Region:Middle East

Author(s):Dev

Product Code:KRAA8385

Pages:99

Published On:November 2025

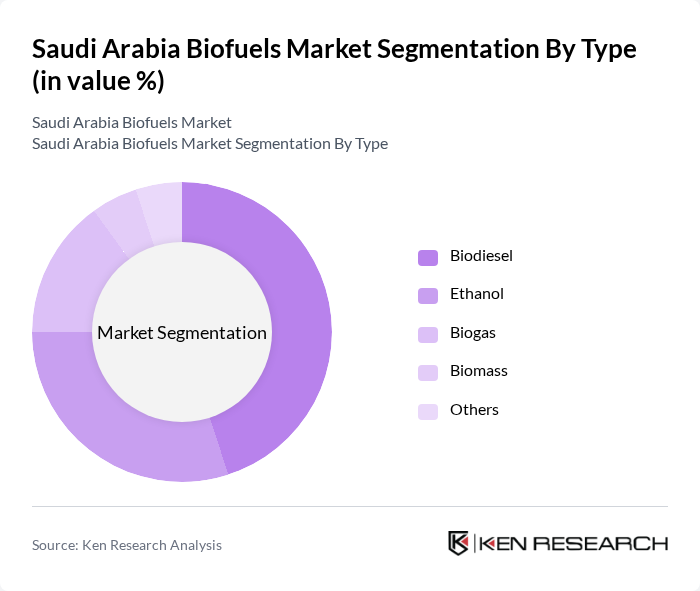

By Type:The market is segmented into Biodiesel, Ethanol, Biogas, Biomass, and Others. Biodiesel is currently the leading sub-segment due to its compatibility with existing diesel engines and its potential to reduce greenhouse gas emissions. Ethanol follows closely, driven by its use in gasoline blends and the growing import of ethanol for fuel blending. Biogas and Biomass are gaining traction as alternative energy sources, particularly in rural areas where agricultural and municipal waste are utilized effectively. The Others category includes emerging biofuels such as algae-based fuels, which are in pilot stages and supported by research institutions.

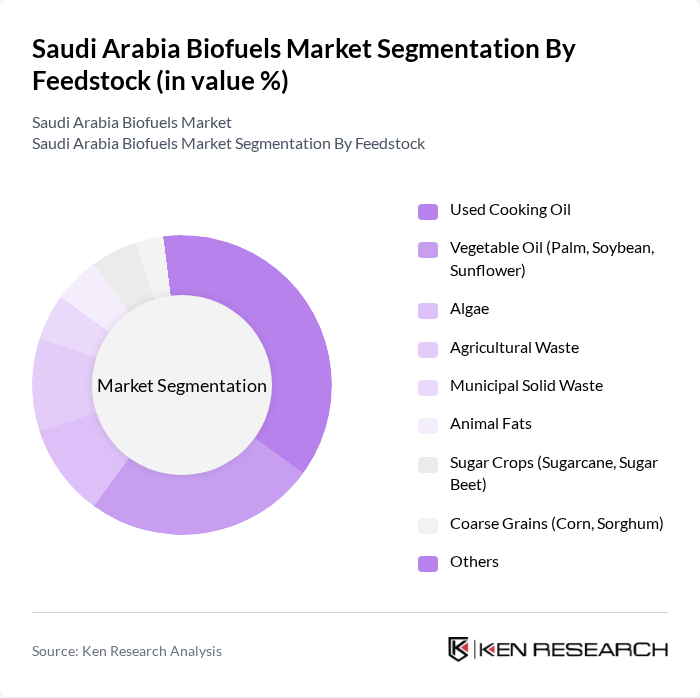

By Feedstock:The feedstock segment includes Used Cooking Oil, Vegetable Oil (Palm, Soybean, Sunflower), Algae, Agricultural Waste, Municipal Solid Waste, Animal Fats, Sugar Crops (Sugarcane, Sugar Beet), Coarse Grains (Corn, Sorghum), and Others. Used Cooking Oil is the dominant feedstock due to its availability and cost-effectiveness, with major refineries such as The Biofuel Company focusing on this input. Vegetable Oils are widely used in biodiesel production, while Algae and Agricultural Waste are emerging as sustainable options, supported by government-funded research. Municipal Solid Waste is increasingly utilized for biogas production, aligning with circular economy principles.

The Saudi Arabia Biofuels Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Biofuel Company, Saudi Aramco, Alfanar Energy, SABIC (Saudi Basic Industries Corporation), Aljomaih and Shell Lubricating Oil Company (JOSLOC), Al-Khobar Biofuel Plant, National Biofuel Company, Al-Babtain Power & Telecom, Al-Muhaidib Group, Al-Suwaidi Industrial Services, ACWA Power, Al-Rajhi Holding Group, Al-Faisaliah Group, Green Fuel Arabia, Arabian Agricultural Services Company (ARASCO) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the biofuels market in Saudi Arabia appears promising, driven by government initiatives and technological advancements. With a projected increase in biofuel production facilities and a focus on sustainable energy solutions, the market is expected to evolve significantly. The integration of biofuels in the transportation sector and the rise of circular economy initiatives will further enhance market dynamics, creating a more sustainable energy landscape in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Biodiesel Ethanol Biogas Biomass Others |

| By Feedstock | Used Cooking Oil Vegetable Oil (Palm, Soybean, Sunflower) Algae Agricultural Waste Municipal Solid Waste Animal Fats Sugar Crops (Sugarcane, Sugar Beet) Coarse Grains (Corn, Sorghum) Others |

| By End-User | Transportation Industrial Power Generation Residential Commercial Government & Utilities |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Fermentation Transesterification Anaerobic Digestion Gasification Algae Cultivation Others |

| By Application | Fuel Production Energy Generation Chemical Feedstock Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Subsidies Tax Incentives Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biofuel Production Facilities | 60 | Plant Managers, Production Supervisors |

| Agricultural Feedstock Suppliers | 50 | Farm Owners, Supply Chain Managers |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Biofuel Technology Developers | 45 | R&D Managers, Technology Officers |

| End-Users in Transportation Sector | 55 | Fleet Managers, Logistics Coordinators |

The Saudi Arabia Biofuels Market is valued at approximately USD 895 million, reflecting a significant growth trajectory driven by government initiatives aimed at diversifying energy sources and reducing carbon emissions under the Vision 2030 plan.