Region:Global

Author(s):Shubham

Product Code:KRAA2480

Pages:98

Published On:August 2025

Market.png)

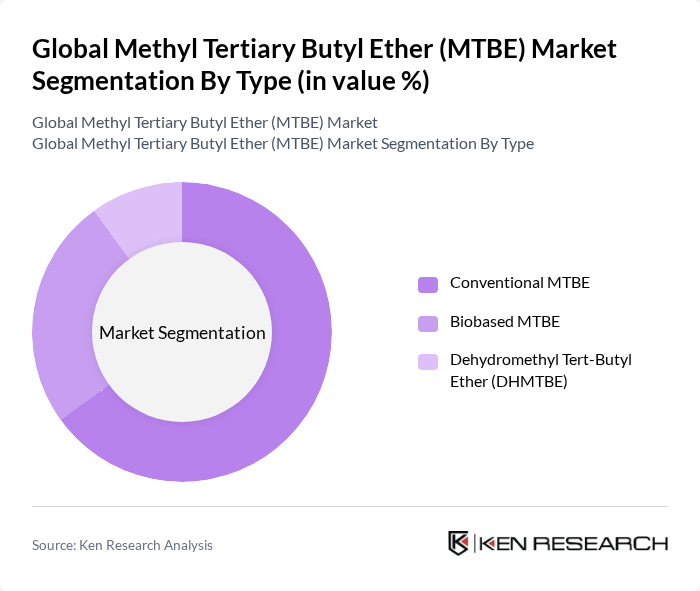

By Type:The market is segmented into three types: Conventional MTBE, Biobased MTBE, and Dehydromethyl Tert-Butyl Ether (DHMTBE). Conventional MTBE remains the most widely used due to its established production processes and cost-effectiveness. Biobased MTBE is gaining momentum as sustainability initiatives and regulatory incentives drive demand for renewable alternatives. DHMTBE is emerging as a niche product, primarily utilized in specialty chemical applications and advanced fuel formulations .

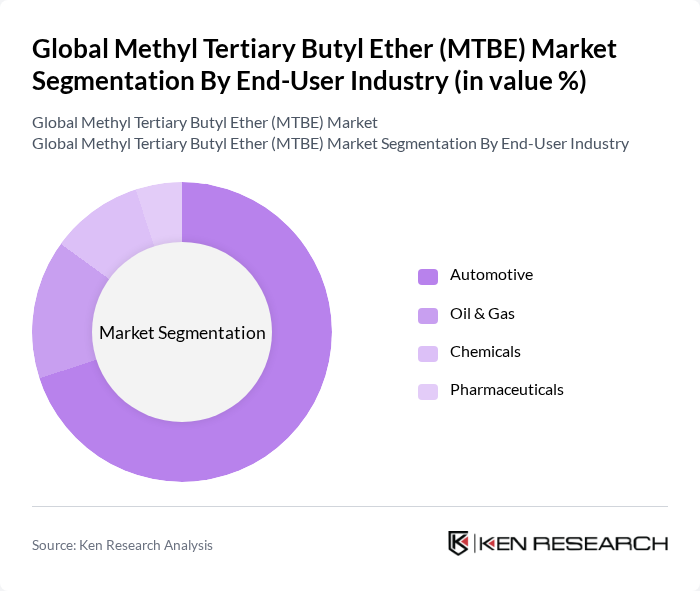

By End-User Industry:The market is segmented into Automotive, Oil & Gas, Chemicals, and Pharmaceuticals. The Automotive sector is the largest consumer, primarily for use as a gasoline additive to boost octane ratings and meet emission standards. Oil & Gas utilizes MTBE in refining and blending operations. Chemicals and Pharmaceuticals represent smaller but expanding segments, driven by demand for intermediates and solvents in specialty applications .

The Global Methyl Tertiary Butyl Ether (MTBE) Market is characterized by a dynamic mix of regional and international players. Leading participants such as LyondellBasell Industries N.V., SABIC (Saudi Basic Industries Corporation), Evonik Industries AG, Petroliam Nasional Berhad (PETRONAS), China National Petroleum Corporation (CNPC), Sinopec (China Petroleum & Chemical Corporation), Reliance Industries Limited, Huntsman Corporation, Zhenhai Refining & Chemical Company (ZRCC), Formosa Plastics Corporation, PTT Global Chemical Public Company Limited, Mitsubishi Gas Chemical Company, Inc., Haldor Topsoe A/S, TPC Group Inc., Gazprom PJSC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the MTBE market appears promising, driven by the increasing global emphasis on sustainable fuel alternatives and technological advancements in production processes. As countries strive to meet ambitious emission reduction targets, the demand for cleaner fuels, including MTBE, is expected to rise. Additionally, innovations in biobased MTBE production could provide new avenues for growth, aligning with environmental goals while addressing market challenges related to traditional fossil fuel dependency.

| Segment | Sub-Segments |

|---|---|

| By Type | Conventional MTBE Biobased MTBE Dehydromethyl Tert-Butyl Ether (DHMTBE) |

| By End-User Industry | Automotive Oil & Gas Chemicals Pharmaceuticals |

| By Application | Gasoline Additive (Blending Component) Industrial Solvent Chemical Intermediate Others (e.g., Extraction Agent) |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, UK, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia-Pacific) Middle East & Africa (GCC, Turkey, Israel, North Africa, South Africa, Rest of MEA) South America (Brazil, Argentina, Rest of South America) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fuel Retailers | 100 | Fuel Station Managers, Regional Directors |

| Automotive Manufacturers | 80 | Product Development Engineers, Procurement Managers |

| Chemical Producers | 60 | Operations Managers, Chemical Engineers |

| Environmental Agencies | 50 | Regulatory Affairs Specialists, Environmental Scientists |

| Research Institutions | 40 | Research Analysts, Policy Advisors |

The Global Methyl Tertiary Butyl Ether (MTBE) Market is valued at approximately USD 17.5 billion, driven by the increasing demand for cleaner-burning fuels and octane boosters in gasoline formulations.