Region:Global

Author(s):Dev

Product Code:KRAA9707

Pages:93

Published On:November 2025

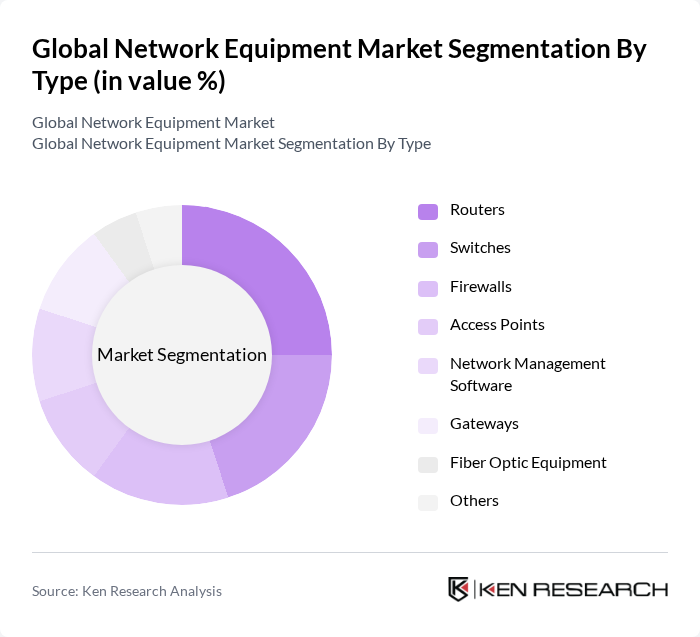

By Type:The market is segmented into various types of network equipment, including routers, switches, firewalls, access points, network management software, gateways, fiber optic equipment, and others. Each of these subsegments plays a crucial role in the overall network infrastructure, catering to different needs such as data transmission, security, and management. Hardware remains the largest segment, with routers and switches leading due to their foundational role in connectivity and data management.

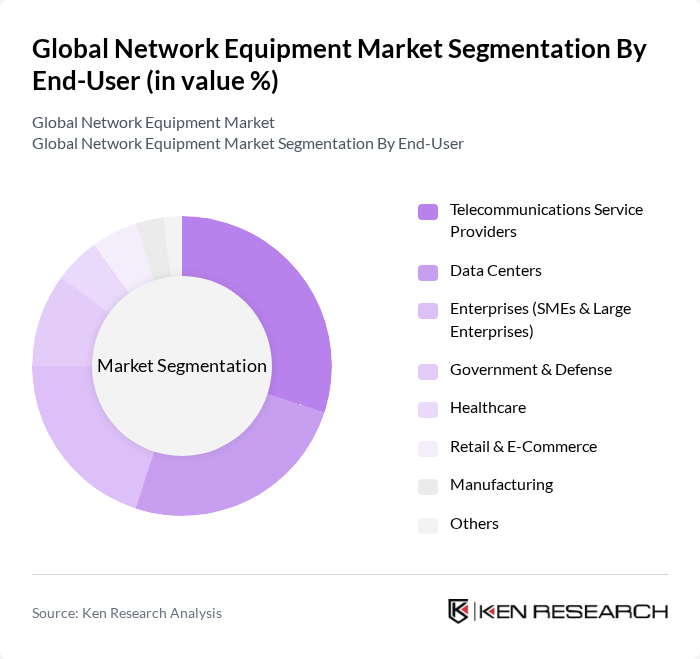

By End-User:The end-user segmentation includes telecommunications service providers, data centers, enterprises (both SMEs and large enterprises), government and defense, healthcare, retail and e-commerce, manufacturing, and others. Each end-user category has unique requirements for network equipment, influencing purchasing decisions and market dynamics. Telecommunications service providers and data centers remain the largest consumers, driven by ongoing investments in 5G, cloud, and hyperscale infrastructure.

The Global Network Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Juniper Networks, Inc., Arista Networks, Inc., Hewlett Packard Enterprise, Huawei Technologies Co., Ltd., Nokia Corporation, Extreme Networks, Inc., Dell Technologies Inc., Netgear, Inc., TP-Link Technologies Co., Ltd., Brocade Communications Systems, Inc., Mellanox Technologies, Ltd., Ciena Corporation, ZTE Corporation, Fortinet, Inc., Ericsson AB, Alcatel-Lucent Enterprise, Ubiquiti Inc., CommScope Holding Company, Inc., H3C Technologies Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the network equipment market is poised for significant transformation, driven by technological advancements and evolving consumer needs. As 5G technology becomes more widespread, it will enable faster data transmission and support a greater number of connected devices. Additionally, the emphasis on energy-efficient solutions will likely lead to innovations that reduce operational costs while enhancing performance. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Routers Switches Firewalls Access Points Network Management Software Gateways Fiber Optic Equipment Others |

| By End-User | Telecommunications Service Providers Data Centers Enterprises (SMEs & Large Enterprises) Government & Defense Healthcare Retail & E-Commerce Manufacturing Others |

| By Application | Network Security Data Transmission Network Management Cloud Services IoT Connectivity Others |

| By Deployment Type | On-Premises Cloud-Based Hybrid Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Service Type | Managed Services Professional Services Technical Support Others |

| By Network Type | LAN (Local Area Network) WAN (Wide Area Network) WLAN (Wireless LAN) Public Network Private Network Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Infrastructure Providers | 120 | Network Architects, Infrastructure Managers |

| Enterprise Network Solutions | 90 | IT Directors, Network Administrators |

| Wireless Equipment Manufacturers | 60 | Product Managers, R&D Engineers |

| Cloud Networking Services | 50 | Cloud Solutions Architects, Service Delivery Managers |

| Network Security Solutions | 70 | Cybersecurity Analysts, Compliance Officers |

The Global Network Equipment Market is valued at approximately USD 145 billion, driven by the increasing demand for high-speed internet, IoT devices, and cloud computing services. This market is expected to grow significantly due to ongoing technological advancements and infrastructure investments.