Region:Global

Author(s):Dev

Product Code:KRAA2601

Pages:93

Published On:August 2025

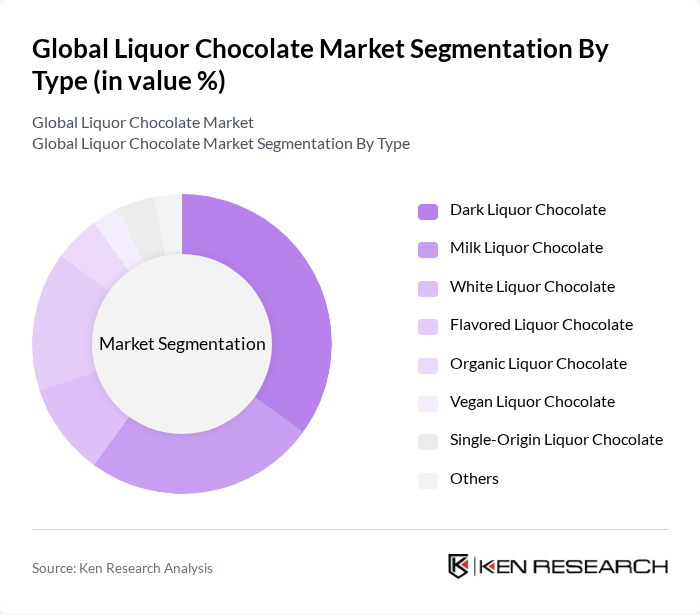

By Type:The market is segmented into various types of liquor chocolates, including Dark Liquor Chocolate, Milk Liquor Chocolate, White Liquor Chocolate, Flavored Liquor Chocolate, Organic Liquor Chocolate, Vegan Liquor Chocolate, Single-Origin Liquor Chocolate, and Others. Among these, Dark Liquor Chocolate is the leading subsegment, driven by its rich flavor profile and increasing consumer preference for dark chocolate, which is often associated with health benefits such as antioxidant content. The premiumization trend has further elevated demand for high-quality dark liquor chocolates, frequently positioned as gourmet products to appeal to discerning consumers .

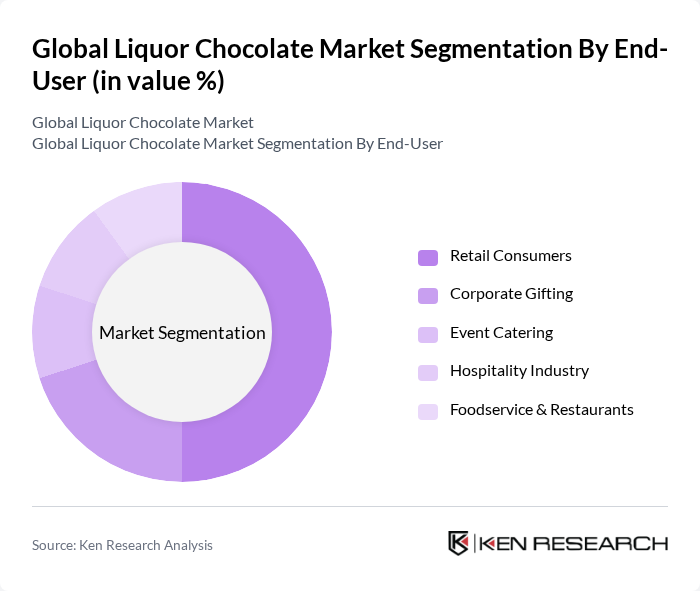

By End-User:The end-user segmentation includes Retail Consumers, Corporate Gifting, Event Catering, Hospitality Industry, and Foodservice & Restaurants. Retail Consumers account for the largest share, propelled by the growing popularity of gifting and personal indulgence. The expansion of e-commerce platforms has enabled broader access to premium liquor chocolates, accelerating sales among individual buyers. Corporate gifting continues to grow, particularly during festive periods, as companies seek to differentiate their offerings with unique and luxurious chocolate gifts .

The Global Liquor Chocolate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lindt & Sprüngli AG, Godiva Chocolatier, Ferrero SpA, Ghirardelli Chocolate Company, Chocoladefabriken Lindt & Sprüngli AG, Cacao Barry, TCHO Chocolate, Neuhaus, Valrhona, Amedei Tuscany, Hotel Chocolat, Chococo, Vosges Haut-Chocolat, Pierre Marcolini, Compartés Chocolatier, The Hershey Company, Mars, Incorporated, Turin Chocolates, Asbach GmbH, and Quintessential Chocolates contribute to innovation, geographic expansion, and service delivery in this space .

The future of the liquor chocolate market in None appears promising, driven by evolving consumer preferences towards premium and unique products. As the trend for sustainable sourcing continues to gain traction, brands that prioritize ethical practices are likely to resonate with consumers. Additionally, the integration of technology in production processes is expected to enhance efficiency and product quality, further supporting market growth. The focus on health-conscious options will also play a crucial role in attracting a broader consumer base.

| Segment | Sub-Segments |

|---|---|

| By Type | Dark Liquor Chocolate Milk Liquor Chocolate White Liquor Chocolate Flavored Liquor Chocolate Organic Liquor Chocolate Vegan Liquor Chocolate Single-Origin Liquor Chocolate Others |

| By End-User | Retail Consumers Corporate Gifting Event Catering Hospitality Industry Foodservice & Restaurants |

| By Sales Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Duty-Free Shops Gourmet Boutiques |

| By Packaging Type | Boxes Bags Bottles Gift Packs Others |

| By Price Range | Premium Mid-Range Economy |

| By Occasion | Festivals Weddings Corporate Events Everyday Consumption Seasonal Promotions |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Liquor Chocolate | 120 | Chocolate Consumers, Food Enthusiasts |

| Retail Insights on Liquor Chocolate Sales | 80 | Retail Managers, Category Buyers |

| Trends in Premium Chocolate Consumption | 60 | Luxury Goods Consumers, Market Analysts |

| Distribution Channel Effectiveness | 50 | Wholesalers, Distributors, E-commerce Managers |

| Impact of Marketing Strategies on Sales | 70 | Marketing Executives, Brand Managers |

The Global Liquor Chocolate Market is valued at approximately USD 1 billion, reflecting a growing consumer preference for premium and artisanal products, particularly during festive seasons and special occasions.