Region:Global

Author(s):Dev

Product Code:KRAB0379

Pages:92

Published On:August 2025

By Type:The major segments in this category include Refrigerators & Freezers, Washing Machines & Dryers, Dishwashers, Cooktops, Ovens & Ranges, Air Conditioners, Water Heaters & Boilers, Microwaves, Hoods & Ventilation, and Others. Among these, Refrigerators & Freezers dominate the market due to their essential role in food preservation and the strong push toward energy-efficient and connected models. Increasing integration of smart technology, such as Wi?Fi control and energy optimization features, is driving consumer interest and sales in the category .

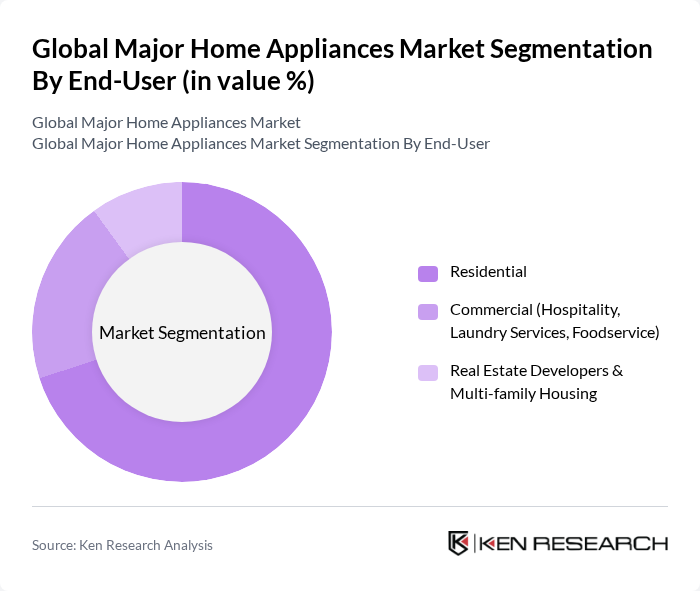

By End-User:The end-user segments include Residential, Commercial (Hospitality, Laundry Services, Foodservice), and Real Estate Developers & Multi-family Housing. The Residential segment leads the market, supported by household formation, home improvement spending, and replacement demand for more energy-efficient and smart appliances, which continues to propel uptake .

The Global Major Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Whirlpool Corporation, Samsung Electronics Co., Ltd., LG Electronics Inc., BSH Hausgeräte GmbH, AB Electrolux (Electrolux Group), Panasonic Holdings Corporation, Haier Smart Home Co., Ltd. (Haier Group), Miele & Cie. KG, GE Appliances, a Haier company, Sharp Corporation, Hisense Group, Midea Group Co., Ltd., Arçelik A.?., Gree Electric Appliances, Inc. of Zhuhai, TCL Electronics Holdings Limited contribute to innovation, geographic expansion, and service delivery in this space .

The future of the major home appliances market appears promising, driven by technological advancements and changing consumer preferences. As smart home technology continues to evolve, manufacturers are expected to invest heavily in R&D to enhance product features and connectivity. Additionally, sustainability will remain a key focus, with brands increasingly prioritizing eco-friendly materials and energy-efficient designs. This alignment with consumer values will likely foster brand loyalty and drive long-term growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators & Freezers Washing Machines & Dryers Dishwashers Cooktops, Ovens & Ranges Air Conditioners Water Heaters & Boilers Microwaves Hoods & Ventilation Others |

| By End-User | Residential Commercial (Hospitality, Laundry Services, Foodservice) Real Estate Developers & Multi-family Housing |

| By Distribution Channel | Online Retail (Brand D2C, Marketplaces) Offline Retail (Specialty Stores, Hypermarkets) Contract/Project Sales (Builders, Institutions) |

| By Price Range | Entry-Level Mid-Range Premium & Luxury |

| By Feature Set | Connected/Smart (Wi?Fi/IoT Enabled) High-Efficiency/Inverter Standard/Conventional |

| By Finish/Material | Stainless Steel Painted/Coated Metal Glass & Ceramics Plastic/Polymer |

| By Energy Efficiency Rating | ENERGY STAR/Top Runner/Equivalent Rated Non?Rated/Below Standard |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Major Appliance Retailers | 120 | Store Managers, Sales Executives |

| Consumer Electronics Distributors | 90 | Distribution Managers, Product Line Managers |

| Home Appliance Manufacturers | 80 | Product Development Managers, Marketing Directors |

| Consumer Insights and Market Research Firms | 70 | Market Analysts, Research Directors |

| Home Appliance Repair Services | 60 | Service Managers, Technicians |

The Global Major Home Appliances Market is valued at approximately USD 395 billion, reflecting strong demand driven by energy-efficient features, rising disposable incomes, and urbanization trends. This valuation is based on a comprehensive five-year historical analysis.