Region:Middle East

Author(s):Rebecca

Product Code:KRAC8389

Pages:90

Published On:November 2025

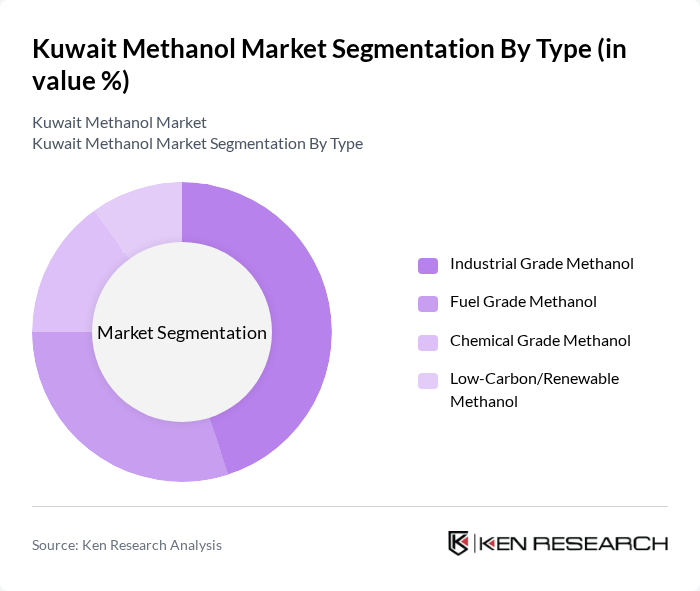

By Type:The market is segmented into multiple types including Industrial Grade Methanol, Fuel Grade Methanol, Chemical Grade Methanol, and Low-Carbon/Renewable Methanol. Among these, Industrial Grade Methanol is the leading subsegment, driven by its extensive use in chemical manufacturing processes. The demand for Fuel Grade Methanol is also significant, particularly in the energy sector, as it serves as a cleaner alternative to traditional fuels. MTO/MTP emerged as the largest revenue-generating segment, followed by formaldehyde as the fastest-growing segment.

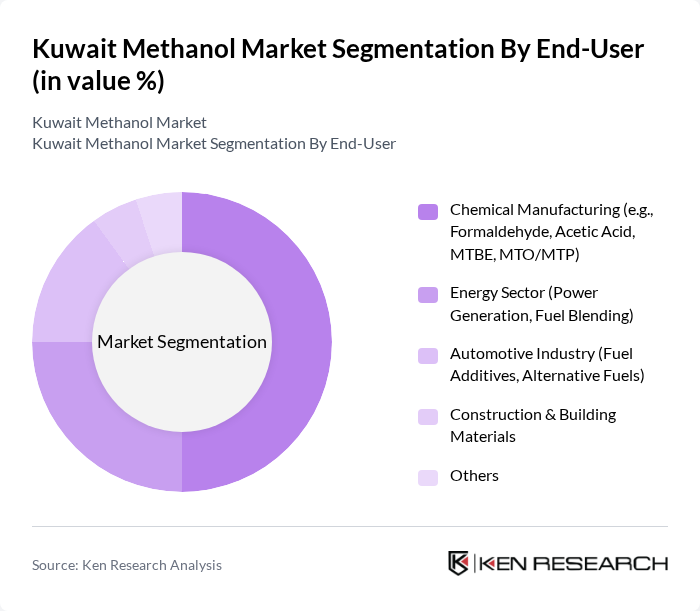

By End-User:The end-user segmentation includes Chemical Manufacturing, Energy Sector, Automotive Industry, Construction & Building Materials, and Others. The Chemical Manufacturing sector is the dominant end-user, utilizing methanol for producing various chemicals such as formaldehyde and acetic acid. The Energy Sector follows closely, leveraging methanol for power generation and fuel blending, reflecting a growing trend towards sustainable energy solutions.

The Kuwait Methanol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait National Petroleum Company (KNPC), Equate Petrochemical Company, Petrochemical Industries Company (PIC), Gulf Petrochemical Industries Company (GPIC), Methanex Corporation, SABIC (Saudi Basic Industries Corporation), Saudi Methanol Company (AR-RAZI), BASF SE, Mitsubishi Gas Chemical Company, Inc., LyondellBasell Industries, Celanese Corporation, OCI N.V., Formosa Plastics Corporation, Methanol Holdings (Trinidad) Limited (MHTL), Mitsui Chemicals, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait methanol market is poised for significant transformation, driven by technological advancements and a shift towards sustainable production methods. As global demand for methanol as an energy carrier increases, Kuwait's strategic investments in renewable methanol production are expected to position the country as a leader in this emerging sector. Additionally, the establishment of strategic partnerships with international firms will enhance innovation and market reach, fostering a competitive edge in the global landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Methanol Fuel Grade Methanol Chemical Grade Methanol Low-Carbon/Renewable Methanol |

| By End-User | Chemical Manufacturing (e.g., Formaldehyde, Acetic Acid, MTBE, MTO/MTP) Energy Sector (Power Generation, Fuel Blending) Automotive Industry (Fuel Additives, Alternative Fuels) Construction & Building Materials Others |

| By Application | Formaldehyde Production Acetic Acid Production MTBE (Methyl Tertiary Butyl Ether) Production Methanol-to-Olefins (MTO/MTP) Fuel Additives Solvents Others |

| By Distribution Channel | Direct Sales to End Users Distributors/Traders Online Sales Others |

| By Geography | Central Kuwait Northern Kuwait Southern Kuwait Others |

| By Production Technology | Steam Methane Reforming (SMR) Gas-to-Liquids (GTL) Technology Biomass Gasification CO2 Hydrogenation Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Frameworks Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Methanol Production Facilities | 50 | Plant Managers, Production Supervisors |

| End-User Industries (Automotive) | 40 | Procurement Managers, Product Development Engineers |

| Chemical Distribution Networks | 40 | Sales Managers, Logistics Coordinators |

| Research Institutions and Academia | 40 | Research Scientists, Industry Analysts |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Officers |

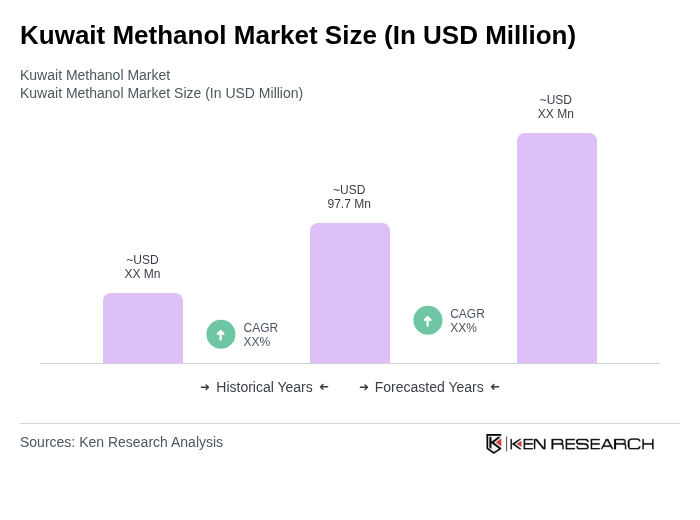

The Kuwait Methanol Market is valued at approximately USD 97.7 million, reflecting a five-year historical analysis. This valuation is driven by increasing demand for methanol in chemical manufacturing and energy production, alongside investments in green methanol production.