Region:Global

Author(s):Geetanshi

Product Code:KRAA2278

Pages:83

Published On:August 2025

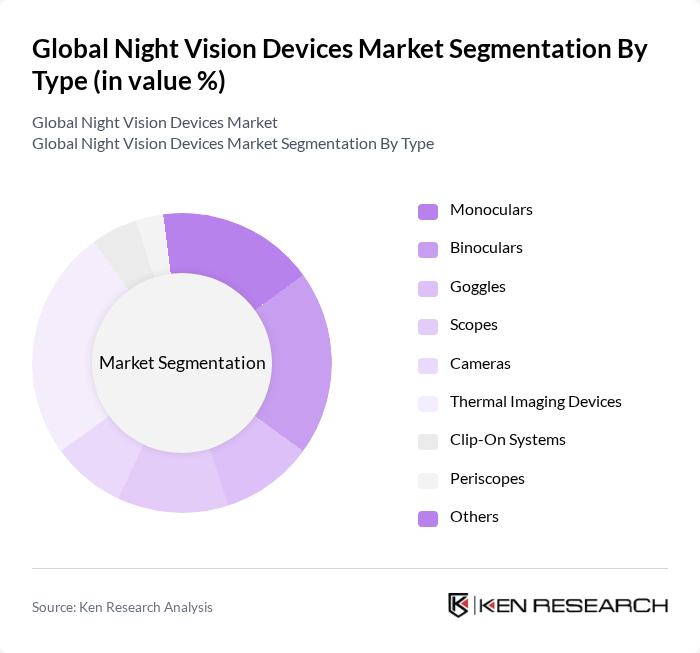

By Type:The night vision devices market is segmented into monoculars, binoculars, goggles, scopes, cameras, thermal imaging devices, clip-on systems, periscopes, and others. Among these, thermal imaging devices are experiencing significant growth due to their effectiveness in detecting heat signatures, making them essential for military, security, and search and rescue operations. Monoculars and binoculars also maintain substantial market shares, valued for their portability and widespread use in outdoor activities, wildlife observation, and law enforcement .

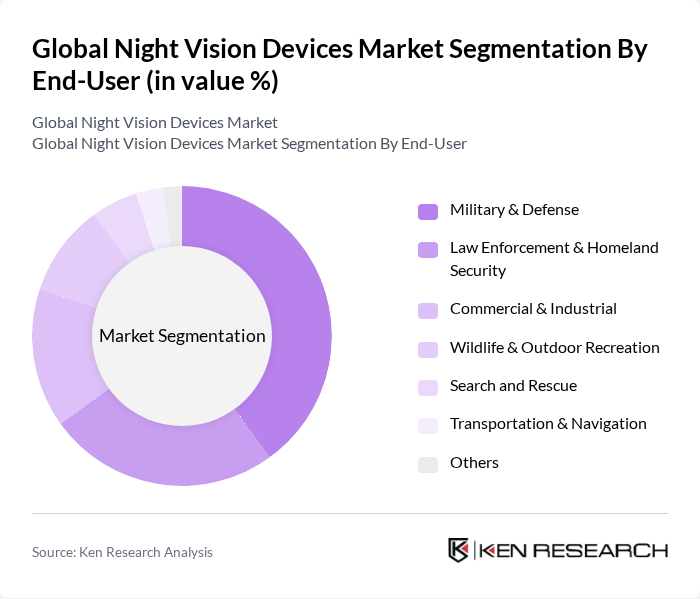

By End-User:The end-user segmentation includes military & defense, law enforcement & homeland security, commercial & industrial, wildlife & outdoor recreation, search and rescue, transportation & navigation, and others. The military & defense sector remains the largest consumer of night vision devices, driven by the need for advanced operational capabilities in low-light and night-time conditions. Law enforcement agencies also play a significant role, utilizing these devices for surveillance, border control, and tactical operations. Commercial and industrial applications are expanding, supported by the adoption of night vision for security, infrastructure monitoring, and outdoor recreation .

The Global Night Vision Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Teledyne FLIR LLC, L3Harris Technologies, Inc., Elbit Systems of America, LLC, American Technologies Network Corporation (ATN Corp.), BAE Systems plc, Night Optics USA, Pulsar (Yukon Advanced Optics Worldwide), Armasight, Sightmark, Nitehog, AGM Global Vision, Vortex Optics, Bushnell, Leupold & Stevens, Inc., EOTech, Thales Group, Raytheon Technologies Corporation, Bharat Electronics Limited (BEL), Excelitas Technologies Corp., Photonis Technologies S.A.S. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the night vision devices market appears promising, driven by ongoing technological innovations and increasing applications across various sectors. As defense budgets continue to rise, the demand for advanced surveillance solutions will likely grow. Additionally, the integration of night vision technology with smart devices and augmented reality applications is expected to create new opportunities, enhancing user experience and functionality in both military and civilian markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Monoculars Binoculars Goggles Scopes Cameras Thermal Imaging Devices Clip-On Systems Periscopes Others |

| By End-User | Military & Defense Law Enforcement & Homeland Security Commercial & Industrial Wildlife & Outdoor Recreation Search and Rescue Transportation & Navigation Others |

| By Application | Surveillance & Security Hunting & Shooting Sports Search and Rescue Operations Wildlife Observation & Research Navigation & Driving Assistance Military Operations Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Government Procurement Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Image Intensification Thermal Imaging Digital Night Vision Infrared Illumination Shortwave Infrared (SWIR) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Applications | 100 | Defense Procurement Officers, Military Technology Experts |

| Law Enforcement Usage | 60 | Police Equipment Managers, Tactical Unit Leaders |

| Consumer Market Insights | 50 | Outdoor Enthusiasts, Retail Buyers |

| Industrial Applications | 40 | Safety Managers, Industrial Equipment Buyers |

| Research & Development Feedback | 40 | Optical Engineers, Product Development Specialists |

The Global Night Vision Devices Market is valued at approximately USD 11.4 billion, driven by advancements in imaging technologies and increasing demand for surveillance and security applications across various sectors, including military and law enforcement.