Region:Global

Author(s):Geetanshi

Product Code:KRAE1010

Pages:114

Published On:December 2025

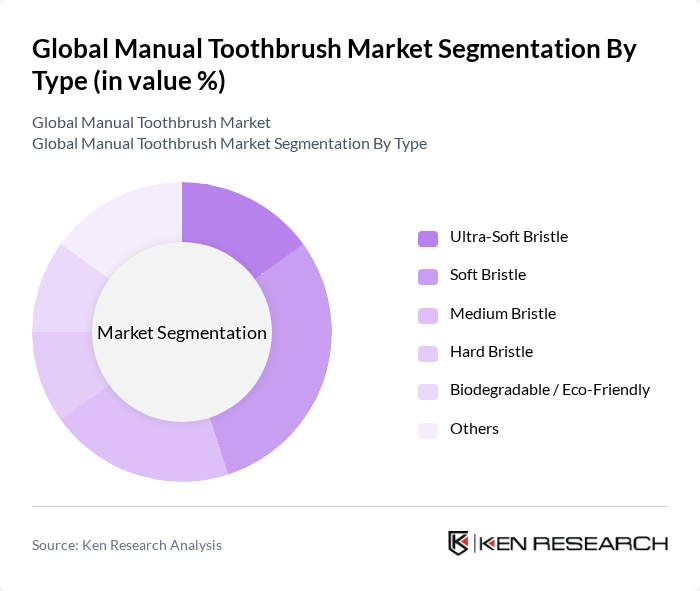

By Type:The market is segmented into various types of manual toothbrushes, including Ultra-Soft Bristle, Soft Bristle, Medium Bristle, Hard Bristle, Biodegradable / Eco-Friendly, and Others. Among these, the Soft and Medium Bristle segments together form the core of global demand due to their widespread acceptance among consumers for their gentle cleaning action, making them suitable for sensitive gums. The increasing awareness of oral health and the recommendation of dental professionals further bolster the demand for these toothbrushes.

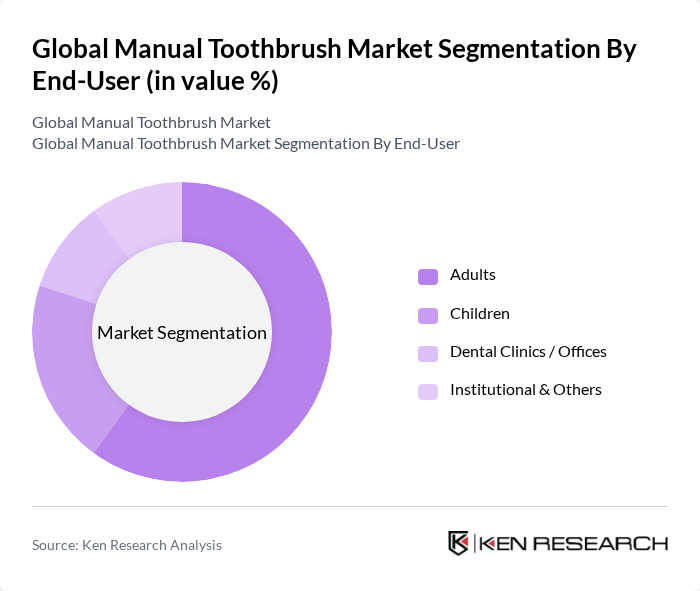

By End-User:The market is segmented by end-users into Adults, Children, Dental Clinics / Offices, and Institutional & Others. The Adults segment holds the largest share, driven by the increasing focus on personal hygiene and preventive dental care. Adults are more likely to invest in quality oral care products, leading to a higher demand for manual toothbrushes tailored to their specific needs, such as sensitivity and gum health.

The Global Manual Toothbrush Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble (Oral-B), Colgate-Palmolive, Unilever (Signal, Pepsodent), GlaxoSmithKline (Sensodyne, Parodontax), Church & Dwight (Arm & Hammer), Lion Corporation, Sunstar Suisse SA (GUM), Henkel AG & Co. KGaA, Johnson & Johnson (Reach), TePe Munhygienprodukter AB, Curaden AG (Curaprox), Dr. Bronner’s Magic Soaps, RADIUS Corporation, EcoTools (Paris Presents Inc.), Brush with Bamboo, WooBamboo, The Humble Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the manual toothbrush market appears promising, driven by increasing consumer awareness of oral hygiene and a growing preference for sustainable products. As innovations continue to enhance product offerings, manufacturers are likely to focus on developing eco-friendly designs that cater to health-conscious consumers. Additionally, the expansion into emerging markets will provide new growth avenues, as rising disposable incomes enable greater access to dental care products, including manual toothbrushes.

| Segment | Sub-Segments |

|---|---|

| By Type | Ultra-Soft Bristle Soft Bristle Medium Bristle Hard Bristle Biodegradable / Eco-Friendly Others |

| By End-User | Adults Children Dental Clinics / Offices Institutional & Others |

| By Material | Conventional Plastic Bioplastics & Plant-Based Polymers Bamboo & Wood Recycled Materials Others |

| By Design | Straight Handle Ergonomic / Contoured Handle Compact Head Orthodontic & Specialty Heads Travel-Friendly / Foldable Others |

| By Distribution Channel | Supermarkets / Hypermarkets Pharmacies & Drugstores Convenience & Grocery Stores Online Retail & E-commerce Dental Clinics & Professional Channels Others |

| By Price Range | Mass / Economy Mid-Range Premium Super-Premium & Specialty |

| By Brand Positioning | Value & Mass-Market Brands Premium & Professional Brands Eco-Friendly & Sustainable Brands Kids-Focused & Lifestyle Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Manual Toothbrushes | 140 | General Consumers, Health-Conscious Individuals |

| Dental Professional Insights | 60 | Dentists, Dental Hygienists |

| Retail Market Trends | 50 | Retail Managers, Category Buyers |

| Environmental Impact Awareness | 40 | Sustainability Advocates, Eco-conscious Consumers |

| Brand Loyalty and Switching Behavior | 70 | Brand Loyalists, Switchers |

The Global Manual Toothbrush Market is valued at approximately USD 5 billion, reflecting a significant growth driven by increased consumer awareness of oral hygiene, rising dental health issues, and a demand for eco-friendly products.