Region:Global

Author(s):Shubham

Product Code:KRAA2723

Pages:98

Published On:August 2025

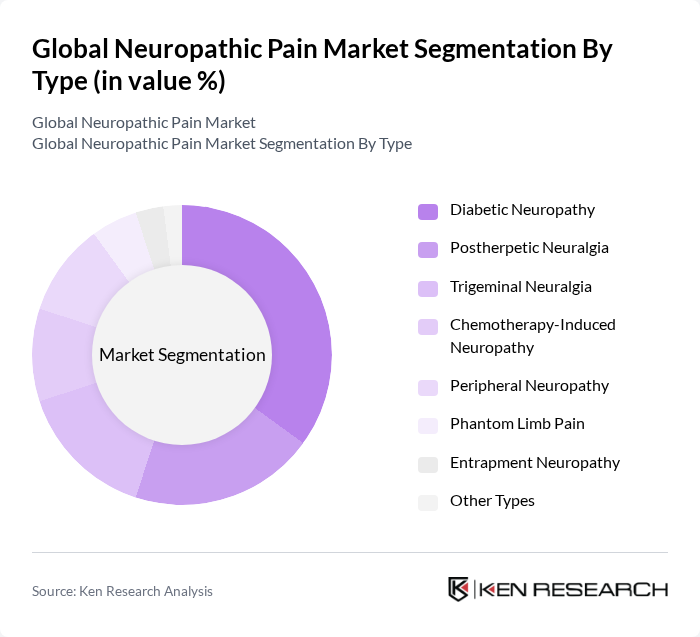

By Type:The market is segmented into diabetic neuropathy, postherpetic neuralgia, trigeminal neuralgia, chemotherapy-induced neuropathy, peripheral neuropathy, phantom limb pain, entrapment neuropathy, and other types. Diabetic neuropathy remains the most prevalent type, driven by the global rise in diabetes incidence. Increased awareness, improved diagnostic rates, and the growing burden of cancer and chemotherapy-induced neuropathy are also contributing to higher demand for effective treatment options .

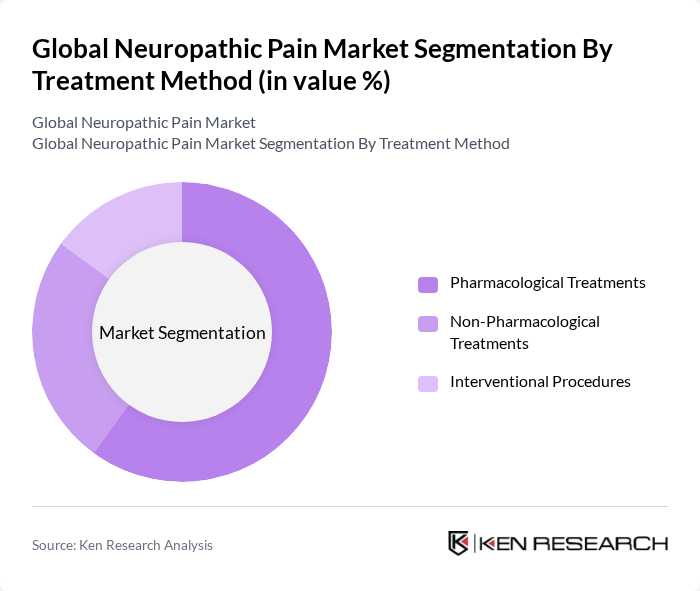

By Treatment Method:Neuropathic pain is managed through pharmacological treatments, non-pharmacological interventions, and interventional procedures. Pharmacological treatments, particularly anticonvulsants and antidepressants, dominate due to their established efficacy. Non-pharmacological approaches, such as physical therapy, cognitive behavioral therapy, and neuromodulation, are increasingly adopted as adjuncts to improve patient outcomes and quality of life .

The Global Neuropathic Pain Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Johnson & Johnson, Novartis AG, Teva Pharmaceutical Industries Ltd., Amgen Inc., Eli Lilly and Company, Astellas Pharma Inc., Sanofi S.A., GSK plc (GlaxoSmithKline plc), AbbVie Inc., Merck & Co., Inc., Bayer AG, Mallinckrodt Pharmaceuticals, Viatris Inc., Vertex Pharmaceuticals Incorporated, UCB S.A., Almatica Pharma LLC, Azurity Pharmaceuticals, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the neuropathic pain market is poised for transformative growth, driven by the integration of personalized medicine and digital health solutions. As healthcare systems increasingly adopt patient-centric care models, the focus will shift towards tailored treatment plans that address individual patient needs. Additionally, the expansion of telemedicine is expected to enhance access to care, particularly in underserved regions, thereby improving patient outcomes and fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Diabetic Neuropathy Postherpetic Neuralgia Trigeminal Neuralgia Chemotherapy-Induced Neuropathy Peripheral Neuropathy Phantom Limb Pain Entrapment Neuropathy Other Types |

| By Treatment Method | Pharmacological Treatments Anticonvulsants Antidepressants Opioids Topical Agents Non-Pharmacological Treatments Physical Therapy Cognitive Behavioral Therapy Interventional Procedures Nerve Blocks Spinal Cord Stimulation Transcutaneous Electrical Nerve Stimulation (TENS) |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Direct Tender Third Party Distributor |

| By End-User | Hospitals Clinics Home Care Settings Ambulatory Surgical Centers Research Organizations |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Patient Demographics | Age Group Gender Socioeconomic Status |

| By Severity of Pain | Mild Pain Moderate Pain Severe Pain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chronic Pain Management Clinics | 100 | Pain Management Specialists, Clinic Administrators |

| Neurology Departments in Hospitals | 80 | Neurologists, Resident Doctors |

| Pharmaceutical Sales Representatives | 60 | Sales Managers, Product Specialists |

| Patient Advocacy Groups | 50 | Patient Advocates, Community Health Workers |

| Healthcare Policy Makers | 40 | Health Economists, Policy Analysts |

The Global Neuropathic Pain Market is valued at approximately USD 7.4 billion, driven by the rising prevalence of conditions such as diabetes and cancer, advancements in treatment modalities, and increased awareness of pain management strategies among healthcare providers and patients.