Region:Global

Author(s):Dev

Product Code:KRAA2535

Pages:85

Published On:August 2025

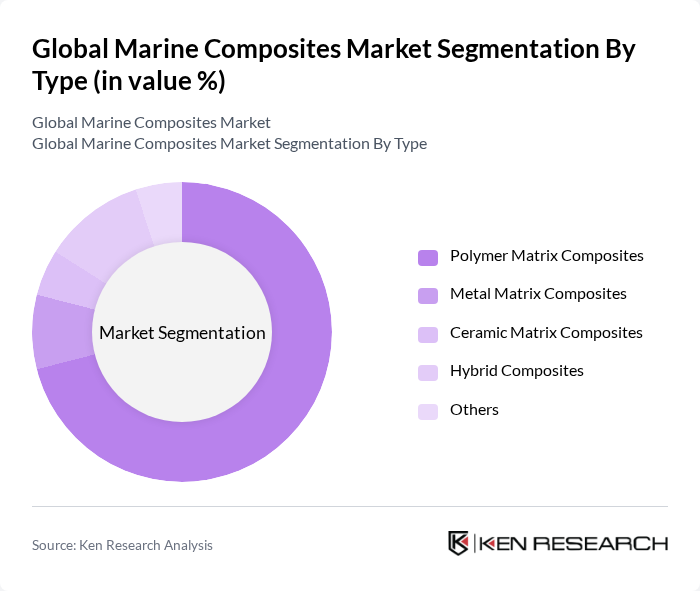

By Type:The market is segmented into various types of composites, including Polymer Matrix Composites, Metal Matrix Composites, Ceramic Matrix Composites, Hybrid Composites, and Others. Among these, Polymer Matrix Composites are the most widely used due to their excellent strength-to-weight ratio, corrosion resistance, and cost-effective processing. These characteristics make them ideal for a broad range of marine applications, from hulls and decks to structural and interior components. The demand for these composites is further driven by their versatility and the growing trend toward lightweight vessel construction .

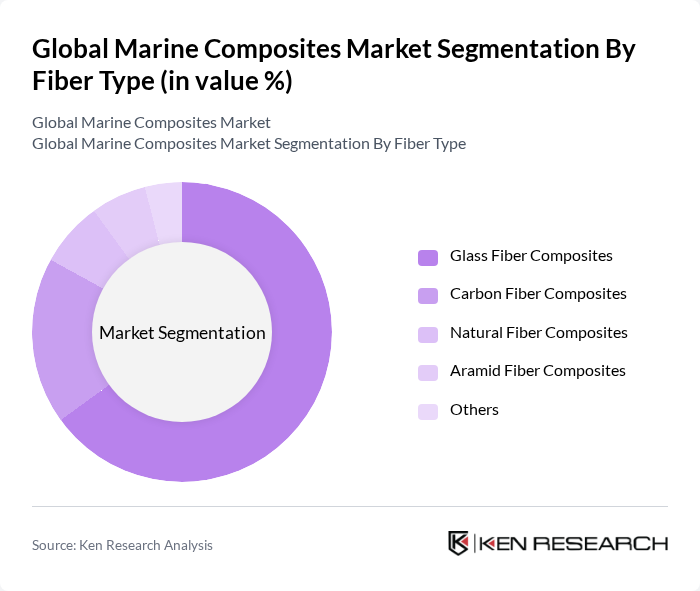

By Fiber Type:The fiber type segmentation includes Glass Fiber Composites, Carbon Fiber Composites, Natural Fiber Composites, Aramid Fiber Composites, and Others. Glass Fiber Composites continue to dominate the market, attributed to their cost-effectiveness, favorable mechanical properties, and widespread use in both recreational and commercial vessels. The adoption of carbon fiber composites is increasing, particularly in high-performance and luxury vessels, due to their superior strength and lightweight characteristics. Natural and aramid fiber composites are gaining traction for specialized applications where sustainability and high-impact resistance are required .

The Global Marine Composites Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hexcel Corporation, Gurit Holding AG, Owens Corning, Solvay S.A., Teijin Limited, Sika AG, 3M Company, BASF SE, Mitsubishi Chemical Corporation, Jushi Group Co., Ltd., Toray Industries, Inc., AOC, LLC, Cytec Industries Inc. (Solvay Group), Zoltek Companies, Inc. (Toray Group), Formosa Plastics Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the marine composites market appears promising, driven by ongoing innovations and increasing environmental awareness. As manufacturers continue to develop sustainable composite materials, the market is likely to see a shift towards eco-friendly solutions. Additionally, the integration of smart technologies, such as IoT and sensors, into marine composites will enhance functionality and performance, catering to the evolving needs of the industry. This dynamic landscape is expected to foster significant growth opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Polymer Matrix Composites Metal Matrix Composites Ceramic Matrix Composites Hybrid Composites Others |

| By Fiber Type | Glass Fiber Composites Carbon Fiber Composites Natural Fiber Composites Aramid Fiber Composites Others |

| By Resin Type | Polyester Vinyl Ester Epoxy Thermoplastic Phenolic Acrylic Others |

| By Vessel Type | Power Boats Sailboats Cruise Ships Cargo Vessels Naval Boats Jet Boats Personal Watercraft Offshore Energy Platforms Others |

| By Application | Hull Construction Decks and Superstructures Interior Components Repair and Maintenance Propellers and Shafts Masts and Stacks Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Material Source | Domestic Suppliers International Suppliers Recycled Materials Others |

| By Product Form | Sheets Rolls Prepregs Mats Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Recreational Boat Manufacturers | 100 | Product Development Managers, Design Engineers |

| Commercial Shipping Companies | 80 | Fleet Managers, Procurement Specialists |

| Marine Equipment Suppliers | 60 | Sales Directors, Supply Chain Managers |

| Research Institutions in Marine Technology | 50 | Research Scientists, Academic Professors |

| Regulatory Bodies for Marine Safety | 40 | Policy Makers, Compliance Officers |

The Global Marine Composites Market is valued at approximately USD 5.2 billion, driven by the increasing demand for lightweight and durable materials in the marine industry, along with advancements in composite manufacturing technologies.