Region:Global

Author(s):Rebecca

Product Code:KRAD4889

Pages:93

Published On:December 2025

By Type:The market is segmented into various types of biometric authentication technologies, including Fingerprint Recognition, Facial Recognition, Iris Recognition, Voice Recognition, Palm Vein and Vascular Pattern Recognition, Behavioral Biometrics, and Multimodal Biometric Authentication. Each of these technologies has unique applications and advantages, catering to different security needs.

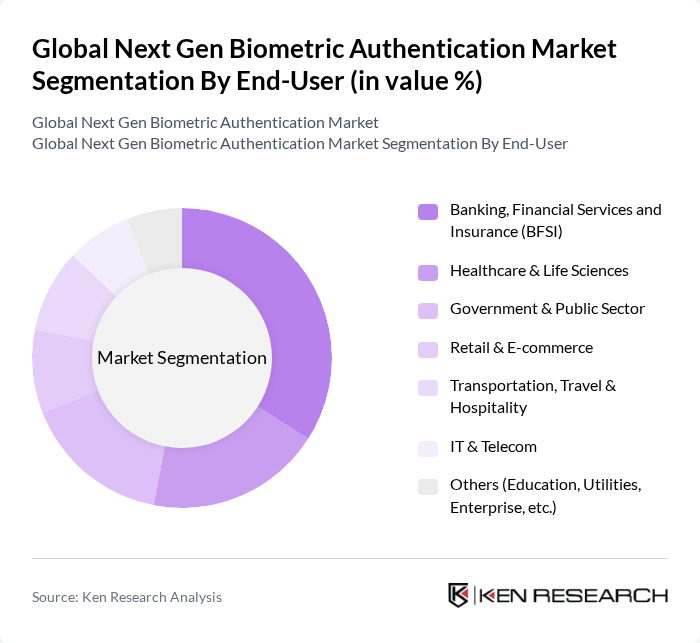

By End-User:The market is further segmented by end-user applications, including Banking, Financial Services and Insurance (BFSI), Healthcare & Life Sciences, Government & Public Sector, Retail & E-commerce, Transportation, Travel & Hospitality, IT & Telecom, and Others. Each sector has distinct requirements for biometric authentication, influencing the adoption rates of various technologies, with BFSI, government, and healthcare among the most intensive adopters due to high security, compliance, and identity assurance needs.

The Global Next Gen Biometric Authentication Market is characterized by a dynamic mix of regional and international players. Leading participants such as NEC Corporation, Thales Group (Including Gemalto Digital Identity & Security), HID Global Corporation, IDEMIA, Suprema Inc., Aware, Inc., BioID AG, FaceTec, Inc., ZKTeco Co., Ltd., Innovatrics s.r.o., Cognitec Systems GmbH, Nuance Communications, Inc. (Microsoft), Daon, Inc., Veridium IP Ltd., NEXT Biometrics Group ASA contribute to innovation, geographic expansion, and service delivery in this space.

The future of biometric authentication is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As organizations increasingly prioritize security, the integration of AI and machine learning will enhance biometric accuracy and efficiency. Additionally, the shift towards contactless solutions will likely accelerate adoption, particularly in public spaces and healthcare settings. This evolution will create a more secure and user-friendly environment, fostering greater trust in biometric technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Fingerprint Recognition Facial Recognition Iris Recognition Voice Recognition Palm Vein and Vascular Pattern Recognition Behavioral Biometrics (Keystroke, Gait, Signature, etc.) Multimodal Biometric Authentication |

| By End-User | Banking, Financial Services and Insurance (BFSI) Healthcare & Life Sciences Government & Public Sector (ID, Border, Law Enforcement) Retail & E?commerce Transportation, Travel & Hospitality IT & Telecom Others (Education, Utilities, Enterprise, etc.) |

| By Application | Physical Access Control & Logical Access Management Time and Attendance Tracking Digital Identity Verification & KYC Border Control, eGate & Passenger Processing Mobile & Online Payments / Transaction Authentication Fraud Prevention & Continuous Authentication |

| By Technology | Contact-based Biometrics Contactless Biometrics Hybrid / Multimodal Biometric Platforms AI-driven Liveness Detection & Anti-Spoofing Biometric-on-Card and Secure Element Technologies Cloud & Edge-based Biometric Matching |

| By Deployment Mode | On-Premises Cloud-Based (Biometrics-as-a-Service) Hybrid Edge / Device-Embedded |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Industry Vertical | Banking, Financial Services and Insurance (BFSI) Retail & E?commerce Government & Public Sector Healthcare & Life Sciences Transportation, Travel & Hospitality IT & Telecom and Other Enterprise Verticals |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Biometric Adoption | 120 | IT Security Managers, Compliance Officers |

| Healthcare Biometric Solutions | 90 | Healthcare IT Directors, Patient Data Managers |

| Retail Sector Biometric Implementations | 80 | Store Managers, Loss Prevention Officers |

| Government Biometric Programs | 70 | Policy Makers, IT Administrators |

| Education Sector Biometric Systems | 60 | Campus Security Directors, IT Coordinators |

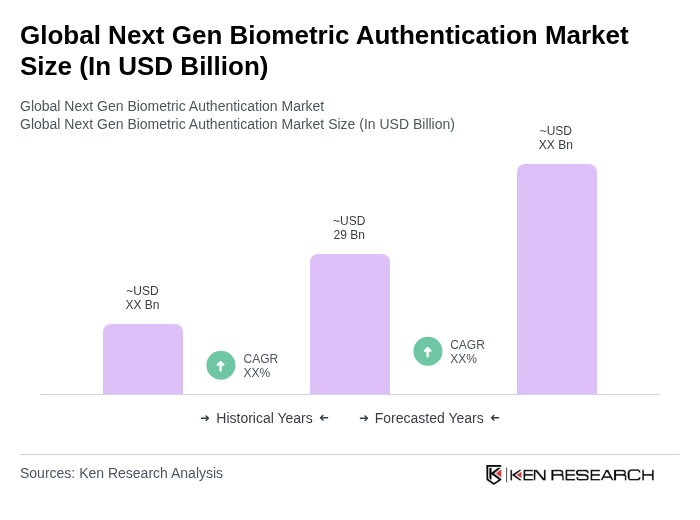

The Global Next Gen Biometric Authentication Market is valued at approximately USD 29 billion, reflecting a significant growth trend driven by the increasing demand for secure authentication methods across various sectors, including banking, healthcare, and government.