Region:Middle East

Author(s):Dev

Product Code:KRAC8721

Pages:100

Published On:November 2025

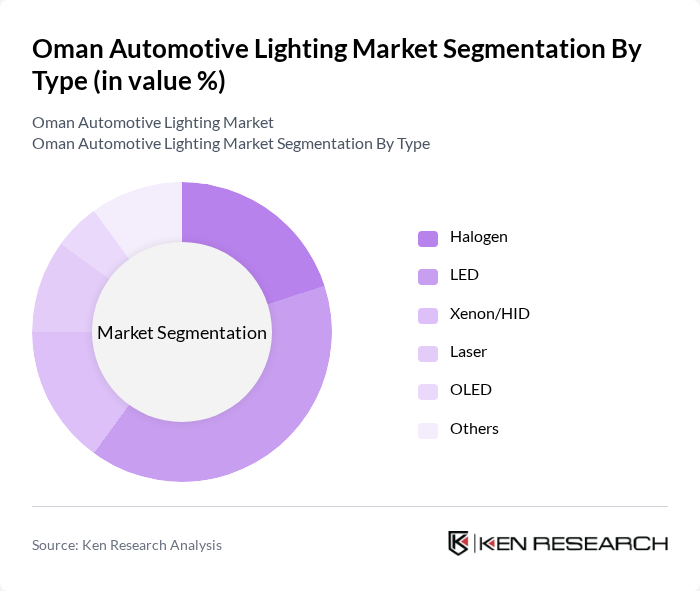

By Type:The market is segmented into various types of automotive lighting solutions, including Halogen, LED, Xenon/HID, Laser, OLED, and Others. Each type serves different consumer preferences and vehicle requirements, with LED lighting gaining significant traction due to its energy efficiency and longevity.

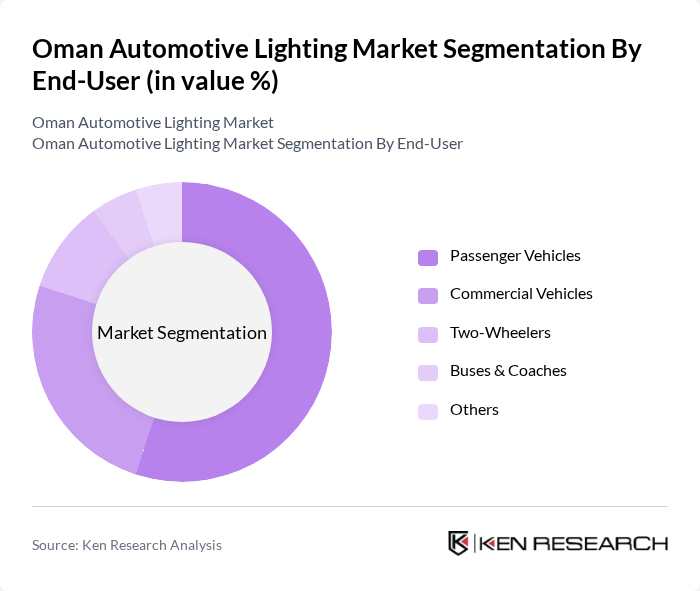

By End-User:The segmentation by end-user includes Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Buses & Coaches, and Others. The passenger vehicle segment dominates the market, driven by the increasing consumer preference for personal vehicles and the growing population in urban areas.

The Oman Automotive Lighting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify (Philips Lighting), Osram Licht AG (ams OSRAM), Valeo S.A., HELLA GmbH & Co. KGaA, Koito Manufacturing Co., Ltd., Stanley Electric Co., Ltd., General Electric Company, Marelli Automotive Lighting, Federal-Mogul LLC (now part of Tenneco Inc.), Changzhou Xingyu Automotive Lighting Systems Co., Ltd., Lumileds Holding B.V., Wolfspeed, Inc. (formerly Cree, Inc.), Sylvania Automotive (OSRAM Sylvania Inc.), Truck-Lite Co., LLC, TYC Brother Industrial Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive lighting market in Oman appears promising, driven by technological advancements and increasing consumer awareness of safety features. As electric vehicle adoption rises, the demand for innovative lighting solutions will likely grow, with manufacturers focusing on integrating smart technologies. Additionally, the emphasis on sustainability will push companies to develop eco-friendly lighting products, aligning with government energy efficiency goals. Overall, the market is poised for significant transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Halogen LED Xenon/HID Laser OLED Others |

| By End-User | Passenger Vehicles Commercial Vehicles Two-Wheelers Buses & Coaches Others |

| By Application | Front Lighting/Headlamps Rear Lighting Side Lighting Interior Lighting Signal Lighting Daytime Running Lights (DRL) Others |

| By Distribution Channel | OEM (Original Equipment Manufacturer) Aftermarket Online Retail Offline Retail Direct Sales Others |

| By Vehicle Type | SUVs Sedans Hatchbacks Light Commercial Vehicles Heavy Trucks & Buses Two-Wheelers Others |

| By Technology | Adaptive Lighting Automatic Headlight Control Daytime Running Lights Matrix/Smart Lighting Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 60 | Product Managers, R&D Engineers |

| Distributors of Automotive Lighting | 50 | Sales Managers, Supply Chain Coordinators |

| Automotive Repair Shops | 40 | Shop Owners, Service Technicians |

| Government Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Automotive Technology Experts | 40 | Industry Analysts, Automotive Engineers |

The Oman Automotive Lighting Market is valued at approximately USD 204 million, reflecting a significant growth trend driven by increasing demand for advanced lighting technologies and rising automotive production and sales in the region.