Region:Global

Author(s):Geetanshi

Product Code:KRAA2830

Pages:85

Published On:August 2025

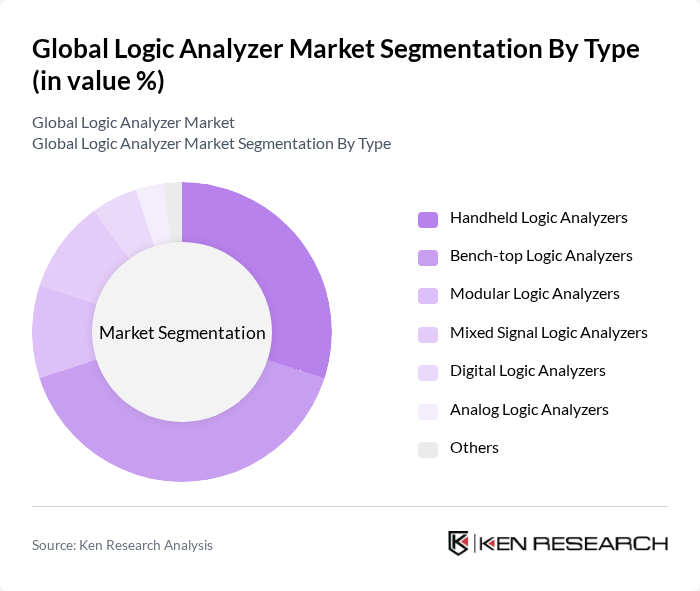

By Type:The logic analyzer market is segmented into handheld, bench-top, modular, mixed signal, digital, analog, and others. Bench-top logic analyzers are currently leading the market due to their advanced capabilities, higher channel counts, and suitability for complex debugging tasks in professional environments. Handheld logic analyzers are also gaining traction for their portability and ease of use, appealing to engineers and technicians who require flexibility in diverse testing environments. Modular and mixed signal analyzers are increasingly adopted for their scalability and ability to handle both digital and analog signals, supporting the growing complexity of modern electronic systems .

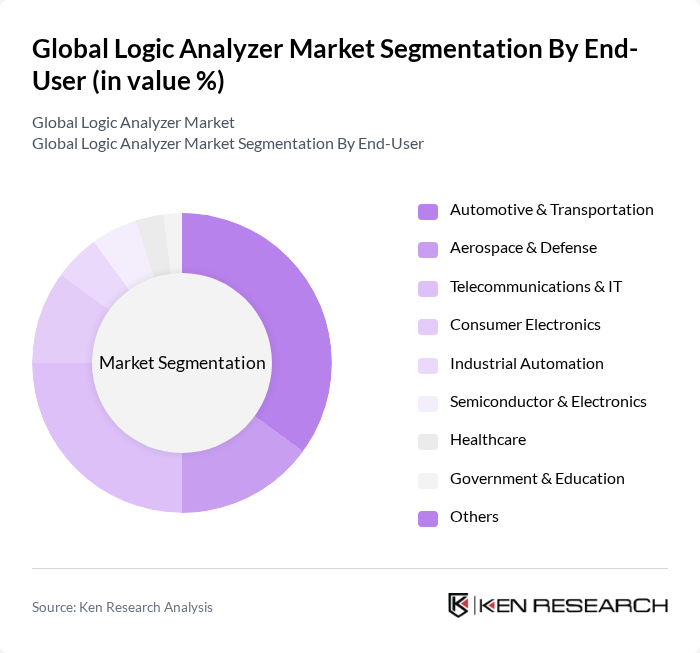

By End-User:The end-user segmentation of the logic analyzer market includes automotive & transportation, aerospace & defense, telecommunications & IT, consumer electronics, industrial automation, semiconductor & electronics, healthcare, government & education, and others. The automotive & transportation sector is currently the dominant end-user, driven by the increasing complexity of automotive electronics, the integration of advanced driver-assistance systems (ADAS), and the need for rigorous testing to ensure safety and regulatory compliance. The telecommunications sector also plays a significant role, as the demand for high-speed data transmission, network reliability, and 5G infrastructure continues to grow. Industrial automation and semiconductor manufacturing are emerging as key growth areas due to the proliferation of smart manufacturing and IoT-enabled devices .

The Global Logic Analyzer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tektronix, Inc., Keysight Technologies, Inc., Rohde & Schwarz GmbH & Co. KG, National Instruments Corporation, Teledyne LeCroy Inc., Advantest Corporation, Yokogawa Test & Measurement Corporation, Saleae LLC, Pico Technology Ltd., B&K Precision Corporation, Siglent Technologies Co., Ltd., Owon Technology, Inc., Hantek Electronics Co., Ltd., TestEquity LLC, Honeywell Technology Solutions, Accusource Electronics Inc., Atec, Inc., Fortive Corporation, Mouser Electronics, Inc., Gao Tek Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the logic analyzer market appears promising, driven by the integration of artificial intelligence and machine learning technologies. These innovations are expected to enhance data analysis capabilities, making tools more efficient and user-friendly. Additionally, the shift towards cloud-based solutions will facilitate remote access and collaboration, further expanding the market. As industries increasingly adopt IoT devices, the demand for versatile and portable logic analyzers will likely rise, creating new avenues for growth and development in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Handheld Logic Analyzers Bench-top Logic Analyzers Modular Logic Analyzers Mixed Signal Logic Analyzers Digital Logic Analyzers Analog Logic Analyzers Others |

| By End-User | Automotive & Transportation Aerospace & Defense Telecommunications & IT Consumer Electronics Industrial Automation Semiconductor & Electronics Healthcare Government & Education Others |

| By Application | Debugging Validation Compliance Testing Research and Development Manufacturing Maintenance and Repair Education and Training Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Value-Added Resellers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low-End Mid-Range High-End |

| By Channel Count | –32 Channels –80 Channels >80 Channels |

| By Brand | Established Brands Emerging Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Equipment Testing | 100 | Test Engineers, R&D Managers |

| Automotive Electronics Development | 70 | Design Engineers, Quality Assurance Specialists |

| Consumer Electronics Prototyping | 65 | Product Development Managers, Electronics Technicians |

| Academic Research in Electronics | 50 | Professors, Graduate Students |

| Industrial Automation Systems | 80 | Automation Engineers, System Integrators |

The Global Logic Analyzer Market is valued at approximately USD 1.7 billion, reflecting a significant growth trend driven by the increasing demand for advanced testing and debugging tools across various industries, including telecommunications, automotive, and consumer electronics.