Region:North America

Author(s):Shubham

Product Code:KRAA8526

Pages:81

Published On:November 2025

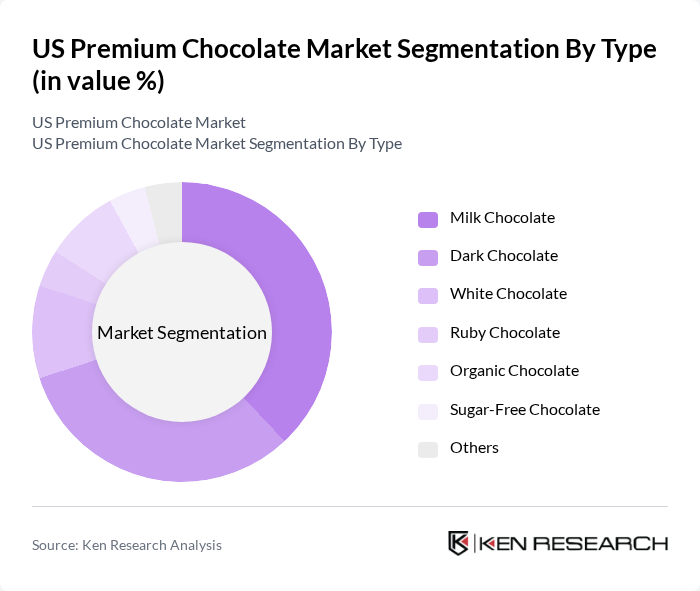

By Type:The premium chocolate market is segmented into various types, including dark chocolate, milk chocolate, white chocolate, ruby chocolate, organic chocolate, sugar-free chocolate, and others. Milk chocolate currently holds the largest revenue share, driven by its creamy texture and broad consumer appeal, while dark chocolate is the fastest-growing sub-segment due to its perceived health benefits and increasing preference for rich flavors. Organic and sugar-free options are gaining traction among health-conscious consumers, and the diversity in flavors and types caters to a wide range of consumer preferences, making this segment dynamic and competitive .

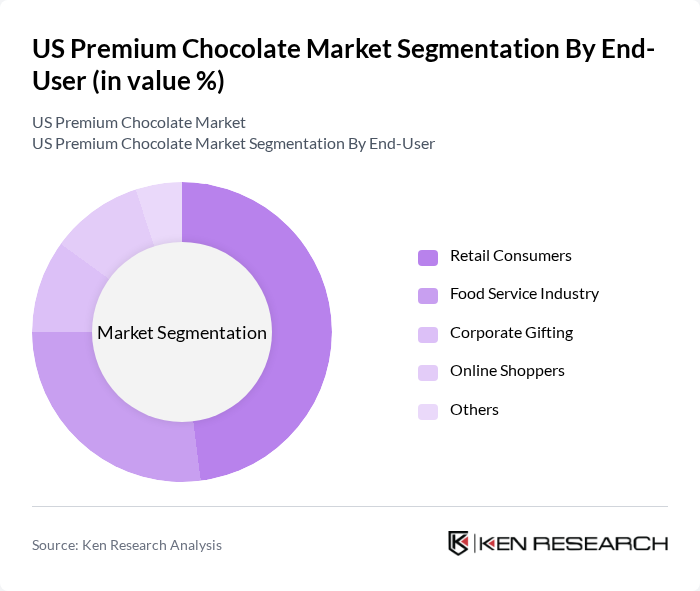

By End-User:The end-user segmentation includes retail consumers, the food service industry, corporate gifting, online shoppers, and others. Retail consumers continue to dominate the market, driven by the increasing trend of gifting premium chocolates during holidays and special occasions, as well as everyday indulgence. The food service industry is a significant contributor, with restaurants and cafes incorporating premium chocolates into their dessert offerings. Online shopping has surged, especially post-pandemic, as consumers seek convenience and access to a wider variety of premium chocolate brands .

The US Premium Chocolate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Godiva Chocolatier, Lindt & Sprüngli, Ghirardelli Chocolate Company, Ferrero Rocher, Theo Chocolate, TCHO Chocolate, Green & Black's, Scharffen Berger Chocolate Maker, Alter Eco, Endangered Species Chocolate, Compartés Chocolatier, Vosges Haut-Chocolat, Chocolove, Cacao Barry, Askinosie Chocolate contribute to innovation, geographic expansion, and service delivery in this space.

The US premium chocolate market is poised for continued growth, driven by evolving consumer preferences towards high-quality, ethically sourced products. Innovations in flavor profiles and product offerings are expected to attract a broader audience, while the rise of subscription services will enhance customer engagement. Additionally, as sustainability becomes a key purchasing factor, brands that prioritize ethical sourcing and environmental responsibility will likely gain a competitive edge, positioning themselves favorably in a rapidly changing market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Dark Chocolate Milk Chocolate White Chocolate Ruby Chocolate Organic Chocolate Sugar-Free Chocolate Others |

| By End-User | Retail Consumers Food Service Industry Corporate Gifting Online Shoppers Others |

| By Packaging Type | Boxed Chocolates Pouches Bars Gift Sets Others |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Online Retail Convenience Stores Others |

| By Flavor Profile | Classic Flavors Exotic Flavors Seasonal Flavors Customized Flavors Others |

| By Occasion | Festivals Corporate Events Personal Celebrations Everyday Consumption Others |

| By Price Range | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Premium Chocolate | 120 | Chocolate Consumers, Food Enthusiasts |

| Retail Insights on Premium Chocolate Sales | 90 | Retail Managers, Category Buyers |

| Manufacturers' Perspectives on Market Trends | 60 | Production Managers, Marketing Directors |

| Distribution Channel Analysis | 50 | Logistics Coordinators, Supply Chain Analysts |

| Expert Opinions on Future Trends | 40 | Industry Analysts, Market Researchers |

The US Premium Chocolate Market is valued at approximately USD 8.6 billion, reflecting a significant growth trend driven by consumer demand for high-quality, artisanal chocolates and health-conscious options like dark and organic varieties.