Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4835

Pages:99

Published On:December 2025

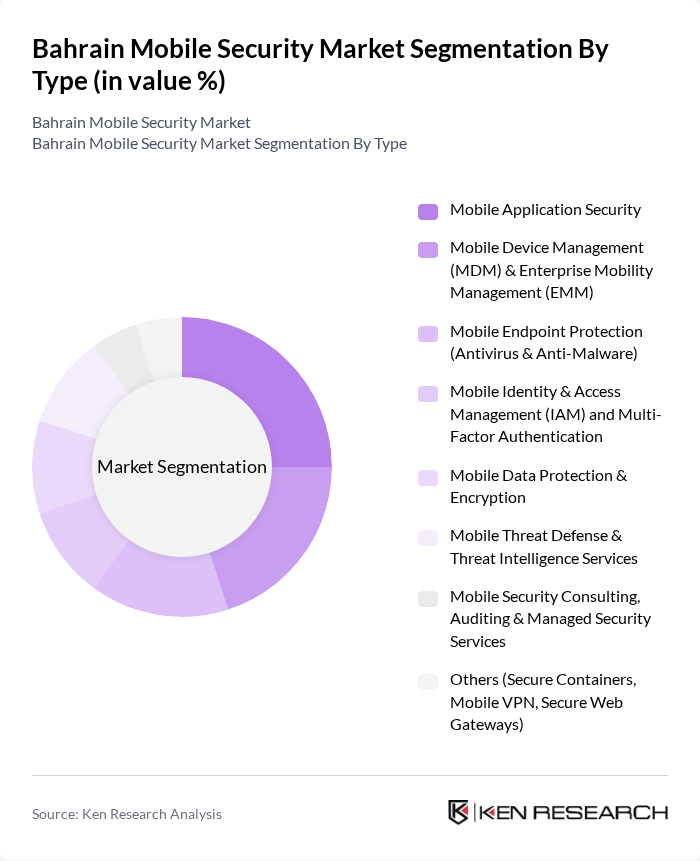

By Type:This segmentation includes various subsegments that cater to different aspects of mobile security, ensuring comprehensive protection for users and organizations.

The Mobile Application Security subsegment is currently dominating the market due to the increasing reliance on mobile applications for various services, including banking, shopping, government services, and communication, which raises the need to protect application code, APIs, and in?app data flows. As mobile threats evolve, businesses and consumers are prioritizing the security of their applications to protect sensitive data, particularly in sectors such as BFSI and telecom where digital channels are central to customer engagement. This trend is further fueled by the rise in mobile malware and phishing attacks globally and regionally, prompting organizations to invest heavily in application security solutions such as code scanning, RASP, and web application firewalls. The growing awareness of data privacy regulations, especially requirements under the Personal Data Protection Law for safeguarding personal data in digital channels, also drives demand for secure application development practices.

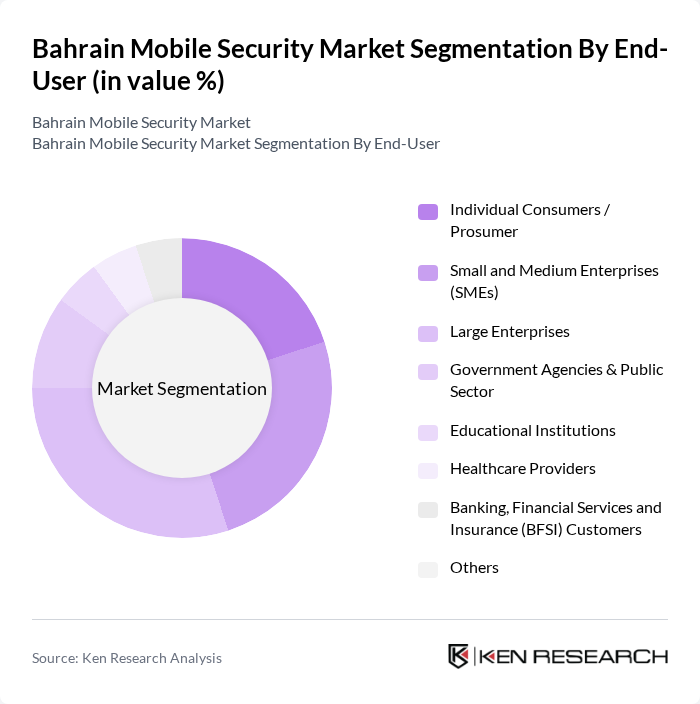

By End-User:This segmentation focuses on the various categories of users who require mobile security solutions, ranging from individual consumers to large enterprises.

Large Enterprises are leading the market segment due to their extensive use of mobile devices and applications for business operations, customer engagement, and field workforce enablement, as well as the critical need for robust security measures to protect sensitive corporate and customer data. The increasing trend of remote work, hybrid workplaces, and cloud adoption has heightened the focus on mobile security solutions, as these organizations face significant risks from credential theft, device loss, and targeted cyber threats. Additionally, compliance with sectoral and national cybersecurity requirements, including expectations under the National Cybersecurity Strategy and data protection obligations in regulated sectors such as BFSI and healthcare, and the need for secure communication channels further drive the demand for integrated mobile security, MDM/EMM, and IAM solutions among large enterprises.

The Bahrain Mobile Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as stc Bahrain (Saudi Telecom Company Bahrain), Bahrain Telecommunications Company B.S.C. (Batelco), Zain Bahrain B.S.C., Beyon Cyber (Batelco Group), Kalaam Telecom Bahrain B.S.C., Etisalcom Bahrain Company W.L.L., CTM360, SANS Institute – Bahrain Partnerships, Trend Micro Incorporated, Check Point Software Technologies Ltd., Fortinet, Inc., Cisco Systems, Inc., Palo Alto Networks, Inc., Kaspersky Lab, Microsoft Corporation – Enterprise Mobility + Security (EMS) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain mobile security market appears promising, driven by technological advancements and increasing regulatory pressures. As organizations continue to prioritize cybersecurity, the integration of artificial intelligence and machine learning into security solutions is expected to enhance threat detection capabilities. Additionally, the growing trend towards cloud-based security solutions will likely facilitate more scalable and cost-effective options for businesses, ensuring that mobile security remains a top priority in the digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Application Security Mobile Device Management (MDM) & Enterprise Mobility Management (EMM) Mobile Endpoint Protection (Antivirus & Anti-Malware) Mobile Identity & Access Management (IAM) and Multi-Factor Authentication Mobile Data Protection & Encryption Mobile Threat Defense & Threat Intelligence Services Mobile Security Consulting, Auditing & Managed Security Services Others (Secure Containers, Mobile VPN, Secure Web Gateways) |

| By End-User | Individual Consumers / Prosumer Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies & Public Sector Educational Institutions Healthcare Providers Banking, Financial Services and Insurance (BFSI) Customers Others |

| By Industry Vertical | Banking, Financial Services and Insurance (BFSI) Retail & E-commerce Telecommunications & ICT Service Providers Transportation, Logistics & Smart Mobility Oil & Gas, Energy and Utilities Government, Defense & Public Safety Healthcare & Life Sciences Others (Education, Media, Hospitality) |

| By Deployment Mode | On-Premises Cloud-Based (Public & Private) Hybrid Carrier-Grade / Network-Embedded Security |

| By Region | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate Others (Industrial Zones & Free Zones) |

| By Customer Size | Micro and Small Enterprises Medium Enterprises Large Enterprises & Strategic Accounts Public Sector & Critical National Infrastructure |

| By Security Features | Malware & Ransomware Protection Data Loss Prevention (DLP) & Data Privacy Controls Network & Mobile Traffic Security (VPN, Secure Web Gateway) Endpoint Detection & Response (EDR/XDR) for Mobile Fraud Prevention & Secure Mobile Payments Others (Compliance Monitoring, Audit & Reporting) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Mobile Security | 120 | IT Security Managers, Compliance Officers |

| Healthcare Mobile Security Solutions | 90 | Healthcare IT Directors, Data Protection Officers |

| Retail Sector Mobile Security Practices | 80 | Operations Managers, Security Analysts |

| Telecommunications Mobile Security Strategies | 100 | Network Security Engineers, Risk Management Executives |

| Government Mobile Security Initiatives | 70 | Policy Makers, Cybersecurity Advisors |

The Bahrain Mobile Security Market is valued at approximately USD 160 million, reflecting its growth in relation to the broader cybersecurity market in Bahrain, which is valued at around USD 425 million.