Region:Global

Author(s):Rebecca

Product Code:KRAA2883

Pages:81

Published On:August 2025

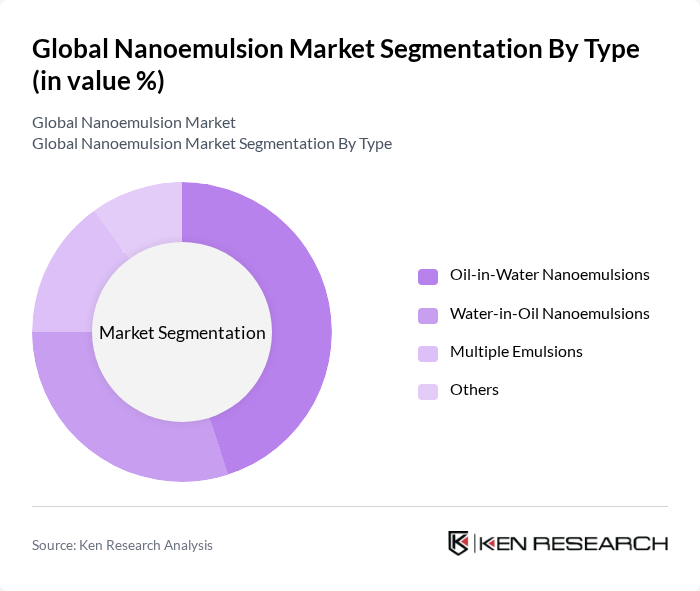

By Type:The market is segmented into four main types: Oil-in-Water Nanoemulsions, Water-in-Oil Nanoemulsions, Multiple Emulsions, and Others. Oil-in-Water Nanoemulsions are gaining significant traction due to their widespread use in pharmaceuticals and cosmetics, where they enhance solubility and bioavailability of active ingredients. The demand for advanced drug delivery systems and cosmetic formulations with improved skin absorption continues to drive growth in this sub-segment .

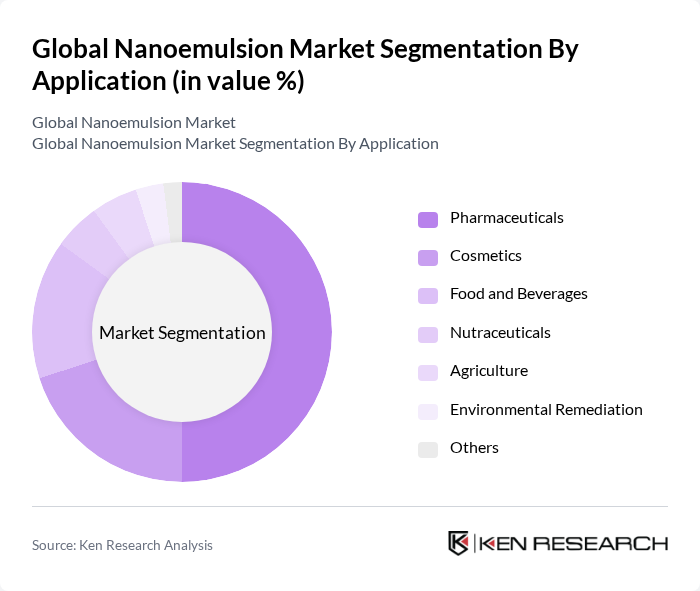

By Application:Nanoemulsions are applied across Pharmaceuticals, Cosmetics, Food and Beverages, Nutraceuticals, Agriculture, Environmental Remediation, and Others. The pharmaceutical sector leads, driven by the need for advanced drug delivery systems that improve the bioavailability of poorly soluble drugs. Personalized medicine trends and the rising prevalence of chronic diseases further accelerate demand for nanoemulsions in this sector. Cosmetics and food and beverages also represent major application areas, leveraging nanoemulsions for improved product performance and consumer appeal .

The Global Nanoemulsion Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Croda International Plc, Evonik Industries AG, Gattefossé S.A., Dow Inc., Avestin Inc., Solvay S.A., Unilever PLC, Procter & Gamble Co., Pfizer Inc., Merck KGaA, Amgen Inc., Nestlé S.A., Herbalife Nutrition Ltd., GlaxoSmithKline plc, Sanofi S.A., Johnson & Johnson, Lonza Group AG, AbbVie Inc., Novartis AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the nanoemulsion market appears promising, driven by ongoing innovations and increasing applications across various sectors. As consumer preferences shift towards natural and effective solutions, companies are likely to invest in research and development to enhance product formulations. Furthermore, the integration of smart packaging technologies is expected to improve product shelf life and consumer engagement, while the rise of e-commerce channels will facilitate broader market access, enabling companies to reach diverse consumer bases effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Oil-in-Water Nanoemulsions Water-in-Oil Nanoemulsions Multiple Emulsions Others |

| By Application | Pharmaceuticals Cosmetics Food and Beverages Nutraceuticals Agriculture Environmental Remediation Others |

| By End-User | Pharmaceutical Companies Cosmetic Manufacturers Food & Beverage Producers Nutraceutical Firms Agricultural Enterprises Research Institutions Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Region | North America (United States, Canada, Mexico) Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Latin America (Brazil, Argentina, Rest of South America) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa) |

| By Packaging Type | Bottles Sachets Tubes Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | R&D Managers, Product Development Scientists |

| Cosmetic Industry | 80 | Brand Managers, Formulation Chemists |

| Food & Beverage Sector | 70 | Quality Assurance Managers, Product Innovators |

| Agricultural Applications | 50 | Agronomists, Product Development Leads |

| Industrial Applications | 40 | Process Engineers, Operations Managers |

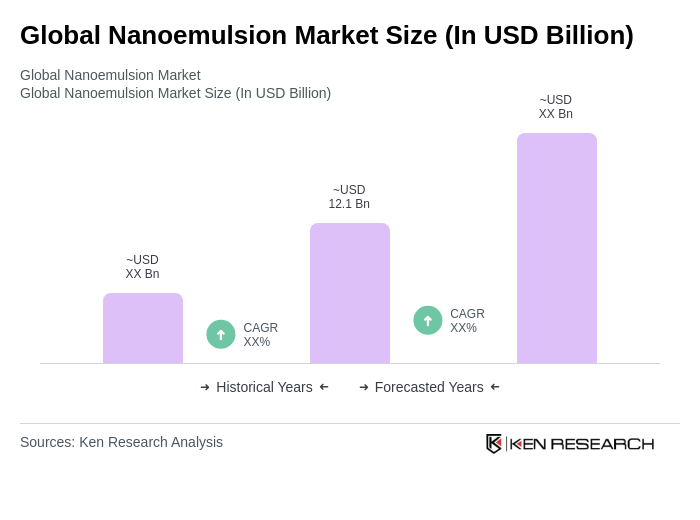

The Global Nanoemulsion Market is valued at approximately USD 12.1 billion, driven by increasing demand in pharmaceuticals, cosmetics, and food and beverages. This growth is attributed to the unique properties of nanoemulsions that enhance product efficacy, stability, and bioavailability.