supervisors |

| Healthcare IT Vendors | 40 | Product Managers, Sales Directors |

The Global Laboratory Information System (LIS) Market is valued at approximately USD 2.5 billion, reflecting a significant growth trend driven by the increasing demand for efficient laboratory management solutions and advanced diagnostics in healthcare.