Region:Global

Author(s):Dev

Product Code:KRAA3064

Pages:96

Published On:August 2025

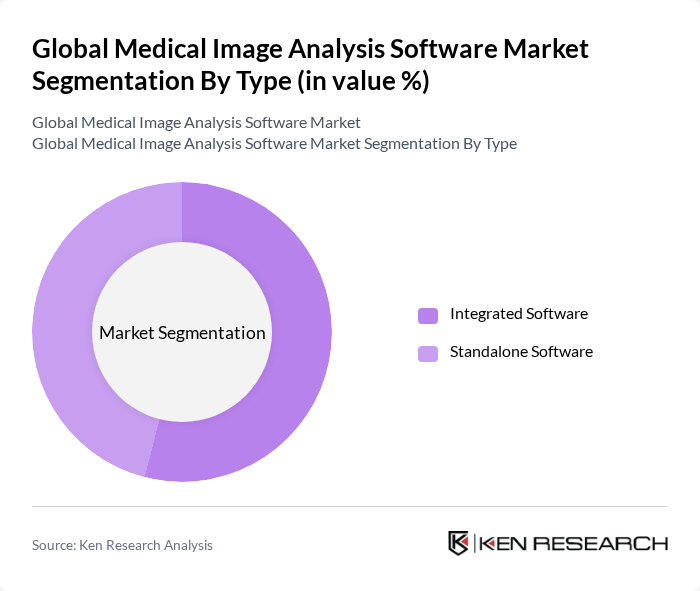

By Type:The market is segmented into Integrated Software and Standalone Software. Integrated Software solutions are increasingly preferred due to their ability to provide comprehensive functionalities within a single platform, enhancing workflow efficiency and interoperability in healthcare settings. Standalone Software remains relevant for specialized applications, particularly in smaller facilities or departments that do not require full integration. Integrated platforms are favored for their scalability and seamless data management, while standalone solutions are valued for targeted diagnostic tasks.

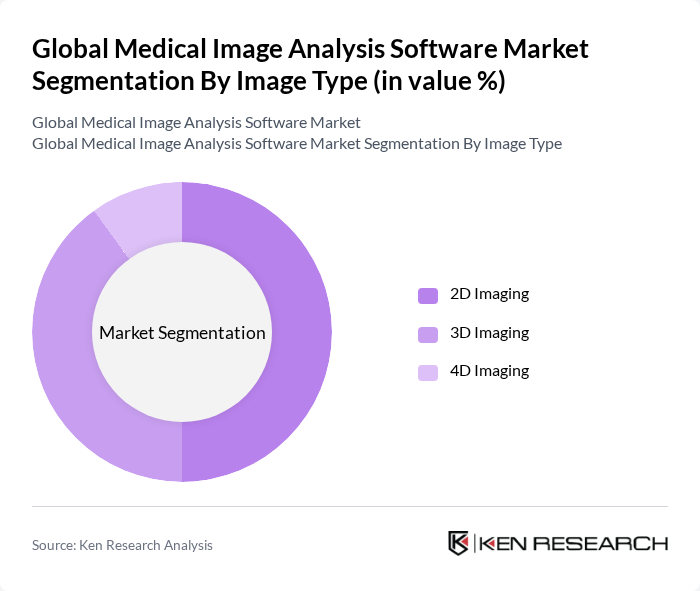

By Image Type:The market is categorized into 2D Imaging, 3D Imaging, and 4D Imaging. 2D Imaging remains the most widely used modality, especially for routine clinical diagnostics and established workflows. 3D Imaging is rapidly gaining traction due to its enhanced visualization capabilities, supporting more precise treatment planning and research applications. 4D Imaging, which incorporates real-time temporal changes, is emerging in advanced clinical and research settings, particularly in cardiology and oncology, as technology and computational power improve.

The Global Medical Image Analysis Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE Healthcare, Philips Healthcare, IBM Watson Health, Agfa HealthCare, Canon Medical Systems, Fujifilm Healthcare, Carestream Health, Mirada Medical, Zebra Medical Vision, Arterys, Qure.ai, Aidoc, RadNet, Intrasense contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medical image analysis software market appears promising, driven by ongoing technological advancements and a growing focus on personalized medicine. As healthcare providers increasingly adopt AI-driven solutions, the integration of machine learning algorithms will enhance diagnostic accuracy and efficiency. Additionally, the rise of telemedicine and remote diagnostics will further expand the market, enabling healthcare professionals to leverage advanced imaging technologies for patient care, regardless of location.

| Segment | Sub-Segments |

|---|---|

| By Type | Integrated Software Standalone Software |

| By Image Type | D Imaging D Imaging D Imaging |

| By Modality | Tomography (CT, PET, SPECT) Ultrasound Imaging Radiographic (X-ray) Imaging Combined Modalities Mammography Others |

| By Application | Cardiology Orthopedics Oncology Neurology Obstetrics and Gynecology Dental Applications Respiratory Applications Urology & Nephrology Others |

| By End-User | Hospitals Diagnostic Imaging Centers Research Centers/Institutions Ambulatory Surgical Centers Others |

| By Deployment Model | On-Premise Cloud-Based Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| By Customer Type | Individual Practitioners Small Clinics Large Healthcare Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 100 | Radiologists, Imaging Technologists |

| Diagnostic Centers | 60 | Center Managers, IT Directors |

| Healthcare IT Solutions | 50 | Software Developers, Product Managers |

| Research Institutions | 40 | Clinical Researchers, Data Analysts |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Global Medical Image Analysis Software Market is valued at approximately USD 3.3 billion, driven by the increasing prevalence of chronic diseases, advancements in imaging technologies, and the demand for efficient diagnostic solutions.