Region:North America

Author(s):Shubham

Product Code:KRAA1921

Pages:84

Published On:August 2025

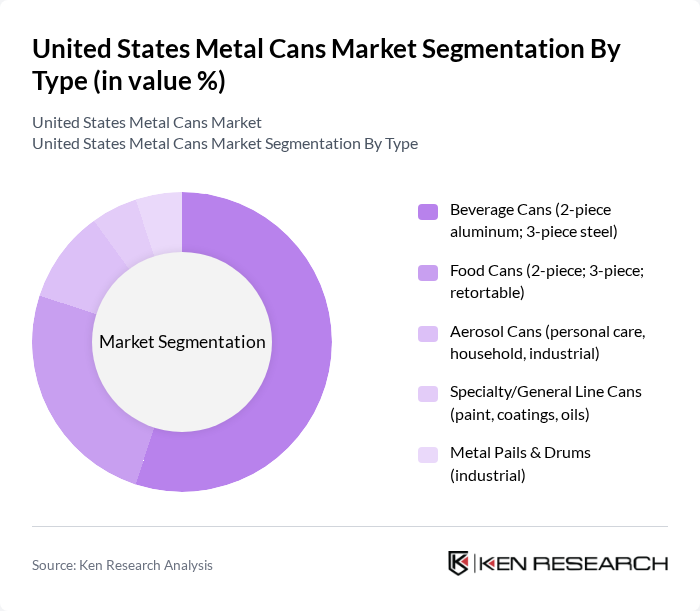

By Type:

The metal cans market can be segmented into various types, including beverage cans, food cans, aerosol cans, specialty/general line cans, and metal pails & drums. Among these, beverage cans, particularly 2-piece aluminum and 3-piece steel, dominate the market due to the rising consumption of canned beverages, including soft drinks and alcoholic beverages. The convenience and portability of these cans, along with their recyclability, make them a preferred choice among consumers. Food cans also hold a significant share, driven by the demand for preserved and ready-to-eat meals.

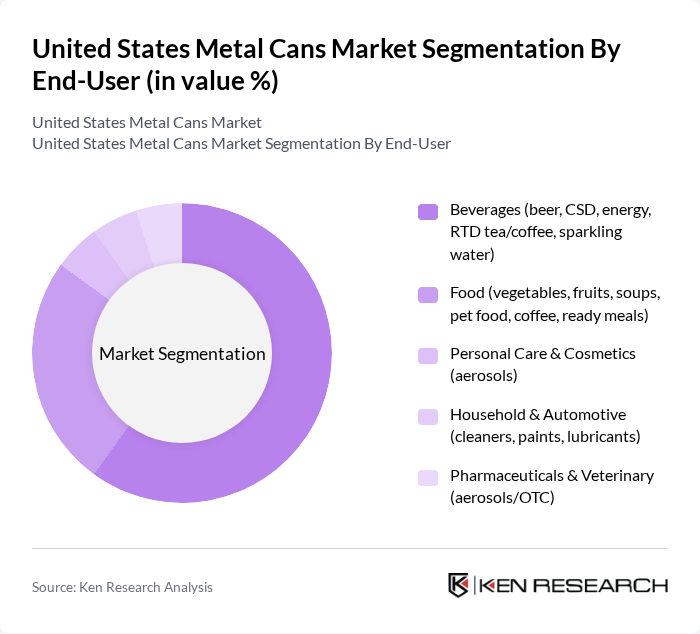

By End-User:

The end-user segmentation of the metal cans market includes beverages, food, personal care & cosmetics, household & automotive, and pharmaceuticals & veterinary. The beverage segment is the largest, driven by the increasing consumption of carbonated soft drinks, energy drinks, and alcoholic beverages. The convenience of metal cans, along with their ability to preserve product freshness, has led to a significant rise in demand from this sector. The food segment also shows robust growth, particularly in canned vegetables, soups, and ready meals, as consumers seek convenient meal options.

The United States Metal Cans Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ball Corporation, Crown Holdings, Inc., Ardagh Group S.A., Silgan Holdings Inc., CANPACK S.A., Toyo Seikan Group Holdings, Ltd., CPMC Holdings Limited, Reynolds Group Holdings Limited (Pactiv Evergreen’s packaging affiliates), Kian Joo Can Factory Berhad, Allstate Can Corporation, Mauser Packaging Solutions (formerly BWAY), Novelis Inc., Sonoco Products Company, Greif, Inc., Trivium Packaging contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. metal cans market appears promising, driven by increasing consumer awareness of sustainability and the ongoing growth of the beverage sector. As manufacturers invest in advanced technologies and sustainable practices, the market is likely to see enhanced product offerings and improved efficiency. Additionally, the focus on recycling initiatives and collaborations with beverage brands will further strengthen the market's position, ensuring that metal cans remain a preferred packaging choice in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Beverage Cans (2-piece aluminum; 3-piece steel) Food Cans (2-piece; 3-piece; retortable) Aerosol Cans (personal care, household, industrial) Specialty/General Line Cans (paint, coatings, oils) Metal Pails & Drums (industrial) |

| By End-User | Beverages (beer, CSD, energy, RTD tea/coffee, sparkling water) Food (vegetables, fruits, soups, pet food, coffee, ready meals) Personal Care & Cosmetics (aerosols) Household & Automotive (cleaners, paints, lubricants) Pharmaceuticals & Veterinary (aerosols/OTC) |

| By Material | Aluminum Steel (tinplate, tin-free steel) Hybrid/Composite Metal Closures |

| By Distribution Channel | Direct to Brands/Fillers (contract-brew, co-packers) Distributors/Wholesalers Online/Spot Market Platforms OEM/Private Label Supply |

| By Region | Northeast Midwest South West |

| By Price Range | Economy Mid-Range Premium |

| By Application | Carbonated Beverages (beer, CSD) Non-Carbonated Beverages (water, RTD, juices) Processed Foods (soups, vegetables, fruits, pet food) Aerosols (personal care, household, industrial) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Beverage Packaging Insights | 150 | Product Managers, Packaging Engineers |

| Food Industry Packaging Preferences | 100 | Supply Chain Managers, Quality Assurance Officers |

| Consumer Attitudes Towards Metal Cans | 150 | General Consumers, Eco-conscious Shoppers |

| Market Trends in Recycling and Sustainability | 80 | Sustainability Managers, Environmental Consultants |

| Industrial Applications of Metal Cans | 70 | Procurement Managers, Operations Directors |

The United States Metal Cans Market is valued at approximately USD 21 billion, reflecting a significant growth trend driven by the increasing demand for sustainable packaging solutions, particularly in the beverage sector.