Global Methyl Isobutyl Ketone Market Overview

- The Global Methyl Isobutyl Ketone market is valued at USD 750 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for solvents in various industries, including paints, coatings, adhesives, and rubber processing. The rise in industrial activities, especially in emerging markets, and the expansion of the automotive and construction sectors have further fueled the market's growth, as MIBK is widely used as a solvent and chemical intermediate. Additionally, the use of MIBK in agrochemicals and pharmaceuticals is contributing to market expansion .

- Key players in this market include the United States, Germany, and China, which dominate due to their robust industrial bases and high consumption rates of chemical solvents. The presence of major chemical manufacturers and a strong focus on research and development in these countries contribute to their leadership in the MIBK market. Asia Pacific, led by China, holds the largest share, driven by rapid industrialization and infrastructure development .

- In 2023, the U.S. Environmental Protection Agency (EPA) amended the National Emission Standards for Hazardous Air Pollutants (NESHAP) for Miscellaneous Organic Chemical Manufacturing (MON Rule), tightening controls on volatile organic compounds (VOCs) including MIBK. This regulation, issued under the Clean Air Act, requires manufacturers to implement stricter emission controls, adopt best available control technologies, and enhance monitoring and reporting to reduce air pollution from industrial solvents .

Global Methyl Isobutyl Ketone Market Segmentation

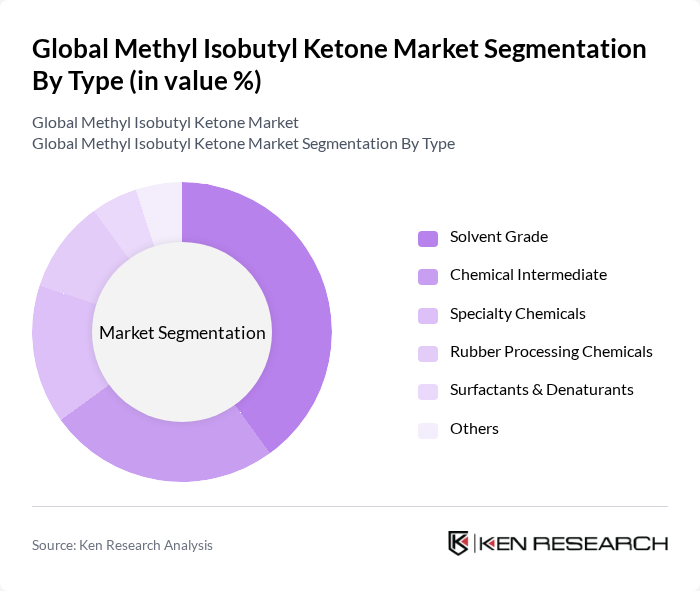

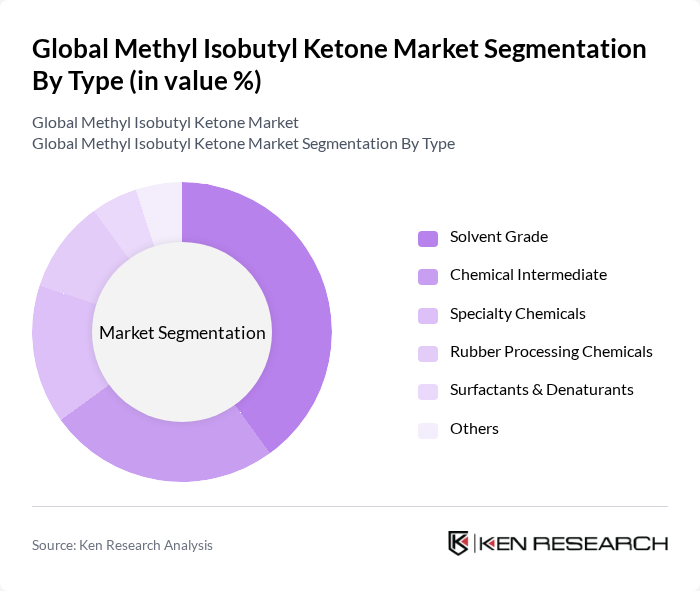

By Type:The Methyl Isobutyl Ketone market is segmented into various types, including Solvent Grade, Chemical Intermediate, Specialty Chemicals, Rubber Processing Chemicals, Surfactants & Denaturants, and Others. Among these, the Solvent Grade segment is the most dominant due to its extensive use in paints, coatings, adhesives, and rubber processing, driven by the growing construction and automotive industries. The demand for high-purity solvents that comply with environmental and safety standards is also propelling this segment's growth .

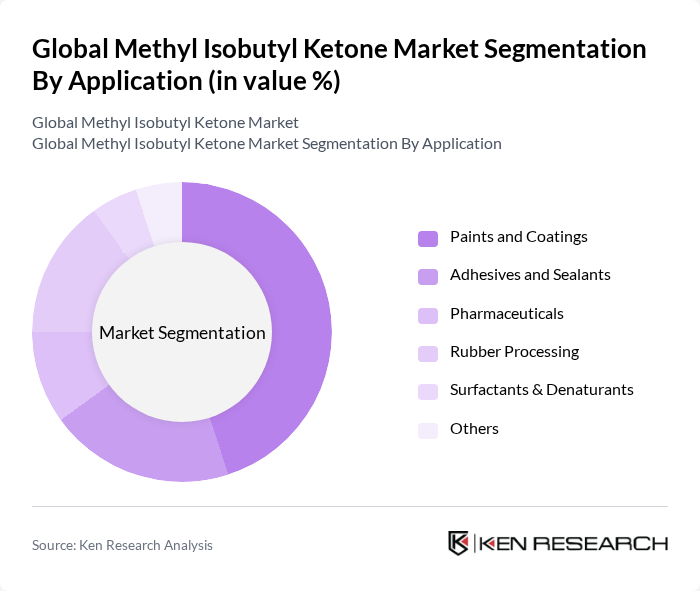

By Application:The applications of Methyl Isobutyl Ketone include Paints and Coatings, Adhesives and Sealants, Pharmaceuticals, Rubber Processing, Surfactants & Denaturants, and Others. The Paints and Coatings segment holds the largest share, driven by the increasing demand for high-performance coatings in the automotive and construction sectors. The trend towards eco-friendly and low-VOC formulations is also influencing the growth of this application segment, along with rising demand in rubber processing and agrochemicals .

Global Methyl Isobutyl Ketone Market Competitive Landscape

The Global Methyl Isobutyl Ketone Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Chemical Company, Shell Chemicals, Eastman Chemical Company, Olin Corporation, BASF SE, Mitsubishi Chemical Corporation, LG Chem Ltd., INEOS Group, Dow Chemical Company, Huntsman Corporation, Arkema Group, Solvay S.A., Chevron Phillips Chemical Company, Formosa Plastics Corporation, Taminco Corporation, Sasol Ltd., Mitsui Chemicals, Inc., Kumho P&B Chemicals, Inc., Celanese Corporation contribute to innovation, geographic expansion, and service delivery in this space .

Global Methyl Isobutyl Ketone Market Industry Analysis

Growth Drivers

- Increasing Demand from Paints and Coatings Industry:The paints and coatings sector is projected to consume approximately 1.3 million tons of methyl isobutyl ketone (MIBK) in future, driven by a surge in construction activities. The global construction market is expected to reach $11 trillion, with a significant portion allocated to infrastructure development. This growth is further supported by the increasing preference for high-performance coatings that utilize MIBK for its solvent properties, enhancing product durability and finish quality.

- Rising Use in Adhesives and Sealants:The adhesives and sealants market is anticipated to grow to $65 billion in future, with MIBK playing a crucial role as a solvent. The automotive and construction industries are major contributors, with automotive production expected to reach approximately 93 million units globally in future. MIBK's effectiveness in enhancing adhesion properties makes it a preferred choice, particularly in high-performance applications, thereby driving its demand in this segment significantly.

- Growth in Automotive Sector:The automotive sector is projected to witness a production increase of 4% annually, reaching approximately 93 million vehicles in future. MIBK is essential in manufacturing processes, particularly in coatings and adhesives used in vehicle assembly. The shift towards electric vehicles (EVs) is also expected to boost demand for MIBK, as manufacturers seek advanced materials that enhance performance and sustainability in vehicle production.

Market Challenges

- Volatility in Raw Material Prices:The price of raw materials for MIBK production has seen fluctuations, with costs rising by 18% in the past year due to supply chain disruptions and geopolitical tensions. This volatility poses a significant challenge for manufacturers, as it affects profit margins and pricing strategies. Companies are increasingly pressured to find cost-effective alternatives or optimize production processes to mitigate these impacts.

- Stringent Environmental Regulations:Regulatory frameworks governing volatile organic compounds (VOCs) are becoming increasingly stringent, with compliance costs rising by 25% in recent years. In regions like the EU, regulations such as REACH impose strict limits on VOC emissions, compelling manufacturers to invest in cleaner technologies. This regulatory landscape presents a challenge for MIBK producers, as they must adapt to maintain market access while ensuring environmental compliance.

Global Methyl Isobutyl Ketone Market Future Outlook

The future of the methyl isobutyl ketone market appears promising, driven by increasing applications across various industries. The automotive sector's transition towards electric vehicles is expected to create new demand for high-performance materials, including MIBK. Additionally, the trend towards sustainable practices will likely encourage innovations in production processes, leading to eco-friendly alternatives. As manufacturers adapt to regulatory changes, the focus on product quality and performance will further enhance MIBK's market position in the coming years.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets, particularly in Asia-Pacific, are projected to experience an annual growth rate of approximately 5% in future in the broader East Asia and Pacific region, driven by strong domestic demand and industrialization. This growth presents significant opportunities for MIBK, as rising industrialization and urbanization drive demand for paints, coatings, and adhesives. Companies can capitalize on this trend by establishing local production facilities to meet regional needs effectively.

- Development of Eco-friendly Products:The increasing consumer preference for eco-friendly products is creating opportunities for MIBK manufacturers to innovate. Developing bio-based MIBK alternatives can cater to the growing demand for sustainable solutions. This shift not only aligns with regulatory trends but also positions companies favorably in a market increasingly focused on environmental responsibility and sustainability.