Region:Global

Author(s):Shubham

Product Code:KRAA8765

Pages:83

Published On:November 2025

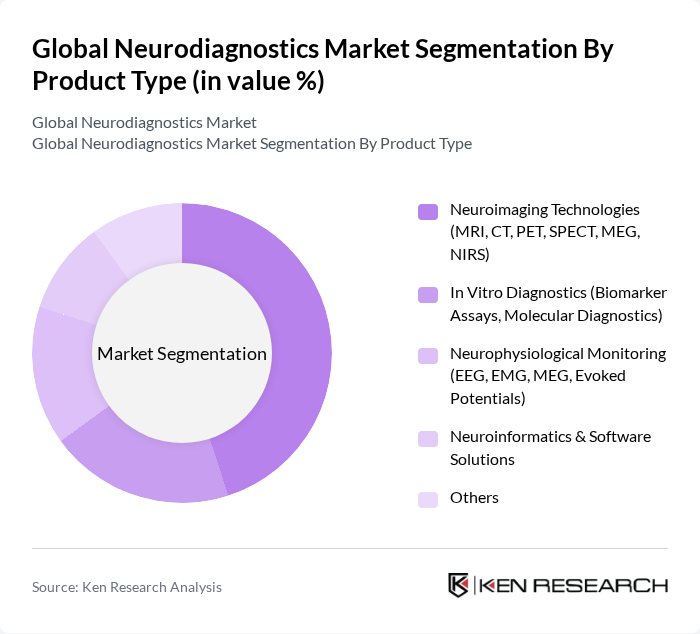

By Product Type:The product type segmentation includes various categories such as neuroimaging technologies, in vitro diagnostics, neurophysiological monitoring, neuroinformatics & software solutions, and others. Among these, neuroimaging technologies are leading the market due to their critical role in diagnosing and monitoring neurological conditions. The demand for advanced imaging techniques like MRI and CT scans is increasing, driven by technological advancements, integration of artificial intelligence, and the need for accurate, non-invasive diagnostics.

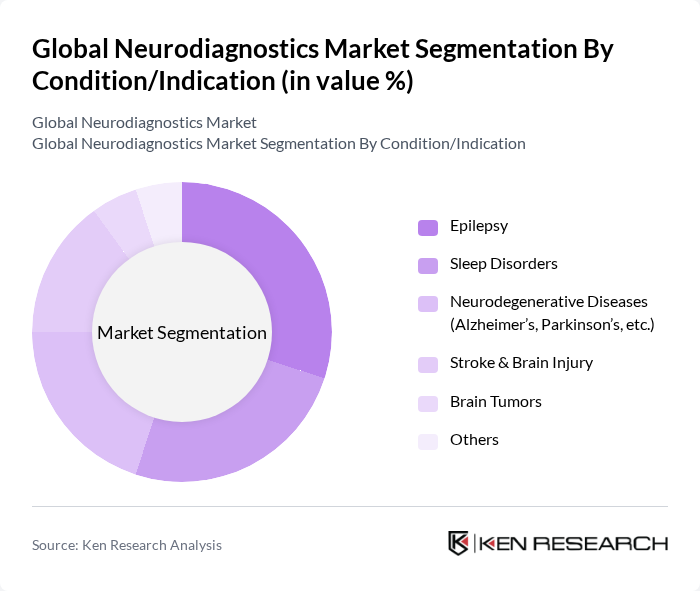

By Condition/Indication:The condition/indication segmentation encompasses various neurological disorders such as epilepsy, sleep disorders, neurodegenerative diseases, stroke & brain injury, brain tumors, and others. Epilepsy remains the leading condition in this segment, driven by the increasing incidence of epilepsy cases, improved access to diagnostic modalities, and heightened awareness of the need for effective diagnostic tools and treatment options.

The Global Neurodiagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems Corporation, Hitachi Medical Corporation, Nihon Kohden Corporation, Medtronic plc, Abbott Laboratories, Natus Medical Incorporated, Compumedics Limited, BrainScope Company, Inc., NeuroWave Systems Inc., Cadwell Industries, Inc., Elekta AB, United Imaging Healthcare Co., Ltd., Drägerwerk AG & Co. KGaA, Masimo Corporation, Zynex Medical, Inc., Lifelines Neuro Company, LLC, Neurosoft Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the neurodiagnostics market appears promising, driven by technological advancements and a growing emphasis on preventive healthcare. As artificial intelligence continues to integrate into diagnostic processes, accuracy and efficiency are expected to improve significantly. Additionally, the expansion of telemedicine will facilitate access to neurodiagnostic services, particularly in underserved areas. These trends indicate a robust growth trajectory for the market, with increased investment in research and development further enhancing service delivery and patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Neuroimaging Technologies (MRI, CT, PET, SPECT, MEG, NIRS) In Vitro Diagnostics (Biomarker Assays, Molecular Diagnostics) Neurophysiological Monitoring (EEG, EMG, MEG, Evoked Potentials) Neuroinformatics & Software Solutions Others |

| By Condition/Indication | Epilepsy Sleep Disorders Neurodegenerative Diseases (Alzheimer’s, Parkinson’s, etc.) Stroke & Brain Injury Brain Tumors Others |

| By End-User | Hospitals & Surgical Centers Diagnostic Laboratories & Imaging Centers Ambulatory Care & Emergency Settings Research & Academic Institutes Specialized Neurology Centers Others |

| By Technology | Digital Neurodiagnostics Wearable Neurodiagnostic Devices Cloud-based Neurodiagnostic Solutions Artificial Intelligence & Machine Learning Tools Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Policy Support | Government Grants Tax Incentives Research Funding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Neurodiagnostic Departments | 100 | Neurodiagnostic Technologists, Department Heads |

| Neurology Clinics | 70 | Neurologists, Clinic Managers |

| Medical Device Manufacturers | 50 | Product Managers, R&D Directors |

| Healthcare Policy Makers | 40 | Health Economists, Policy Analysts |

| Academic Institutions | 40 | Research Professors, Graduate Students in Neuroscience |

The Global Neurodiagnostics Market is valued at approximately USD 8.7 billion, driven by the increasing prevalence of neurological disorders and advancements in neuroimaging technologies. This market is expected to grow further due to rising demand for early diagnosis and treatment options.