Region:Asia

Author(s):Dev

Product Code:KRAD7686

Pages:83

Published On:December 2025

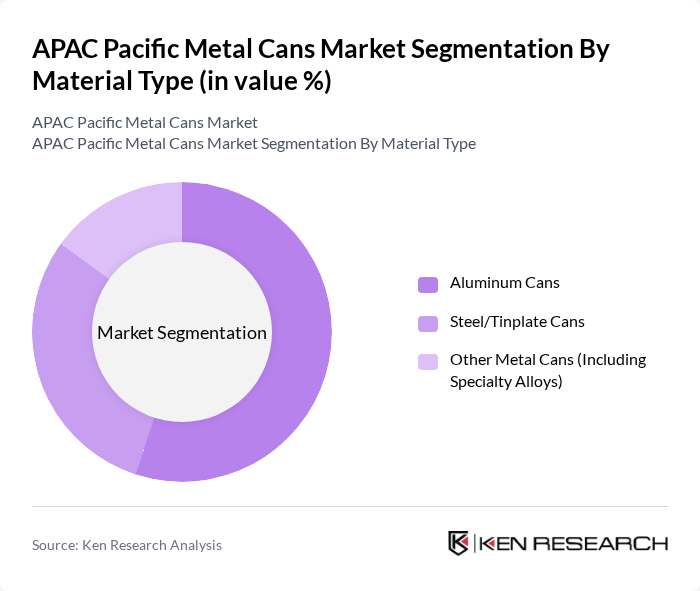

By Material Type:The market is segmented into three primary material types: Aluminum Cans, Steel/Tinplate Cans, and Other Metal Cans (Including Specialty Alloys). Aluminum cans are leading the market due to their lightweight nature, high corrosion resistance, and very high recyclability rates, making them a preferred choice for carbonated soft drinks, beer, energy drinks, and ready-to-drink beverages across the region. Steel/tinplate cans are also significant, particularly in food packaging for products such as canned vegetables, soups, meat, fish, and pet food, where strength and barrier properties are critical. Other metal cans (including specialty alloys) cater to niche markets such as aerosols, industrial products, and premium or decorative packaging, where differentiation, shape customization, and product protection are key purchase drivers.

By Product Type:The product segmentation includes 2-Piece Cans, 3-Piece Cans, and Specialty & Shaped Cans. The 2-piece cans segment is dominating the market due to their efficiency in high-speed production, lower material usage through drawn-and-ironed technology, excellent stackability, and suitability for beverages and some food applications, which appeals to manufacturers looking to reduce costs while improving line productivity. The 3-piece cans are primarily used in food packaging and certain industrial and aerosol products, where flexibility in size, height, and print area is important, especially for canned foods, pet food, and powdered products. Specialty and shaped cans cater to unique consumer and brand-owner demands in categories such as premium beverages, gift packs, confectionery, personal care, and promotional packaging, where differentiation, aesthetics, and convenience features (such as easy-open ends) are prioritized.

The APAC Pacific Metal Cans Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ball Corporation, Crown Holdings, Inc., Ardagh Group S.A., Silgan Holdings Inc., Toyo Seikan Group Holdings, Ltd., CPMC Holdings Limited, ORG Technology Co., Ltd., Kian Joo Can Factory Berhad, Nampak Limited, Can-One Berhad, Daiwa Can Company, Tata Steel Packaging (Asia-Pacific), Mauser Packaging Solutions, Guangzhou Chumboon Printing & Packaging Co., Ltd., Shengxing Group Co., Ltd. contribute to innovation, geographic expansion, lightweighting initiatives, and improved recycling and collection systems in this space.

The APAC Pacific Metal Cans Market is poised for substantial growth, driven by increasing consumer demand for sustainable packaging and innovations in manufacturing technologies. As the beverage industry expands, manufacturers are likely to invest in advanced production techniques to enhance efficiency and reduce environmental impact. Additionally, the focus on recycling initiatives and eco-friendly practices will shape the market landscape, encouraging collaboration between manufacturers and beverage brands to meet evolving consumer preferences and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Aluminum Cans Steel/Tinplate Cans Other Metal Cans (Including Specialty Alloys) |

| By Product Type | Piece Cans Piece Cans Specialty & Shaped Cans |

| By Can Type | Beverage Cans (Alcoholic & Non-Alcoholic) Food Cans Aerosol Cans Other Can Types (Industrial, Chemical, etc.) |

| By End-Use Industry | Food & Beverage Personal Care & Cosmetics Household & Industrial Pharmaceutical & Healthcare Others |

| By Country | China Japan India South Korea Australia & New Zealand Rest of Asia-Pacific |

| By Filling Technology | Standard/Conventional Cans Easy-Open End (EOE) & Stay-On Tab Cans Aseptic & Retort-Processed Cans |

| By Sustainability Attribute | High Recycled Content Cans Lightweighted Cans Returnable/Refillable Metal Cans |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Beverage Can Manufacturers | 120 | Production Managers, Quality Control Supervisors |

| Food Packaging Companies | 100 | Procurement Managers, Product Development Leads |

| Recycling and Sustainability Initiatives | 80 | Sustainability Officers, Environmental Compliance Managers |

| Retail Distribution Channels | 100 | Logistics Coordinators, Supply Chain Analysts |

| Market Research Analysts | 90 | Market Analysts, Industry Consultants |

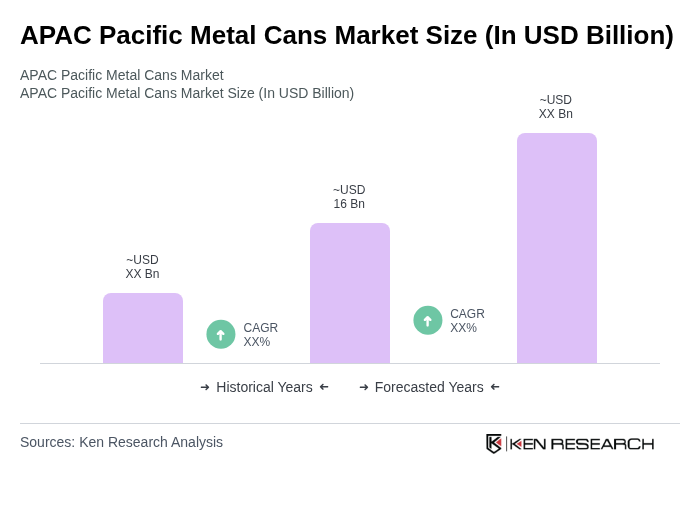

The APAC Pacific Metal Cans Market is valued at approximately USD 16 billion, based on a five-year historical analysis. This valuation reflects the growing demand for sustainable packaging solutions, particularly in the food and beverage sectors.