Japan Major Home Appliances Market Overview

- The Japan Major Home Appliances Market is valued at USD 28 billion, based on a five-year historical analysis. This growth is driven by technological innovations, rising popularity of energy-efficient products, and a shift towards smart home solutions. The market has seen a steady rise in the adoption of appliances that offer convenience, connectivity, and integration with Internet of Things (IoT) technologies, reflecting evolving consumer lifestyles and preferences. The penetration rate of smart home devices in Japan is projected to reach nearly 26%, supported by the tech-savvy population and increasing awareness of energy conservation .

- Tokyo, Osaka, and Yokohama are the dominant cities in the Japan Major Home Appliances Market. These urban centers are characterized by high population density, advanced infrastructure, and a strong economic base, which contribute to increased consumer spending on home appliances. The presence of major manufacturers and retailers in these cities enhances market accessibility, competition, and supports the rapid adoption of new technologies .

- In 2022, the Japanese government revised its energy efficiency standards for home appliances, introducing redesigned labels and a new rating scale to enhance consumer understanding and promote energy efficiency. This initiative mandates that new appliances meet specific energy consumption criteria, encouraging the use of eco-friendly technologies. These regulations are part of Japan's broader strategy to reduce carbon emissions and foster sustainable consumption practices among consumers .

Japan Major Home Appliances Market Segmentation

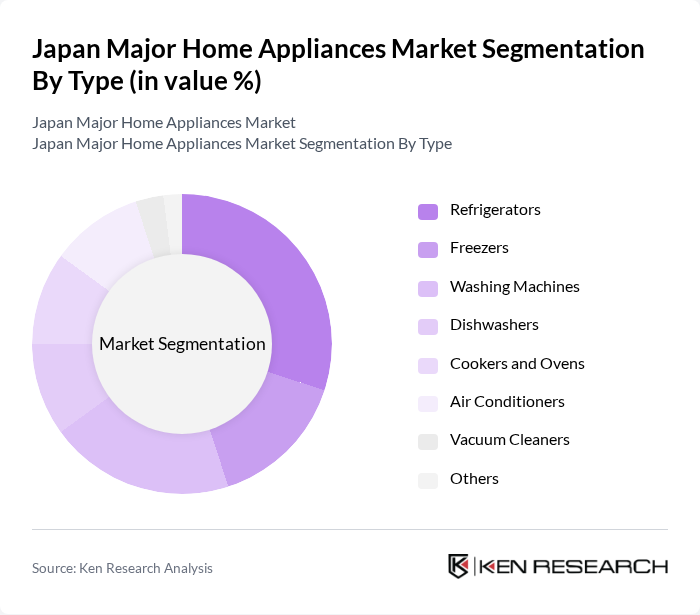

By Type:

The major segments under this category include Refrigerators, Freezers, Washing Machines, Dishwashers, Cookers and Ovens, Air Conditioners, Vacuum Cleaners, and Others. Among these, Refrigerators hold the largest market share due to their essential role in food preservation and the increasing demand for energy-efficient and smart models. Consumers are opting for smart refrigerators that offer advanced features such as connectivity, energy monitoring, and remote control. The overall demand for energy-efficient appliances is influencing consumer choices, with eco-friendly and IoT-enabled products gaining significant traction .

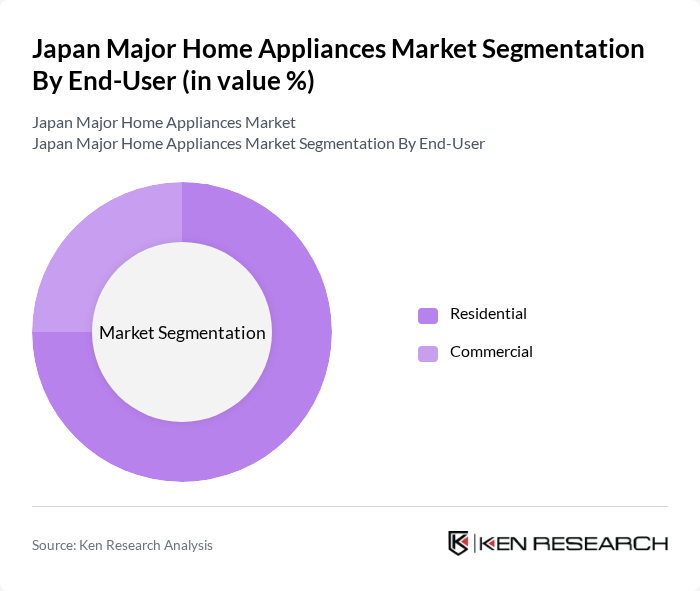

By End-User:

This segmentation includes Residential and Commercial users. The Residential segment accounts for the majority share of the market, driven by the increasing number of households, rising disposable income, and strong demand for home automation and smart appliances. Consumers in residential settings prioritize convenience, efficiency, and sustainability. The Commercial segment, while smaller, is expanding as businesses invest in modern appliances to enhance operational efficiency and customer experience, especially in hospitality and retail sectors .

Japan Major Home Appliances Market Competitive Landscape

The Japan Major Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Panasonic Corporation, Hitachi, Ltd., Sharp Corporation, Toshiba Corporation, Mitsubishi Electric Corporation, Daikin Industries, Ltd., Haier Japan, Inc., LG Electronics Japan, Inc., Samsung Electronics Japan Co., Ltd., Electrolux Japan K.K., Whirlpool Japan, Inc., Aisin Corporation, Miele Japan K.K., BSH Home Appliances Ltd., Smeg Japan K.K., Gree Electric Appliances, Inc. of Zhuhai contribute to innovation, geographic expansion, and service delivery in this space.

Japan Major Home Appliances Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Japan's urban population is projected to reach approximately 91.8% by future, according to the World Bank. This urbanization trend drives demand for major home appliances as urban households typically require more advanced and efficient appliances. The shift towards urban living is also associated with smaller living spaces, increasing the need for multifunctional appliances that save space while enhancing convenience and lifestyle quality for urban residents.

- Rising Disposable Income:The average disposable income in Japan is expected to rise to around ¥4.2 million (approximately $29,000) in future, as reported by the Ministry of Internal Affairs and Communications. This increase in disposable income allows consumers to invest in higher-quality home appliances, which are often more energy-efficient and technologically advanced. As consumers prioritize comfort and convenience, the demand for premium appliances is likely to grow, further stimulating market expansion.

- Technological Advancements:The Japanese home appliances sector is witnessing rapid technological innovations, with R&D spending projected to exceed ¥1.2 trillion (approximately $8.5 billion) in future. These advancements include smart appliances integrated with IoT capabilities, enhancing user experience and energy efficiency. As consumers become more tech-savvy, the demand for appliances that offer connectivity and automation is expected to rise, driving market growth significantly in the coming years.

Market Challenges

- Intense Competition:The Japanese major home appliances market is characterized by fierce competition among established brands such as Panasonic, Sony, and Sharp, which collectively hold over 60% market share. This intense rivalry leads to price wars and increased marketing expenditures, which can erode profit margins. Companies must continuously innovate and differentiate their products to maintain market position, making it challenging for new entrants to gain traction in this saturated market.

- Supply Chain Disruptions:The global supply chain disruptions caused by the COVID-19 pandemic have significantly impacted the availability of raw materials and components for home appliances. In future, the average lead time for appliance manufacturing is expected to remain around 12 weeks, up from 8 weeks pre-pandemic. These delays can hinder production schedules and lead to increased costs, ultimately affecting the ability of manufacturers to meet consumer demand in a timely manner.

Japan Major Home Appliances Market Future Outlook

The future of the Japan major home appliances market appears promising, driven by ongoing technological advancements and a growing emphasis on sustainability. As consumers increasingly seek energy-efficient and smart appliances, manufacturers are likely to invest in innovative solutions that cater to these preferences. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice and convenience. Overall, the market is poised for growth as it adapts to evolving consumer needs and preferences.

Market Opportunities

- Growth in E-commerce Sales:E-commerce sales in Japan are projected to reach ¥22.7 trillion (approximately $170 billion) by future, according to the Ministry of Economy, Trade and Industry. This growth presents a significant opportunity for home appliance manufacturers to expand their online presence and reach a broader customer base, particularly among younger consumers who prefer online shopping for convenience and variety.

- Expansion of Smart Home Technologies:The smart home technology market in Japan is expected to grow to ¥1.2 trillion (approximately $9 billion) by future. This expansion offers home appliance manufacturers the chance to integrate IoT features into their products, enhancing functionality and user experience. As consumers increasingly adopt smart home solutions, the demand for connected appliances will likely surge, creating new revenue streams for manufacturers.