Region:Global

Author(s):Shubham

Product Code:KRAA2696

Pages:92

Published On:August 2025

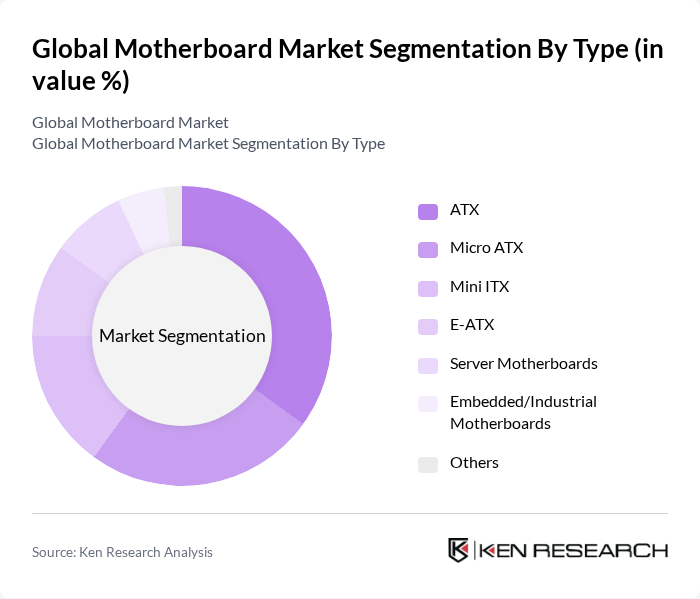

By Type:The motherboard market can be segmented into various types, including ATX, Micro ATX, Mini ITX, E-ATX, Server Motherboards, Embedded/Industrial Motherboards, and Others. Each type serves different consumer needs, with ATX and Micro ATX being the most popular due to their versatility, broad compatibility, and support for a wide range of components and expansion options. Mini ITX and E-ATX are preferred for compact builds and high-end workstations, respectively, while server and industrial motherboards cater to specialized enterprise and embedded applications.

By End-User:The end-user segmentation includes Gaming, Workstations, Servers & Data Centers, Consumer Electronics, and Industrial/Embedded Systems. The gaming segment is particularly dominant, driven by the increasing popularity of esports, high-performance gaming setups, and the DIY PC culture, which require advanced motherboards for optimal performance and customization. Workstations and servers are fueled by enterprise demand for reliability and scalability, while consumer electronics and industrial systems benefit from ongoing innovation in connectivity and integration.

The Global Motherboard Market is characterized by a dynamic mix of regional and international players. Leading participants such as ASUS, MSI (Micro-Star International Co., Ltd.), Gigabyte Technology Co., Ltd., ASRock Inc., Intel Corporation, Advanced Micro Devices, Inc. (AMD), EVGA Corporation, Biostar Microtech International Corp., Super Micro Computer, Inc. (Supermicro), Tyan Computer Corporation, AOpen Inc., Elitegroup Computer Systems Co., Ltd. (ECS), ZOTAC Technology Limited, Foxconn Technology Group (Hon Hai Precision Industry Co., Ltd.), DFI Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the motherboard market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As AI integration becomes more prevalent, motherboards will increasingly incorporate smart features to enhance performance and efficiency. Additionally, the shift towards modular designs will allow for greater customization, catering to diverse user needs. With the rise of cloud computing, specifications will adapt to support virtualized environments, ensuring that motherboards remain integral to the computing ecosystem in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | ATX Micro ATX Mini ITX E-ATX Server Motherboards Embedded/Industrial Motherboards Others |

| By End-User | Gaming Workstations Servers & Data Centers Consumer Electronics Industrial/Embedded Systems |

| By Component | CPU Socket Type (Intel, AMD, ARM, Others) RAM Slots Expansion Slots (PCIe, M.2, etc.) Integrated Graphics Connectivity (Wi-Fi, Ethernet, Thunderbolt, USB, etc.) |

| By Sales Channel | Online Retail Offline Retail Direct Sales |

| By Distribution Mode | Wholesalers Distributors Direct-to-Consumer |

| By Price Range | Budget Mid-Range Premium |

| By Brand | ASUS MSI Gigabyte ASRock Colorful Biostar Supermicro Intel AMD |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gaming Motherboard Market | 70 | Product Managers, Gaming Hardware Developers |

| Enterprise Motherboard Solutions | 60 | IT Managers, System Architects |

| Consumer Electronics Integration | 50 | Retail Buyers, Electronics Engineers |

| IoT Device Motherboard Applications | 40 | R&D Engineers, Product Development Managers |

| Market Trends and Innovations | 45 | Industry Analysts, Technology Consultants |

The Global Motherboard Market is valued at approximately USD 14 billion, driven by the increasing demand for high-performance computing, gaming, and consumer electronics, alongside advancements in technologies like artificial intelligence and edge computing.