Region:Global

Author(s):Shubham

Product Code:KRAC0758

Pages:88

Published On:August 2025

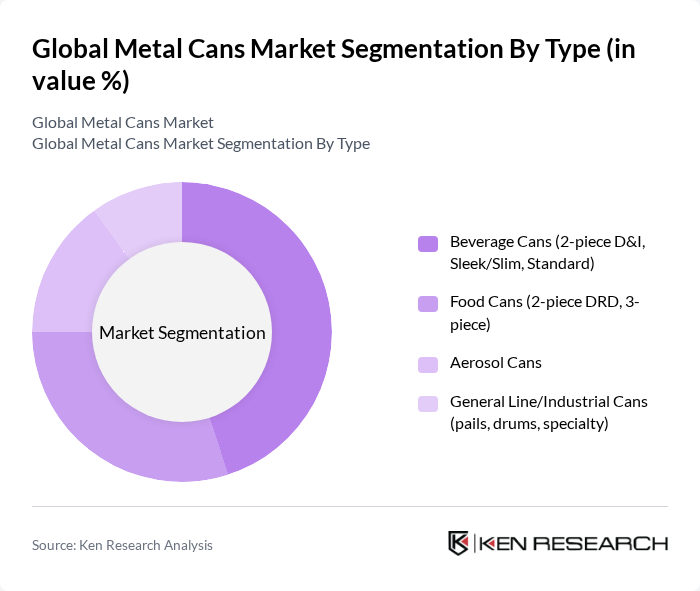

By Type:

The metal cans market is segmented into four main types: Beverage Cans, Food Cans, Aerosol Cans, and General Line/Industrial Cans. Among these, Beverage Cans, particularly the 2-piece Drawn & Ironed (D&I) type, dominate the market due to the rising consumption of carbonated drinks and energy beverages. The convenience and portability of these cans, along with their recyclability, make them a preferred choice among consumers. Food Cans, especially for ready-to-eat meals, are also gaining traction as more consumers opt for convenient meal solutions. The demand for Aerosol Cans is driven by the personal care and household products sectors, while General Line/Industrial Cans cater to a niche market but are essential for various industrial applications .

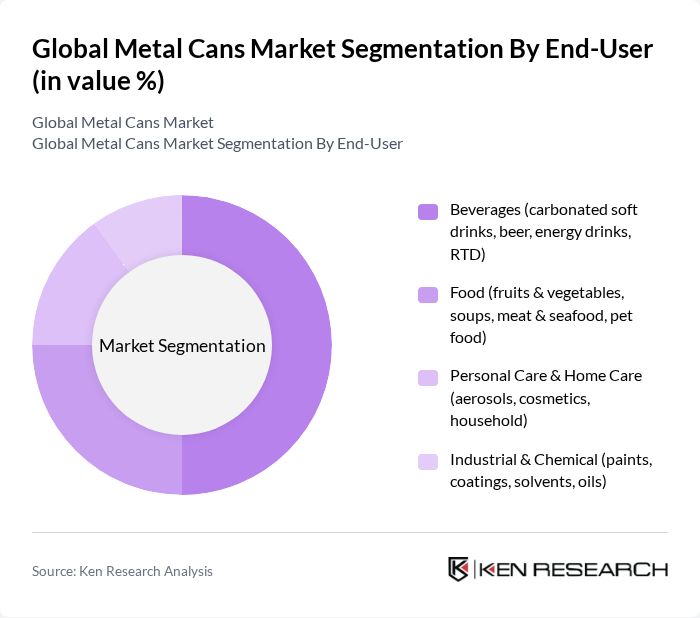

By End-User:

The end-user segmentation includes Beverages, Food, Personal Care & Home Care, and Industrial & Chemical. The Beverages segment holds the largest share, driven by the increasing consumption of carbonated soft drinks, beer, and energy drinks. The Food segment is also significant, with rising demand for canned fruits, vegetables, and ready-to-eat meals. Personal Care & Home Care products, particularly aerosols, are gaining popularity due to their convenience. The Industrial & Chemical segment, while smaller, is essential for packaging paints, coatings, and solvents, contributing to the overall market growth .

The Global Metal Cans Market is characterized by a dynamic mix of regional and international players. Leading participants such as Crown Holdings, Inc., Ball Corporation, Ardagh Group S.A., Silgan Holdings Inc., CANPACK S.A., Toyo Seikan Group Holdings, Ltd., CPMC Holdings Limited, Allstate Can Corporation, Kian Joo Can Factory Berhad, Trivium Packaging, Nampak Ltd., Mauser Packaging Solutions, Envases Group, Ball Metalpack (now Sonoco Metal Packaging), Colep Packaging contribute to innovation, geographic expansion, and service delivery in this space.

The future of the metal cans market appears promising, driven by increasing consumer awareness of sustainability and the ongoing growth of the beverage sector. As manufacturers invest in innovative technologies and sustainable practices, the market is likely to see enhanced production capabilities and product offerings. Additionally, the expansion of e-commerce is expected to create new distribution channels, further boosting demand for metal cans in various applications, including food preservation and craft beverages.

| Segment | Sub-Segments |

|---|---|

| By Type | Beverage Cans (2-piece D&I, Sleek/Slim, Standard) Food Cans (2-piece DRD, 3-piece) Aerosol Cans General Line/Industrial Cans (pails, drums, specialty) |

| By End-User | Beverages (carbonated soft drinks, beer, energy drinks, RTD) Food (fruits & vegetables, soups, meat & seafood, pet food) Personal Care & Home Care (aerosols, cosmetics, household) Industrial & Chemical (paints, coatings, solvents, oils) |

| By Material Type | Aluminum Steel/Tinplate Others (tin-free steel, specialty alloys) |

| By Application | Carbonated Drinks Alcoholic Beverages (beer, RTD cocktails, wine) Non-Carbonated Drinks (juices, teas, functional beverages) Food Preservation (retortable cans, canned meals) Aerosols (personal care, household) |

| By Distribution Channel | Direct to Brand Owners (beverage/CPG contracts) Distributors/Converters Online Procurement/Spot Market Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Product Structure | Piece Drawn & Ironed (D&I) Piece Draw-Redraw (DRD) Piece Welded |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Beverage Packaging Sector | 120 | Production Managers, Supply Chain Analysts |

| Food Packaging Applications | 100 | Quality Control Managers, Procurement Specialists |

| Industrial Metal Cans | 80 | Operations Directors, Product Development Engineers |

| Recycling and Sustainability Initiatives | 70 | Sustainability Managers, Environmental Compliance Officers |

| Emerging Markets Analysis | 90 | Market Analysts, Regional Sales Managers |

The Global Metal Cans Market is valued at approximately USD 68 billion, reflecting strong demand driven by the packaged beverages and food sectors, alongside high recycling rates for aluminum and steel packaging.