Region:Middle East

Author(s):Rebecca

Product Code:KRAD0332

Pages:98

Published On:August 2025

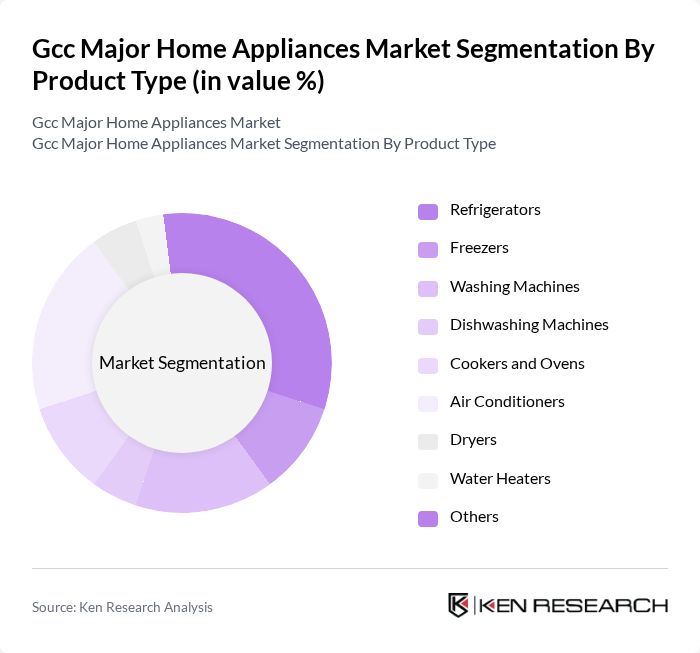

By Product Type:The market is segmented into various product types, including refrigerators, freezers, washing machines, dishwashing machines, cookers and ovens, air conditioners, dryers, water heaters, and others. Among these, refrigerators and air conditioners are the leading segments due to their essential role in modern households and the increasing demand for energy-efficient models. The trend towards smart appliances is also influencing consumer preferences, with a growing number of households opting for connected devices that offer convenience and energy savings.

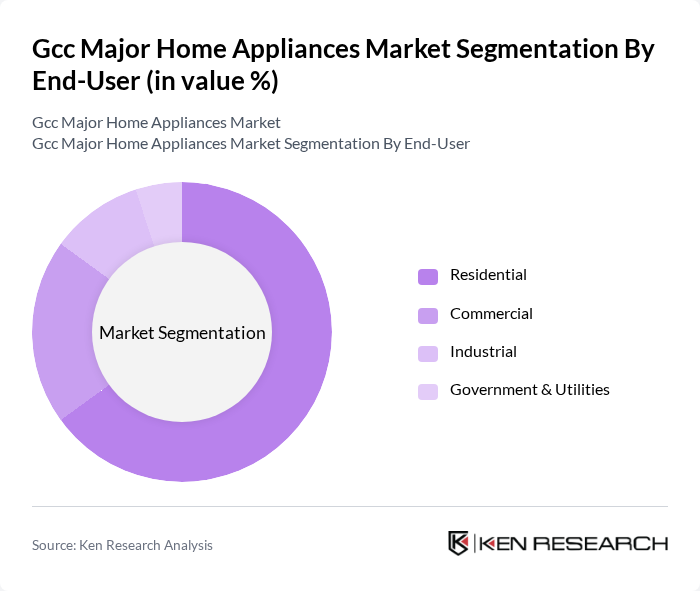

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities. The residential segment dominates the market, driven by the increasing number of households and the rising trend of home renovations. Consumers are increasingly investing in modern appliances that enhance comfort and efficiency in their homes. The commercial segment is also growing, particularly in the hospitality and food service industries, where the demand for high-quality appliances is on the rise.

The GCC Major Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., LG Electronics Inc., Whirlpool Corporation, Bosch Home Appliances (BSH Hausgeräte GmbH), Electrolux AB, Panasonic Corporation, Haier Group Corporation, Miele & Cie. KG, Sharp Corporation, GE Appliances, a Haier company, Arçelik A.?., Hisense Group, TCL Technology Group Corporation, Gree Electric Appliances Inc., Beko, Nikai Group, Super General Company, Al-Futtaim Electronics, Jumbo Electronics Co. Ltd (UAE), Daikin Industries, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC major home appliances market appears promising, driven by technological innovations and changing consumer preferences. As urbanization continues, the demand for smart and energy-efficient appliances is expected to rise. Additionally, sustainability initiatives will play a crucial role in shaping product offerings. Companies that invest in research and development to create eco-friendly and technologically advanced products will likely capture a significant share of the market, ensuring long-term growth and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Refrigerators Freezers Washing Machines Dishwashing Machines Cookers and Ovens Air Conditioners Dryers Water Heaters Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Distribution Channel | Multi-Branded Stores Specialty Retailers Online Direct Sales Offline Stores Wholesale Other Distribution Channels |

| By Price Range | Entry-Level Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers First-Time Buyers |

| By Product Features | Smart Features Energy Efficiency Design and Aesthetics |

| By Region | United Arab Emirates Saudi Arabia Bahrain Oman Qatar Kuwait |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refrigerator Market Insights | 100 | Retail Managers, Product Category Heads |

| Washing Machine Consumer Preferences | 90 | Home Appliance Buyers, Household Decision Makers |

| Air Conditioner Usage Trends | 80 | HVAC Technicians, Homeowners |

| Smart Home Appliances Adoption | 60 | Tech-Savvy Consumers, Early Adopters |

| Energy Efficiency Awareness | 50 | Environmental Advocates, Sustainability Officers |

The GCC Major Home Appliances Market is valued at approximately USD 5.8 billion, driven by factors such as rising disposable incomes, urbanization, and a growing preference for energy-efficient and smart home appliances.