Global Lecithin Market Overview

- The Global Lecithin Market is valued at USD 645 million, based on a five-year historical analysis. Market growth is driven by the rising demand for natural and clean-label emulsifiers in food and beverage applications, as well as increasing consumer awareness of lecithin’s health benefits, including its roles in lipid metabolism and cognitive function enhancement .

- Countries such as the United States, Germany, and China continue to lead the lecithin market, supported by robust food processing industries, high consumption rates of processed foods, and the presence of major manufacturers. The shift toward plant-based and health-oriented products further strengthens their market leadership .

- The European Union’s Regulation (EC) No 1333/2008 on food additives, issued by the European Parliament and Council, establishes binding purity standards, labeling requirements, and maximum usage levels for lecithin (E322) in food products. This regulation ensures product safety, enhances consumer trust, and promotes transparency in the food industry .

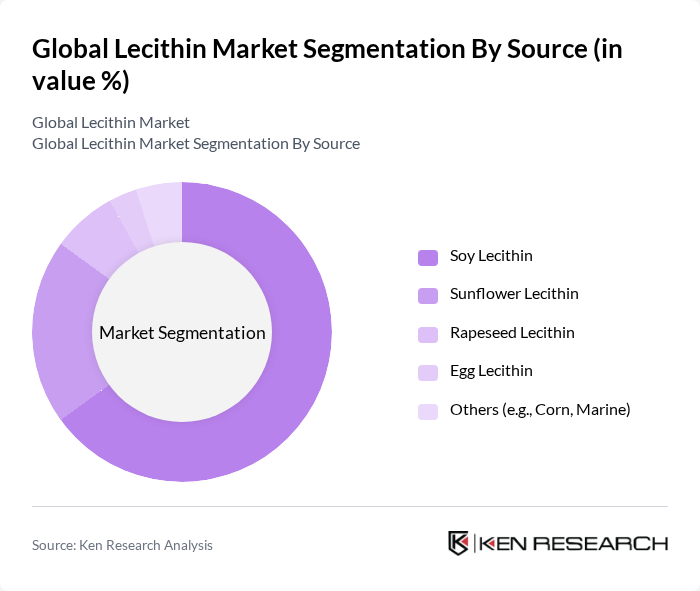

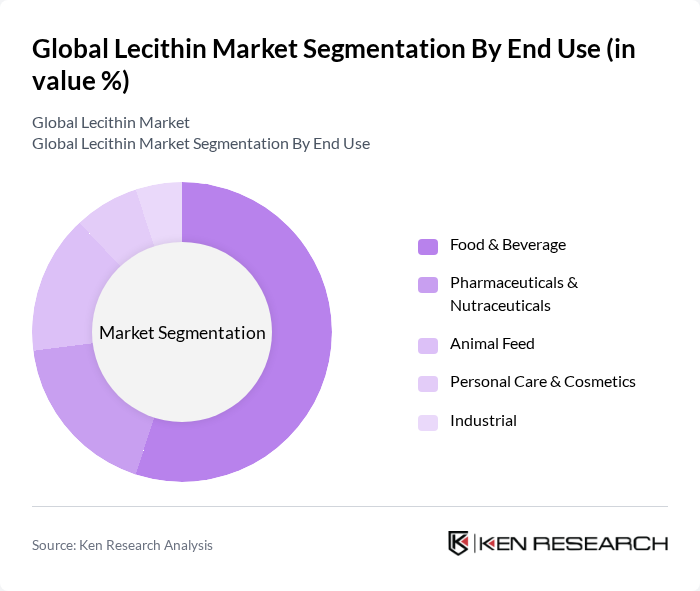

Global Lecithin Market Segmentation

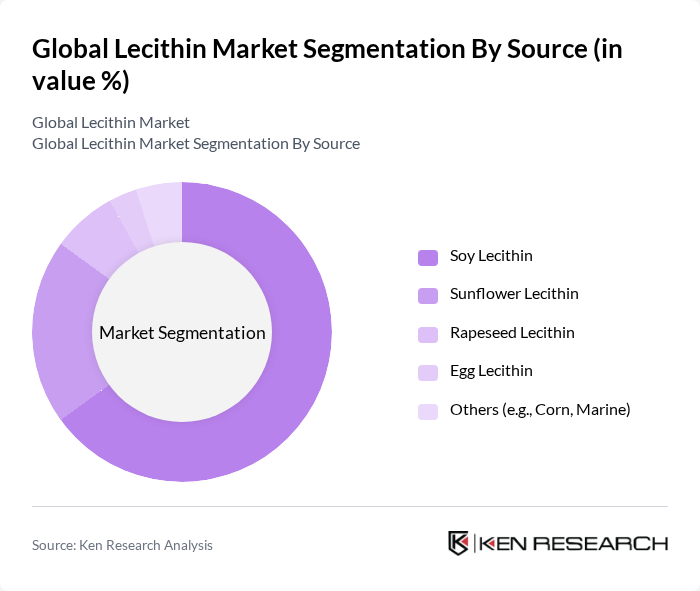

By Source:The lecithin market is segmented by source into soy lecithin, sunflower lecithin, rapeseed lecithin, egg lecithin, and others (e.g., corn, marine). Soy lecithin is the most dominant, accounting for the largest share due to its widespread availability, cost-effectiveness, and established use in food manufacturing. Sunflower lecithin is experiencing rapid growth as a non-GMO alternative, appealing to consumers seeking allergen-free and clean-label options. Rapeseed and egg lecithin are also gaining traction, particularly in specialized food and pharmaceutical applications .

By End Use:The lecithin market is also segmented by end use, including food & beverage, pharmaceuticals & nutraceuticals, animal feed, personal care & cosmetics, industrial, and others. The food & beverage sector holds the largest share, driven by the increasing use of lecithin as an emulsifier and stabilizer in bakery, confectionery, and dairy products. Pharmaceuticals & nutraceuticals are seeing robust growth due to the rising demand for dietary supplements and functional foods containing lecithin for cognitive and metabolic health. Animal feed and personal care applications are also expanding, supported by lecithin’s functional versatility .

Global Lecithin Market Competitive Landscape

The Global Lecithin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Incorporated, Archer Daniels Midland Company (ADM), Bunge Limited, Wilmar International Limited, DuPont de Nemours, Inc., Lipoid GmbH, Lecico GmbH, Sternchemie GmbH & Co. KG, Soya International Ltd., American Lecithin Company, Kewpie Corporation, The Green Labs LLC, GIIAVA S.A., Shandong Jiusan Group Co., Ltd., BASF SE contribute to innovation, geographic expansion, and service delivery in this space.

Global Lecithin Market Industry Analysis

Growth Drivers

- Increasing Demand for Natural Emulsifiers:The global demand for natural emulsifiers, particularly lecithin, is projected to reach 1.5 million tons in future, driven by the food and beverage sector's shift towards clean label products. This trend is supported by a report from the Food and Agriculture Organization, indicating that 60% of consumers prefer products with natural ingredients. The rise in health-conscious eating habits further fuels this demand, as consumers seek alternatives to synthetic emulsifiers.

- Rising Health Consciousness Among Consumers:Health consciousness is significantly influencing the lecithin market, with a survey revealing that 70% of consumers actively seek healthier food options. This trend is reflected in the increasing sales of functional foods, which are expected to surpass $300 billion in future. The World Health Organization's guidelines promoting the consumption of natural ingredients further bolster the demand for lecithin, as it is recognized for its health benefits, including cholesterol management and cognitive support.

- Expanding Applications in Food and Beverage Industry:Lecithin's versatility is leading to its expanded use in various food applications, including bakery products, dairy, and sauces. The food and beverage industry is projected to consume over 1.2 million tons of lecithin in future, according to industry reports. This growth is attributed to the increasing incorporation of lecithin in plant-based products, which are gaining traction, with plant-based food sales expected to reach $162 billion in future, according to the Plant Based Foods Association.

Market Challenges

- Fluctuating Raw Material Prices:The lecithin market faces challenges due to the volatility of raw material prices, particularly soybeans and sunflower seeds, which are essential for lecithin production. Soybean prices have fluctuated between $12 and $15 per bushel, impacting production costs. This instability can lead to increased prices for lecithin, affecting profit margins and pricing strategies for manufacturers, as they struggle to maintain competitive pricing in a price-sensitive market.

- Stringent Regulatory Compliance:The lecithin industry is subject to stringent regulations regarding food safety and labeling, which can pose challenges for manufacturers. The FDA is expected to enforce stricter compliance measures in future, requiring detailed labeling of emulsifiers. This regulatory landscape can increase operational costs and complicate the supply chain, as companies must invest in compliance measures to meet evolving standards, potentially hindering market growth.

Global Lecithin Market Future Outlook

The future of the lecithin market appears promising, driven by the increasing consumer preference for natural ingredients and the growing trend towards plant-based diets. Innovations in lecithin production techniques, such as enzymatic extraction, are expected to enhance product quality and sustainability. Additionally, the expansion of lecithin applications in the nutraceutical sector will likely create new growth avenues, as consumers increasingly seek functional foods that offer health benefits, aligning with global health trends.

Market Opportunities

- Expansion in Emerging Economies:Emerging economies, particularly in Asia-Pacific, present significant growth opportunities for the lecithin market. With a projected increase in disposable income and changing dietary preferences, the demand for lecithin in food products is expected to rise. The Asian market is anticipated to grow by 20% in future, driven by urbanization and a growing middle class seeking healthier food options.

- Innovations in Lecithin Production Techniques:Advancements in lecithin production, such as the development of non-GMO and organic lecithin, are creating new market opportunities. As consumers become more aware of food sourcing, the demand for sustainably produced lecithin is expected to increase. Companies investing in innovative extraction methods can capture a larger market share, with the organic food market projected to reach $300 billion in future, further driving lecithin demand.