Region:Global

Author(s):Geetanshi

Product Code:KRAA1293

Pages:87

Published On:August 2025

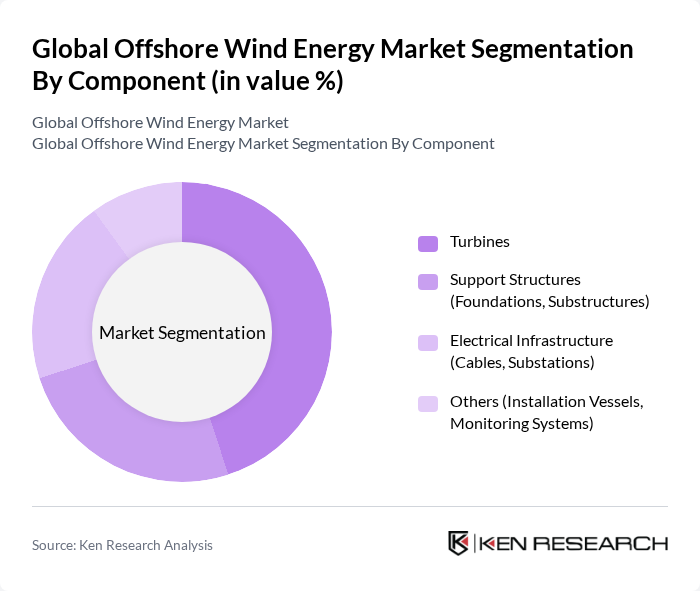

By Component:The components of offshore wind energy systems include essential elements that contribute to the overall functionality and efficiency of wind farms. The primary subsegments are Turbines, Support Structures (Foundations, Substructures), Electrical Infrastructure (Cables, Substations), and Others (Installation Vessels, Monitoring Systems). Among these, Turbines represent the largest and most critical component, as ongoing advancements in turbine technology have significantly increased energy output and efficiency, making them the dominant subsegment in the market.

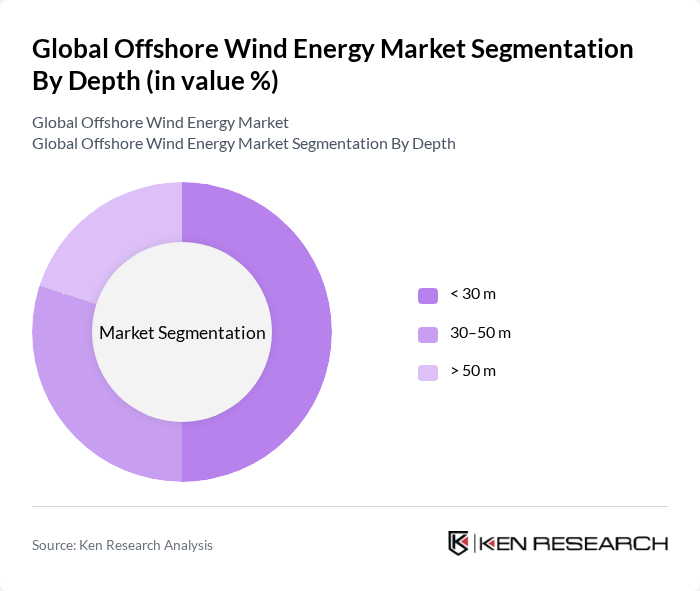

By Depth:The offshore wind energy market is segmented by the depth of water in which wind turbines are installed. The subsegments include less than 30 meters, 30–50 meters, and greater than 50 meters. The less than 30 meters depth category is currently the most prevalent, as it allows for easier installation and maintenance of wind farms, making it the leading subsegment in the market. Shallow water installations remain dominant due to lower construction complexity and costs, while technological advances are gradually expanding opportunities in deeper waters.

The Global Offshore Wind Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ørsted A/S, Siemens Gamesa Renewable Energy S.A., Vestas Wind Systems A/S, GE Renewable Energy, Nordex SE, RWE AG, EDP Renewables, Enel Green Power S.p.A., Iberdrola S.A., MingYang Smart Energy Group Co., Ltd., Shanghai Electric Wind Power Equipment Co., Ltd., Equinor ASA, SSE Renewables, TotalEnergies SE, BP plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the offshore wind energy market in None appears promising, driven by increasing investments and technological advancements. As governments prioritize renewable energy, the sector is expected to see a surge in new projects, particularly in floating wind farms, which can be deployed in deeper waters. Additionally, the integration of digital technologies will enhance operational efficiency, while public support for sustainability initiatives will further bolster market growth, creating a robust environment for offshore wind energy development.

| Segment | Sub-Segments |

|---|---|

| By Component | Turbines Support Structures (Foundations, Substructures) Electrical Infrastructure (Cables, Substations) Others (Installation Vessels, Monitoring Systems) |

| By Depth | < 30 m –50 m > 50 m |

| By Capacity | Up to 3 MW –5 MW Above 5 MW |

| By Location | Shallow Water Transitional Water Deep Water |

| By Region | Europe (UK, Germany, Netherlands, Rest of Europe) Asia Pacific (China, Japan, South Korea, Taiwan, Others) North America (US, Canada, Mexico) Rest of World (Latin America, Middle East & Africa) |

| By End-User | Utilities Independent Power Producers Government Entities |

| By Others | Niche Technologies Pilot Projects Research Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Offshore Wind Farm Development | 100 | Project Managers, Engineers, Developers |

| Regulatory Framework Analysis | 60 | Policy Makers, Regulatory Analysts |

| Supply Chain Management in Offshore Wind | 50 | Supply Chain Managers, Procurement Officers |

| Technological Innovations in Wind Turbines | 40 | R&D Managers, Technology Officers |

| Market Trends and Consumer Insights | 60 | Market Analysts, Energy Consultants |

The Global Offshore Wind Energy Market is valued at approximately USD 55 billion, driven by increasing investments in renewable energy, advancements in turbine technology, and a global shift towards sustainable energy sources.