Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9330

Pages:89

Published On:November 2025

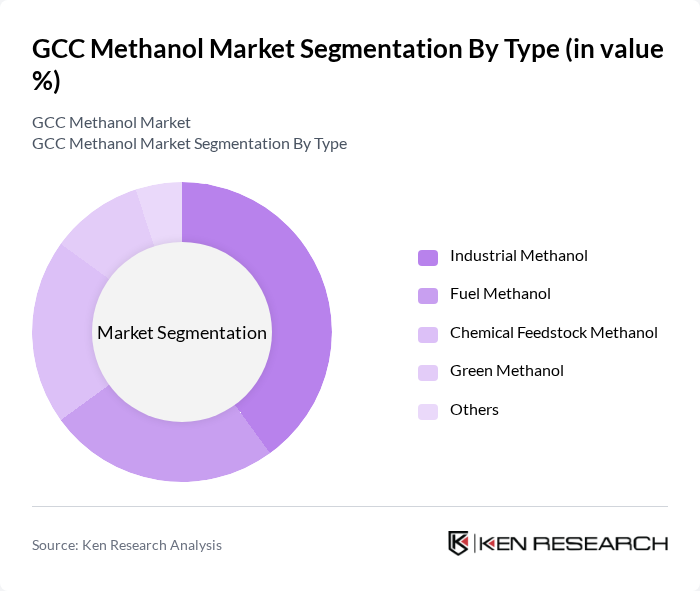

By Type:The market is segmented into Industrial Methanol, Fuel Methanol, Chemical Feedstock Methanol, Green Methanol, and Others. Industrial Methanol is primarily used in the production of formaldehyde, acetic acid, and other chemicals. Fuel Methanol is gaining traction as a cleaner alternative to gasoline and marine fuels, supported by regulatory initiatives for lower emissions. Chemical Feedstock Methanol is essential for producing various petrochemicals, including olefins and solvents. Green Methanol, derived from renewable sources such as biomass or captured CO?, is emerging as a sustainable option in response to decarbonization targets .

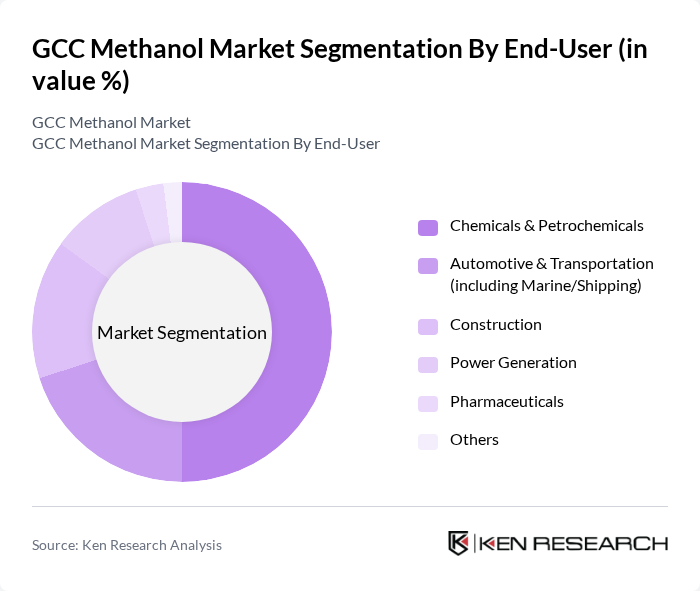

By End-User:The end-user segmentation includes Chemicals & Petrochemicals, Automotive & Transportation (including Marine/Shipping), Construction, Power Generation, Pharmaceuticals, and Others. The Chemicals & Petrochemicals sector remains the largest consumer of methanol, utilizing it for formaldehyde, acetic acid, and olefin production. The Automotive and Marine sectors are increasingly adopting methanol as a fuel alternative, driven by stricter emission standards and the push for cleaner marine fuels. The Construction and Power Generation sectors are exploring methanol for energy production and as a component in building materials .

The GCC Methanol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Methanol Company (AR-RAZI), SABIC (Saudi Basic Industries Corporation), Oman Methanol Company LLC, Qatar Fuel Additives Company Limited (QAFAC), Abu Dhabi National Oil Company (ADNOC), Gulf Petrochemical Industries Company (GPIC), Methanex Corporation, National Petrochemical Industrial Company (NATPET), Al-Jubail Petrochemical Company (KEMYA), Petrochemical Industries Company (PIC) – Kuwait, Linde plc, BASF SE, Mitsubishi Gas Chemical Company, Inc., Celanese Corporation, INEOS Group Limited contribute to innovation, geographic expansion, and service delivery in this space.

The GCC methanol market is poised for significant transformation, driven by the increasing emphasis on sustainability and clean energy solutions. As the region invests heavily in renewable energy and advanced production technologies, methanol's role as a clean fuel and chemical feedstock will expand. The anticipated growth in chemical manufacturing and the development of innovative methanol applications will further enhance market dynamics, positioning the GCC as a key player in the global methanol landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Methanol Fuel Methanol Chemical Feedstock Methanol Green Methanol Others |

| By End-User | Chemicals & Petrochemicals Automotive & Transportation (including Marine/Shipping) Construction Power Generation Pharmaceuticals Others |

| By Application | Formaldehyde Production Acetic Acid Production MTBE (Methyl Tert-Butyl Ether) Production DME (Dimethyl Ether) Production Methanol-to-Olefins (MTO) Solvents Fuel Blending Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Saudi Arabia United Arab Emirates (UAE) Qatar Oman Kuwait Bahrain Others |

| By Production Technology | Steam Methane Reforming (SMR) Gas-to-Liquids (GTL) Biomass Gasification CO? Hydrogenation Others |

| By Pricing Model | Fixed Pricing Variable Pricing Contractual Pricing Spot Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Methanol Production Facilities | 100 | Plant Managers, Production Supervisors |

| End-User Industries (Chemicals) | 80 | Procurement Managers, Chemical Engineers |

| Energy Sector Stakeholders | 60 | Energy Analysts, Regulatory Affairs Managers |

| Environmental Impact Assessors | 40 | Environmental Scientists, Compliance Officers |

| Market Analysts and Consultants | 50 | Market Research Analysts, Industry Consultants |

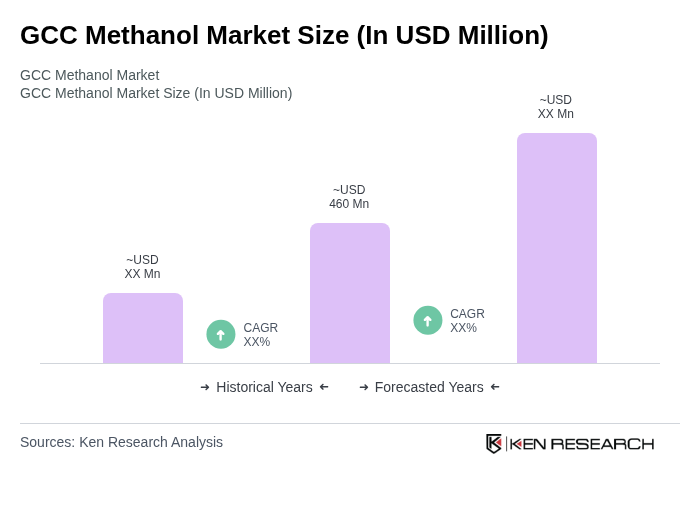

The GCC Methanol Market is valued at approximately USD 460 million, driven by increasing demand for methanol in chemicals, fuel, and energy production, as well as a growing focus on sustainable energy solutions.