Region:Global

Author(s):Geetanshi

Product Code:KRAA0038

Pages:81

Published On:August 2025

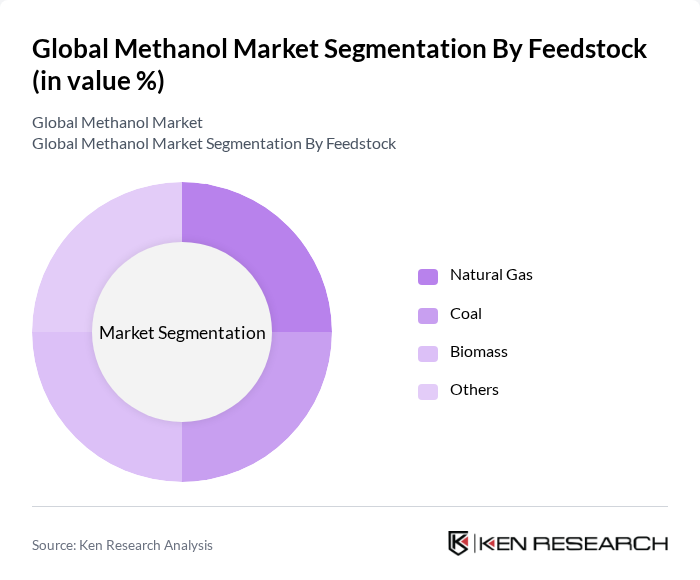

By Feedstock:The feedstock segment includes Natural Gas, Coal, Biomass, and Others. Natural gas remains the dominant feedstock globally due to its cost-effectiveness and widespread availability, especially in North America, the Middle East, and parts of Asia. Coal is a significant feedstock in China, where abundant reserves support large-scale methanol production. Biomass is gaining traction as a sustainable alternative, driven by environmental regulations and investments in renewable methanol. The "Others" category includes unconventional feedstocks such as municipal solid waste and captured carbon dioxide, which are under increasing research and pilot-scale development .

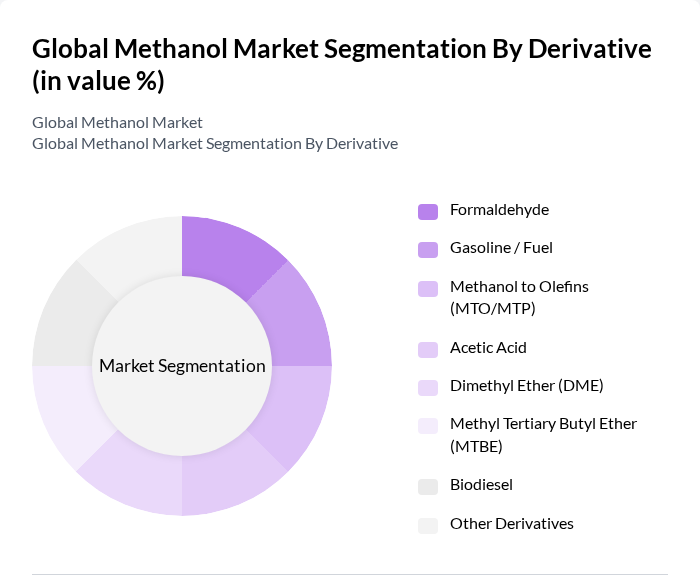

By Derivative:The derivative segment encompasses Formaldehyde, Gasoline/Fuel, Methanol to Olefins (MTO/MTP), Acetic Acid, Dimethyl Ether (DME), Methyl Tertiary Butyl Ether (MTBE), Biodiesel, and Other Derivatives. Formaldehyde is the leading derivative, driven by its use in resins and plastics. Gasoline/Fuel is significant as methanol is increasingly blended for cleaner combustion and as a marine fuel. The MTO/MTP process is expanding, particularly in China, for the production of olefins. DME is gaining attention as a clean LPG substitute, while MTBE remains important as a fuel additive in some regions .

The Global Methanol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Methanex Corporation, SABIC, BASF SE, Mitsubishi Gas Chemical Company, Celanese Corporation, LyondellBasell Industries, China National Petroleum Corporation (CNPC), Sinopec Limited, INEOS Group, OCI N.V., Formosa Plastics Corporation, Acron Group, Yara International, JFE Chemical Corporation, and Petronas Chemicals Group Berhad contribute to innovation, geographic expansion, and service delivery in this space.

The future of the methanol market appears promising, driven by increasing investments in renewable energy and technological advancements. As countries strive to meet climate goals, methanol's role as a clean fuel and feedstock is expected to expand. The integration of digital technologies in production processes will enhance efficiency and reduce costs. Furthermore, the growing interest in bio-methanol and renewable production methods will likely create new avenues for growth, positioning methanol as a key player in the global energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Feedstock | Natural Gas Coal Biomass Others |

| By Derivative | Formaldehyde Gasoline / Fuel Methanol to Olefins (MTO/MTP) Acetic Acid Dimethyl Ether (DME) Methyl Tertiary Butyl Ether (MTBE) Biodiesel Other Derivatives |

| By End-Use Industry | Automotive Construction Paints & Coatings Pharmaceuticals Electronics Packaging Other End-Uses |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Methanol Production Facilities | 60 | Plant Managers, Production Supervisors |

| End-User Industries (Formaldehyde) | 50 | Procurement Managers, Product Development Managers |

| Acetic Acid Manufacturers | 40 | Operations Managers, Chemical Engineers |

| Fuel Applications | 45 | Energy Analysts, Supply Chain Managers |

| Research Institutions and Academia | 40 | Research Scientists, Industry Analysts |

The Global Methanol Market is valued at approximately USD 38 billion, driven by increasing demand for methanol as a clean fuel alternative and its applications across various industries, including automotive, construction, and chemicals.