Global Liquid Handling Technology Market Overview

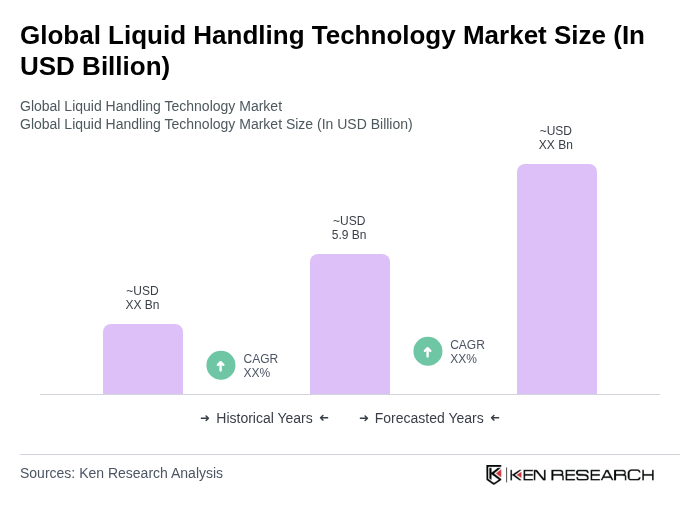

- The Global Liquid Handling Technology Market is valued at USD 5.9 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for automation in laboratories, advancements in liquid handling technologies, and the rising need for precision in drug discovery and clinical diagnostics. The market is also influenced by the growing biotechnology and pharmaceutical sectors, which require efficient liquid handling solutions for various applications. Recent trends include the integration of robotics and artificial intelligence into liquid handling systems, as well as the expansion of automated platforms for high-throughput screening and genomics research.

- Key players in this market are predominantly located in North America and Europe, with the United States and Germany being the most dominant countries. The dominance of these regions can be attributed to their strong research and development infrastructure, high investment in healthcare, and the presence of leading manufacturers and suppliers of liquid handling technologies. Additionally, the increasing number of research institutions and laboratories in these regions further supports market growth. North America accounted for over 39% of global market share, driven by the adoption of personalized medicine and precision therapies, while Europe maintained a robust position through extensive pharmaceutical and biotech R&D.

- In 2023, the U.S. Centers for Medicare & Medicaid Services (CMS) updated the Clinical Laboratory Improvement Amendments (CLIA) regulations to strengthen laboratory safety and efficiency. The revised CLIA regulations, issued by CMS, mandate enhanced documentation and validation for automated liquid handling systems used in clinical laboratories. These requirements aim to minimize human error, improve accuracy in sample processing, and ensure compliance with federal safety standards, thereby driving the adoption of advanced liquid handling technologies across the healthcare sector.

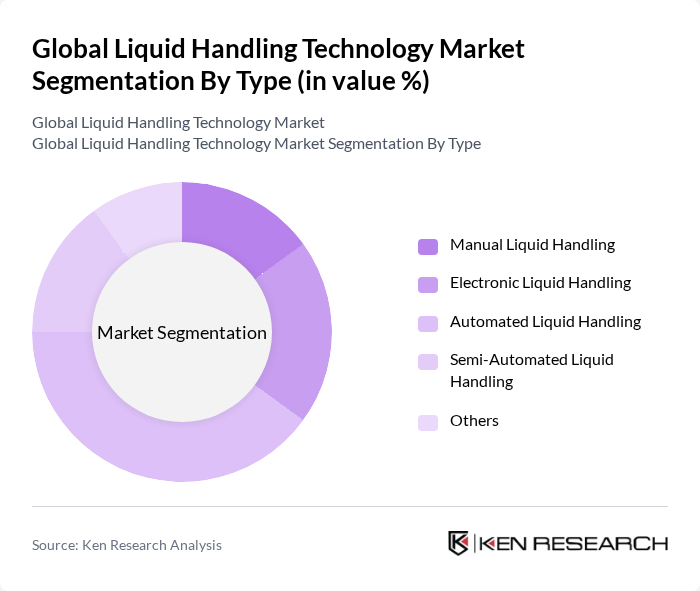

Global Liquid Handling Technology Market Segmentation

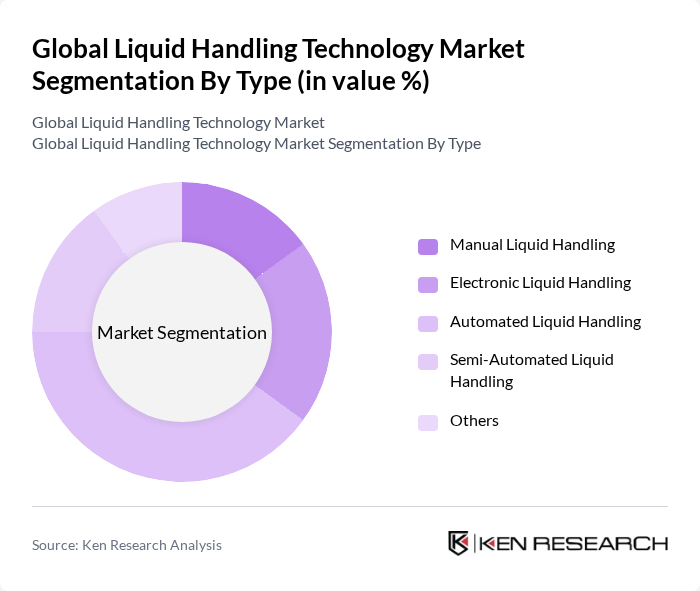

By Type:The liquid handling technology market is segmented into Manual Liquid Handling, Electronic Liquid Handling, Automated Liquid Handling, Semi-Automated Liquid Handling, and Others. Among these, Automated Liquid Handling is the leading sub-segment due to its ability to enhance efficiency, reduce human error, and increase throughput in laboratory processes. The growing trend towards automation in laboratories, including the adoption of robotics and integrated software, is driving the demand for automated solutions, making it a preferred choice for many end-users.

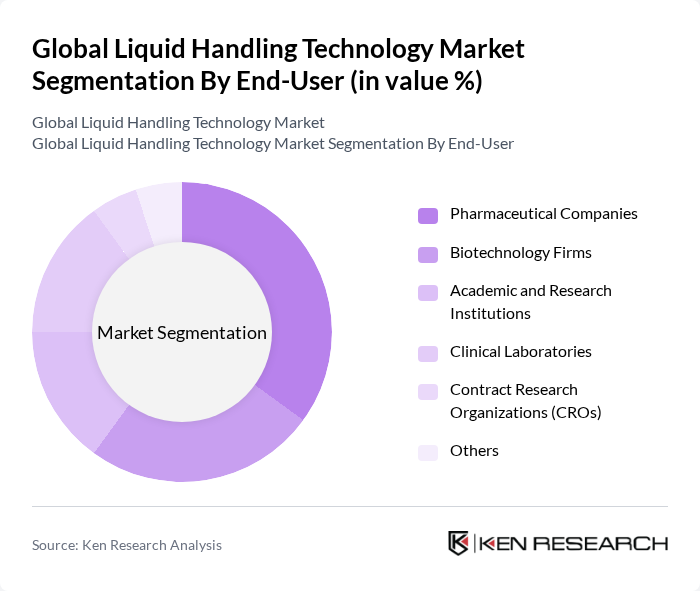

By End-User:The end-user segmentation includes Pharmaceutical Companies, Biotechnology Firms, Academic and Research Institutions, Clinical Laboratories, Contract Research Organizations (CROs), and Others. Pharmaceutical Companies are the dominant end-users in the liquid handling technology market, driven by their need for high-throughput screening and efficient drug development processes. The increasing focus on research and development in the pharmaceutical sector, as well as the demand for precision and scalability in production, is propelling the demand for advanced liquid handling solutions. Biotechnology firms also represent a significant share due to their involvement in genomics, proteomics, and molecular diagnostics.

Global Liquid Handling Technology Market Competitive Landscape

The Global Liquid Handling Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific, Eppendorf AG, Beckman Coulter, Inc., Agilent Technologies, Inc., Tecan Group Ltd., PerkinElmer, Inc., Hamilton Company, Sartorius AG, Mettler Toledo International Inc., Bio-Rad Laboratories, Inc., Corning Incorporated, QIAGEN N.V., Merck KGaA, VWR International, LLC, Gilson, Inc., Integra Biosciences AG, Analytik Jena GmbH, Labcyte Inc. (now part of Beckman Coulter), Opentrons Labworks Inc., SPT Labtech Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Global Liquid Handling Technology Market Industry Analysis

Growth Drivers

- Increasing Demand for Automation in Laboratories:The global laboratory automation market is projected to reach $7.5 billion in future, driven by the need for efficiency and reduced human error. Automation in liquid handling processes enhances throughput and accuracy, which is crucial in high-stakes environments like pharmaceuticals. The World Bank indicates that increased R&D spending in life sciences, estimated at $250 billion in future, further propels the adoption of automated liquid handling technologies.

- Rising Focus on Precision and Accuracy in Liquid Handling:The demand for precision in liquid handling is underscored by the growing complexity of biological assays and drug formulations. According to industry reports, the need for high-precision liquid handling systems is expected to grow, with an estimated 20% increase in demand for pipetting systems alone, reflecting a shift towards more accurate laboratory practices. This trend is supported by the increasing regulatory scrutiny in the pharmaceutical sector, emphasizing quality control.

- Growth in Pharmaceutical and Biotechnology Sectors:The pharmaceutical industry is projected to reach $1.8 trillion in future, with biotechnology contributing significantly to this growth. This expansion necessitates advanced liquid handling technologies to manage complex workflows and ensure compliance with stringent regulations. The International Federation of Pharmaceutical Manufacturers & Associations (IFPMA) reports that biopharmaceuticals account for over 35% of total pharmaceutical sales, driving the need for innovative liquid handling solutions to support drug development.

Market Challenges

- High Initial Investment Costs:The adoption of advanced liquid handling technologies often requires significant upfront capital investment, which can deter smaller laboratories and startups. For instance, the average cost of automated liquid handling systems can range from $60,000 to $600,000, depending on the complexity and features. This financial barrier is particularly pronounced in emerging markets, where budget constraints limit access to cutting-edge technologies, hindering overall market growth.

- Complexity of Integration with Existing Systems:Integrating new liquid handling technologies with legacy laboratory systems poses a significant challenge. Many laboratories operate with outdated equipment, making seamless integration difficult and costly. A survey by the Laboratory Equipment Manufacturers Association (LEMA) indicates that 70% of laboratories face integration issues, leading to increased downtime and operational inefficiencies. This complexity can slow the adoption of innovative solutions, impacting market dynamics.

Global Liquid Handling Technology Market Future Outlook

The future of liquid handling technology is poised for transformative growth, driven by advancements in automation and artificial intelligence. As laboratories increasingly adopt smart technologies, the integration of AI and machine learning will enhance precision and efficiency in liquid handling processes. Additionally, the rising demand for personalized medicine will necessitate innovative solutions that cater to specific patient needs, further propelling market expansion. The focus on sustainability will also drive the development of eco-friendly liquid handling solutions, aligning with global environmental goals.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets present significant growth opportunities for liquid handling technology, with an expected increase in laboratory infrastructure investments. Countries like India and Brazil are projected to invest over $15 billion in laboratory automation in future, driven by rising healthcare demands and government initiatives to enhance research capabilities. This expansion will create a robust market for innovative liquid handling solutions tailored to local needs.

- Development of Innovative Liquid Handling Solutions:The ongoing demand for customized liquid handling solutions presents a lucrative opportunity for manufacturers. Innovations such as microfluidics and lab-on-a-chip technologies are gaining traction, with the microfluidics market expected to reach $25 billion in future. These advancements will enable more efficient and precise liquid handling, catering to the evolving needs of the pharmaceutical and biotechnology sectors, thus driving market growth.