Region:Global

Author(s):Shubham

Product Code:KRAD6576

Pages:95

Published On:December 2025

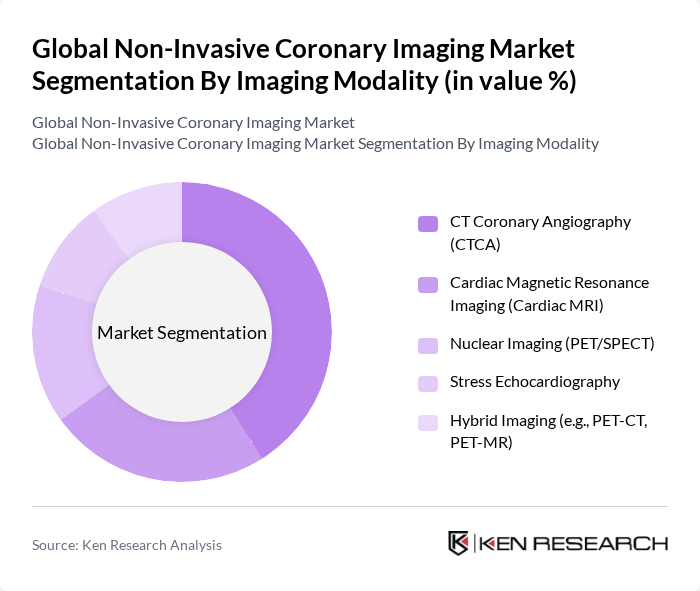

By Imaging Modality:The imaging modalities in the non-invasive coronary imaging market include various advanced technologies that cater to different diagnostic needs. The leading sub-segment is CT Coronary Angiography (CTCA), which is favored for its speed, high negative predictive value, and ability to visualize both lumen and plaque burden in suspected coronary artery disease. Cardiac Magnetic Resonance Imaging (Cardiac MRI) is also gaining traction due to its capability to provide functional, perfusion, and tissue characterization imaging without ionizing radiation, particularly useful in complex or equivocal coronary presentations and in younger or radiation-sensitive patients. Other modalities like Nuclear Imaging (PET/SPECT), Stress Echocardiography, and Hybrid Imaging (such as PET-CT and PET-MR) are utilized based on specific clinical requirements, including ischemia detection, myocardial viability assessment, and comprehensive anatomical–functional evaluation; radionuclide cardiac imaging and echocardiography remain widely used for functional and perfusion assessment, while hybrid imaging is gaining importance for combined anatomical and physiological insight.

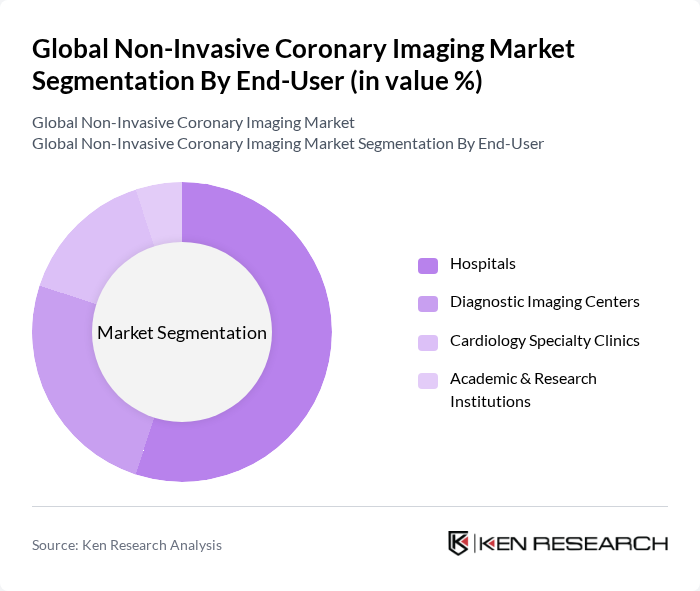

By End-User:The end-user segment of the non-invasive coronary imaging market includes various healthcare settings where these imaging modalities are utilized. Hospitals are the dominant end-user, as they have the necessary infrastructure, multidisciplinary teams, and reimbursement integration to conduct a wide range of advanced cardiac imaging procedures, including CTCA, cardiac MRI, nuclear studies, and echocardiography. Diagnostic Imaging Centers and Cardiology Specialty Clinics also play significant roles, providing specialized, often outpatient-focused services with faster throughput and competitive pricing, particularly for CT-based and ultrasound-based cardiac assessments. Academic & Research Institutions contribute to the market by focusing on innovation, clinical trials, AI-enabled image analysis, and training healthcare professionals in emerging non-invasive coronary imaging protocols and technologies.

The Global Non-Invasive Coronary Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers AG, GE HealthCare Technologies Inc., Philips Healthcare (Royal Philips), Canon Medical Systems Corporation, Fujifilm Healthcare Corporation, Agfa HealthCare NV, Hitachi, Ltd. (Hitachi Medical Systems / Fujifilm partnership), Mindray Medical International Limited, Samsung Medison Co., Ltd., Bracco Imaging S.p.A., HeartFlow, Inc., Cleerly, Inc., Circle Cardiovascular Imaging Inc., ArteryFlow Technology Co., Ltd., Neusoft Medical Systems Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of non-invasive coronary imaging is poised for significant transformation, driven by technological innovations and evolving healthcare paradigms. As telemedicine continues to gain traction, remote imaging consultations are expected to enhance patient access to diagnostic services in future. Additionally, the integration of artificial intelligence in imaging analysis will streamline workflows and improve diagnostic accuracy, fostering a more efficient healthcare delivery system. These trends indicate a promising trajectory for the market, emphasizing the importance of adaptability in meeting emerging healthcare needs.

| Segment | Sub-Segments |

|---|---|

| By Imaging Modality | CT Coronary Angiography (CTCA) Cardiac Magnetic Resonance Imaging (Cardiac MRI) Nuclear Imaging (PET/SPECT) Stress Echocardiography Hybrid Imaging (e.g., PET-CT, PET-MR) |

| By End-User | Hospitals Diagnostic Imaging Centers Cardiology Specialty Clinics Academic & Research Institutions |

| By Clinical Application | Stable Coronary Artery Disease Diagnosis Acute Chest Pain Evaluation Post-PCI and CABG Monitoring Microvascular & Ischemia Assessment Others |

| By Technology | AI-Enhanced Image Analysis Functional Flow Reserve CT (FFR-CT) D & 4D Advanced Visualization Cloud-Based / Remote Reading Platforms Others |

| By Patient Demographics | Adult Patients Pediatric Patients Geriatric Patients Others |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Healthcare Facility Ownership | Public Sector Private Sector Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiology Departments in Hospitals | 120 | Cardiologists, Department Heads |

| Radiology Clinics | 100 | Radiologists, Imaging Technologists |

| Healthcare Procurement Managers | 80 | Procurement Officers, Supply Chain Managers |

| Medical Device Manufacturers | 70 | Product Managers, R&D Directors |

| Health Insurance Providers | 60 | Policy Analysts, Claims Managers |

The Global Non-Invasive Coronary Imaging Market is valued at approximately USD 4.3 billion, driven by the rising prevalence of cardiovascular diseases and advancements in imaging technologies that emphasize early diagnosis and preventive healthcare.