Region:Global

Author(s):Geetanshi

Product Code:KRAD4172

Pages:94

Published On:December 2025

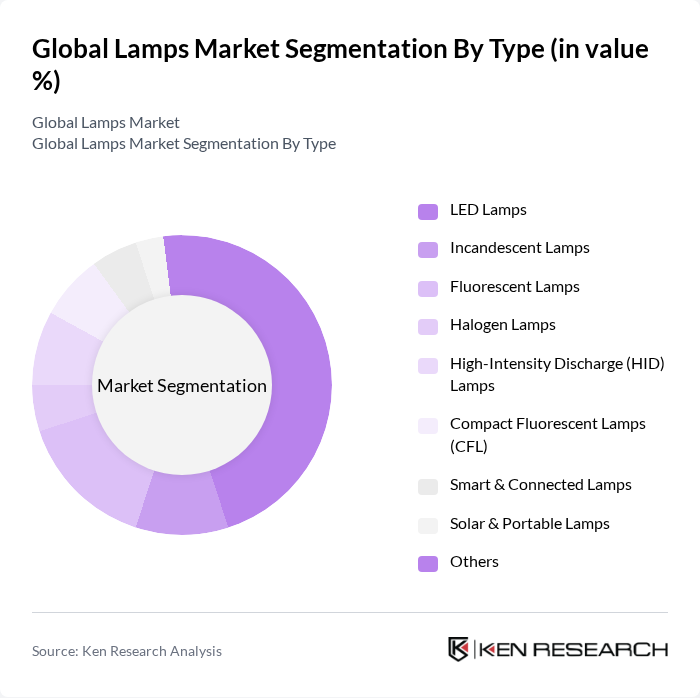

By Type:The lamps market can be segmented into various types, including LED Lamps, Incandescent Lamps, Fluorescent Lamps, Halogen Lamps, High-Intensity Discharge (HID) Lamps, Compact Fluorescent Lamps (CFL), Smart & Connected Lamps, Solar & Portable Lamps, and Others. This segmentation is consistent with leading industry classifications that distinguish LED, fluorescent (including CFL), HID, halogen, and emerging smart or solar-based lamps. Among these, LED lamps are dominating the market due to their energy efficiency, longevity, and decreasing costs, which have led to widespread adoption in both residential and commercial sectors.

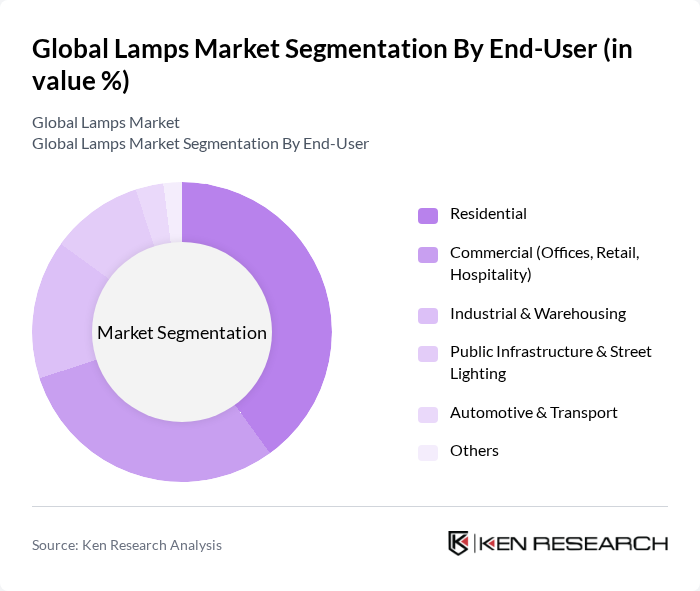

By End-User:The market can also be segmented based on end-users, including Residential, Commercial (Offices, Retail, Hospitality), Industrial & Warehousing, Public Infrastructure & Street Lighting, Automotive & Transport, and Others. These application segments align with common industry breakdowns into residential, commercial, industrial, and outdoor/public lighting uses. The residential segment is currently leading the market, driven by the increasing adoption of energy-efficient lighting solutions, decorative and ambient lighting trends, and the growing penetration of smart home technologies such as app- and voice-controlled lamps.

The Global Lamps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify N.V. (Philips lighting business), OSRAM Licht AG (ams OSRAM Group), General Electric Company (GE Lighting, a Savant company), Acuity Brands, Inc., Eaton Corporation plc (Cooper Lighting Solutions), Hubbell Incorporated (Hubbell Lighting), Panasonic Holdings Corporation (Lighting business), Toshiba Corporation (Toshiba Lighting & Technology), Zumtobel Group AG, Legrand S.A. (Lighting control & fixtures), Lutron Electronics Co., Inc., Cree Lighting (a division of Smart Global Holdings), Feit Electric Company, Inc., Havells India Ltd., Opple Lighting Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the lamps market appears promising, driven by technological advancements and increasing consumer awareness of energy efficiency. As smart lighting solutions gain traction, the integration of IoT technologies is expected to enhance user experience and energy management. Additionally, the growing emphasis on sustainability will likely lead to further innovations in renewable energy-powered lighting solutions, creating a dynamic landscape for manufacturers and consumers alike, fostering a shift towards more environmentally friendly options.

| Segment | Sub-Segments |

|---|---|

| By Type | LED Lamps Incandescent Lamps Fluorescent Lamps Halogen Lamps High-Intensity Discharge (HID) Lamps Compact Fluorescent Lamps (CFL) Smart & Connected Lamps Solar & Portable Lamps Others |

| By End-User | Residential Commercial (Offices, Retail, Hospitality) Industrial & Warehousing Public Infrastructure & Street Lighting Automotive & Transport Others |

| By Application | General Indoor Lighting Outdoor & Street Lighting Decorative & Architectural Lighting Task & Reading Lamps Specialty & Industrial Lamps (UV, Horticulture, Medical, etc.) Automotive Lighting Emergency & Safety Lighting Others |

| By Distribution Channel | Specialty Lighting Stores Home Improvement & Hypermarkets Online Retail & Marketplaces Direct Sales & Project-Based Channels Electrical Wholesalers & Distributors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | LED Technology Fluorescent Technology Halogen Technology High-Intensity Discharge (HID) Technology Other Emerging & Specialty Technologies |

| By Price Range | Budget Mid-range Premium Luxury & Designer |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Lighting Market | 140 | Homeowners, Interior Designers |

| Commercial Lighting Solutions | 110 | Facility Managers, Procurement Officers |

| Industrial Lighting Applications | 90 | Operations Managers, Safety Officers |

| Smart Lighting Technologies | 60 | Technology Developers, Product Managers |

| Energy-Efficient Lighting Initiatives | 80 | Sustainability Officers, Policy Makers |

The Global Lamps Market is valued at approximately USD 15 billion, driven by the increasing demand for energy-efficient lighting solutions and technological advancements, particularly in LED technology, which has significantly contributed to market growth.