Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9520

Pages:84

Published On:November 2025

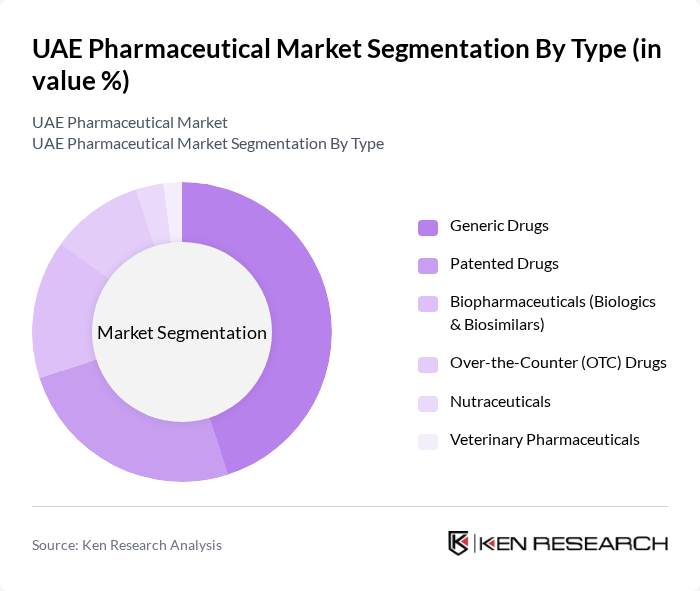

By Type:The pharmaceutical market can be segmented into various types, including Generic Drugs, Patented Drugs, Biopharmaceuticals (Biologics & Biosimilars), Over-the-Counter (OTC) Drugs, Nutraceuticals, and Veterinary Pharmaceuticals. Among these,Generic Drugsdominate the market due to their affordability and increasing acceptance among consumers. The rising healthcare costs have led to a shift towards generic medications, which provide similar therapeutic benefits at lower prices. This trend is further supported by government initiatives promoting the use of generics to enhance healthcare accessibility and the expansion of local manufacturing capabilities .

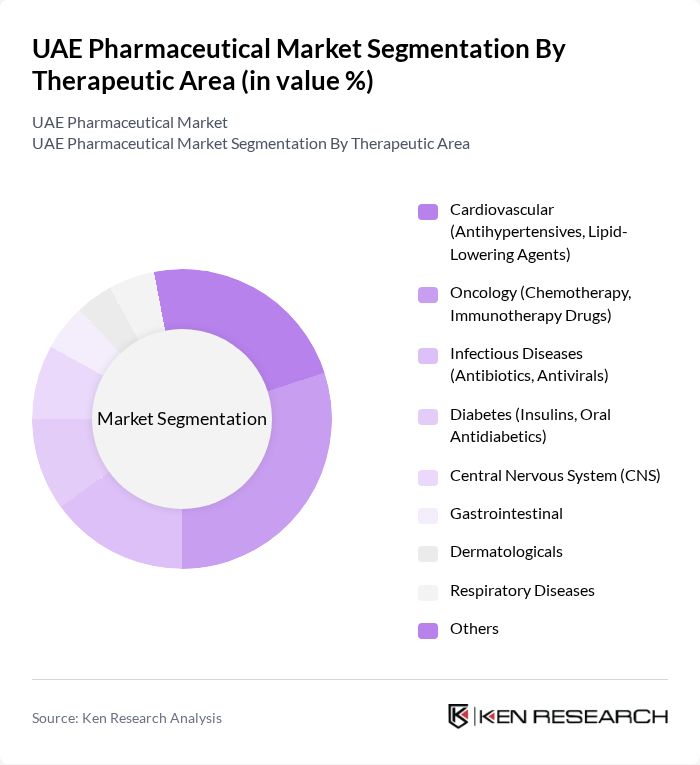

By Therapeutic Area:The pharmaceutical market is also segmented by therapeutic areas, including Cardiovascular, Oncology, Infectious Diseases, Diabetes, Central Nervous System (CNS), Gastrointestinal, Dermatologicals, Respiratory Diseases, and Others. TheOncologysegment is currently leading the market due to the increasing incidence of cancer and the growing demand for advanced treatment options. The rise in awareness about early detection and treatment options, as well as the introduction of innovative therapies, has further fueled the growth of this segment, making it a focal point for pharmaceutical companies .

The UAE Pharmaceutical Market is characterized by a dynamic mix of regional and international players. Leading participants such as Julphar (Gulf Pharmaceutical Industries), Neopharma, Globalpharma (a Sanofi company), LifePharma FZE, Pharmax Pharmaceuticals, Medpharma, Tabuk Pharmaceuticals, Aster Pharmacy, Al Hikma Pharmaceuticals, Pfizer, Novartis, Roche, Sanofi, GSK (GlaxoSmithKline), AstraZeneca, Merck & Co., Bayer, AbbVie, Teva Pharmaceutical Industries, Amgen, Johnson & Johnson, Eli Lilly, Boehringer Ingelheim contribute to innovation, geographic expansion, and service delivery in this space.

The UAE pharmaceutical market is poised for significant transformation, driven by advancements in technology and evolving consumer preferences. The integration of digital health solutions and telemedicine is expected to enhance patient access to medications and healthcare services. Additionally, the focus on personalized medicine will likely lead to the development of targeted therapies, improving treatment outcomes. As the market adapts to these trends, pharmaceutical companies must remain agile and innovative to capitalize on emerging opportunities and address the evolving needs of the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Generic Drugs Patented Drugs Biopharmaceuticals (Biologics & Biosimilars) Over-the-Counter (OTC) Drugs Nutraceuticals Veterinary Pharmaceuticals |

| By Therapeutic Area | Cardiovascular (Antihypertensives, Lipid-Lowering Agents) Oncology (Chemotherapy, Immunotherapy Drugs) Infectious Diseases (Antibiotics, Antivirals) Diabetes (Insulins, Oral Antidiabetics) Central Nervous System (CNS) Gastrointestinal Dermatologicals Respiratory Diseases Others |

| By Distribution Channel | Retail Pharmacies (Chain Pharmacies, e.g., Aster, Life) Hospital Pharmacies E-commerce Wholesalers (Government-Authorized, Independent) Others |

| By Region | Abu Dhabi Dubai Sharjah Other Emirates |

| By Consumer Demographics | Age Group Gender Income Level Others |

| By Product Formulation | Tablets Injectables Topicals Others |

| By Market Segment | Retail Market Institutional Market Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Retail Market | 120 | Pharmacy Owners, Retail Managers |

| Hospital Pharmacy Operations | 100 | Pharmacy Directors, Clinical Pharmacists |

| Healthcare Provider Insights | 80 | General Practitioners, Specialists |

| Patient Medication Adherence | 100 | Chronic Disease Patients, Caregivers |

| Pharmaceutical Distribution Channels | 90 | Supply Chain Managers, Logistics Coordinators |

The UAE Pharmaceutical Market is valued at approximately USD 4.2 billion, driven by increasing healthcare expenditure, a rise in chronic diseases, and a demand for innovative therapies. This growth reflects significant investments in healthcare infrastructure and digital health platforms.