Global Machine Control System Market Overview

- The Global Machine Control System Market is valued at USD 5.6 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for automation in construction, mining, and infrastructure sectors, as well as advancements in GNSS, laser, and sensor technologies that enhance operational efficiency and accuracy. The integration of machine control systems with GPS, real-time data analytics, and digital design plans has further propelled market growth, as companies seek to optimize their operations, improve safety, and reduce costs.

- Key players in this market are predominantly located in North America, Europe, and Asia Pacific, with the United States, Germany, and China being the most significant contributors. The dominance of these regions is attributed to advanced infrastructure, high levels of investment in construction and mining activities, rapid urbanization, and the presence of leading technology providers that drive innovation in machine control systems.

- In 2023, the European Union implemented Regulation (EU) 2023/1230 on machinery, issued by the European Parliament and Council. This regulation mandates that all new construction equipment placed on the EU market must comply with advanced machine control technologies to improve safety, operational efficiency, and reduce environmental impact, thereby fostering a more sustainable construction industry. The regulation covers requirements for digital controls, safety standards, and environmental performance for machinery manufacturers and importers.

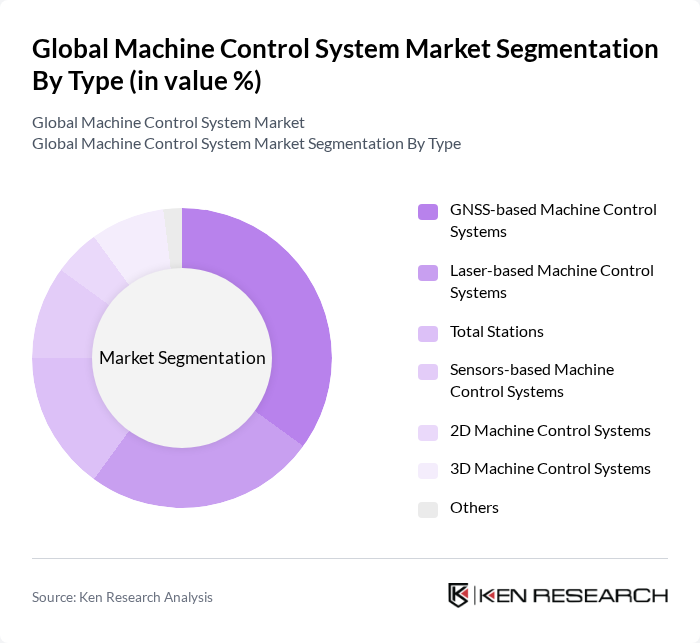

Global Machine Control System Market Segmentation

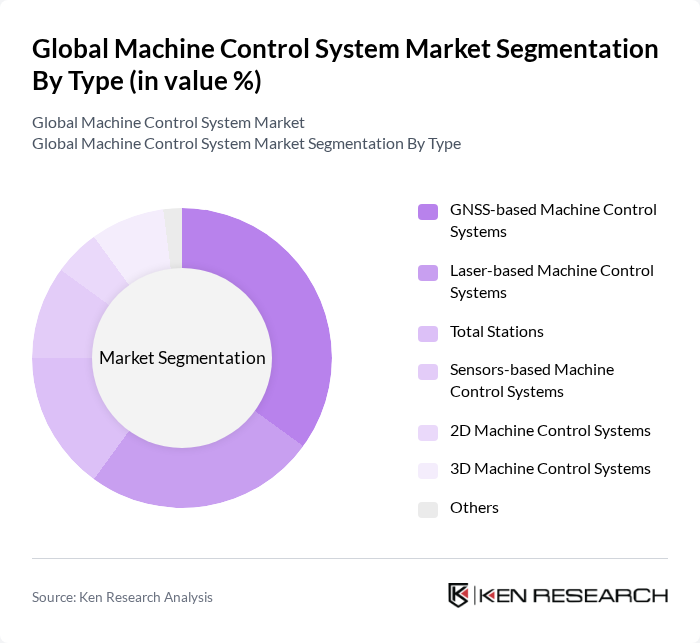

By Type:The market is segmented into various types of machine control systems, including GNSS-based Machine Control Systems, Laser-based Machine Control Systems, Total Stations, Sensors-based Machine Control Systems, 2D Machine Control Systems, 3D Machine Control Systems, and Others. Among these, GNSS-based Machine Control Systems are leading the market due to their high accuracy and reliability in positioning, which is crucial for construction and mining applications. The increasing adoption of these systems is driven by the need for precision in earthmoving and grading tasks, real-time site management, and integration with digital design plans, making them the preferred choice for many operators.

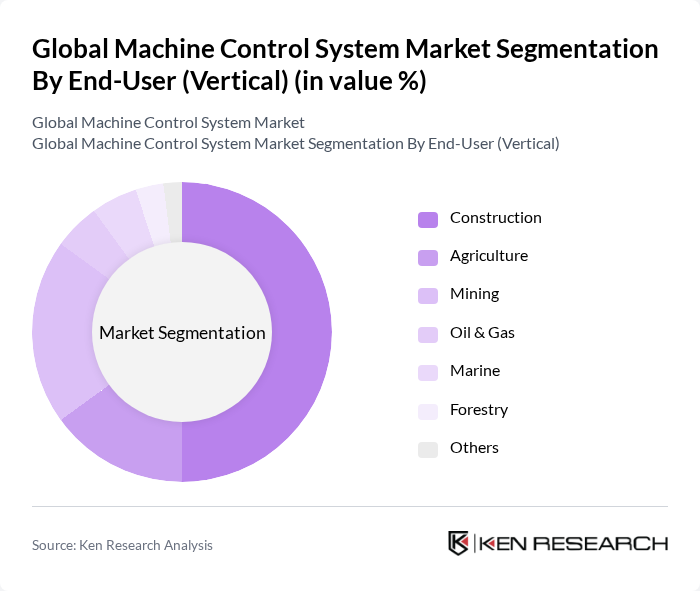

By End-User (Vertical):The market is segmented by end-user verticals, including Construction, Agriculture, Mining, Oil & Gas, Marine, Forestry, and Others. The Construction sector dominates the market, driven by the increasing need for efficient project management, cost reduction, and enhanced productivity. The adoption of machine control systems in construction improves accuracy, safety, and resource allocation, making it a vital tool for contractors and project managers. As infrastructure projects and urbanization continue to grow globally, the demand for machine control systems in this sector remains strong.

Global Machine Control System Market Competitive Landscape

The Global Machine Control System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Caterpillar Inc., Komatsu Ltd., Trimble Inc., Topcon Corporation, Hexagon AB, Leica Geosystems AG, Deere & Company (John Deere), Hitachi Construction Machinery Co., Ltd., Volvo Construction Equipment, Doosan Infracore, SANY Group, Case Construction Equipment, JCB, Manitowoc Company, Inc., Wirtgen GmbH contribute to innovation, geographic expansion, and service delivery in this space.

Global Machine Control System Market Industry Analysis

Growth Drivers

- Increasing Demand for Automation in Construction:The construction sector is projected to reach a value of $10.5 trillion in future, driven by a significant shift towards automation. This transition is fueled by the need for enhanced productivity and reduced labor costs. Automation technologies, including machine control systems, are expected to play a crucial role in this growth, with investments in automation technologies increasing by approximately $1.2 billion annually in the sector, according to the International Federation of Robotics.

- Rising Need for Precision and Efficiency in Operations:The global construction industry is increasingly prioritizing precision, with a reported 30% reduction in project delays attributed to advanced machine control systems. As projects become more complex, the demand for technologies that ensure accuracy and efficiency is surging. The World Economic Forum estimates that improving operational efficiency through such technologies could save the industry up to $1.6 trillion in future, highlighting the critical role of machine control systems.

- Growth in Infrastructure Development Projects:Infrastructure spending is expected to exceed $4 trillion globally in future, driven by government initiatives and private investments. This surge in infrastructure projects, particularly in emerging economies, is creating a robust demand for machine control systems. The Asian Development Bank has reported that Asia alone will require $26 trillion in infrastructure investments in future, further emphasizing the need for advanced technologies to manage these projects effectively.

Market Challenges

- High Initial Investment Costs:The adoption of machine control systems often requires substantial upfront investments, which can exceed $100,000 per unit for advanced systems. This financial barrier can deter smaller construction firms from integrating these technologies. According to the Construction Industry Institute, nearly 40% of companies cite high costs as a primary obstacle to adopting new technologies, limiting market growth potential in the sector.

- Lack of Skilled Workforce:The construction industry faces a significant skills gap, with an estimated shortage of 2 million skilled workers in future in the U.S. alone. This shortage hampers the effective implementation of machine control systems, as operators require specialized training to utilize these technologies effectively. The National Center for Construction Education and Research indicates that 70% of construction firms struggle to find qualified personnel, posing a challenge to market expansion.

Global Machine Control System Market Future Outlook

The future of the machine control system market appears promising, driven by technological advancements and increasing automation in construction. As companies seek to enhance operational efficiency, the integration of IoT and cloud-based solutions is expected to gain traction. Furthermore, the rise of autonomous machinery will likely reshape industry standards, pushing for more sophisticated machine control systems. These trends indicate a transformative phase for the market, with significant opportunities for innovation and growth in the coming years.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets, particularly in Asia and Africa, present significant growth opportunities for machine control systems. With infrastructure investments projected to reach $1.5 trillion in these regions in future, companies can capitalize on the increasing demand for advanced construction technologies. This expansion is expected to drive innovation and create new partnerships, enhancing market penetration.

- Development of Smart Construction Technologies:The ongoing development of smart construction technologies, including AI and machine learning, offers substantial opportunities for machine control systems. As these technologies become more integrated into construction processes, the demand for sophisticated machine control solutions is expected to rise. This trend could lead to a market growth potential of approximately $500 million in future, according to industry forecasts.