Region:Europe

Author(s):Geetanshi

Product Code:KRAA3659

Pages:89

Published On:September 2025

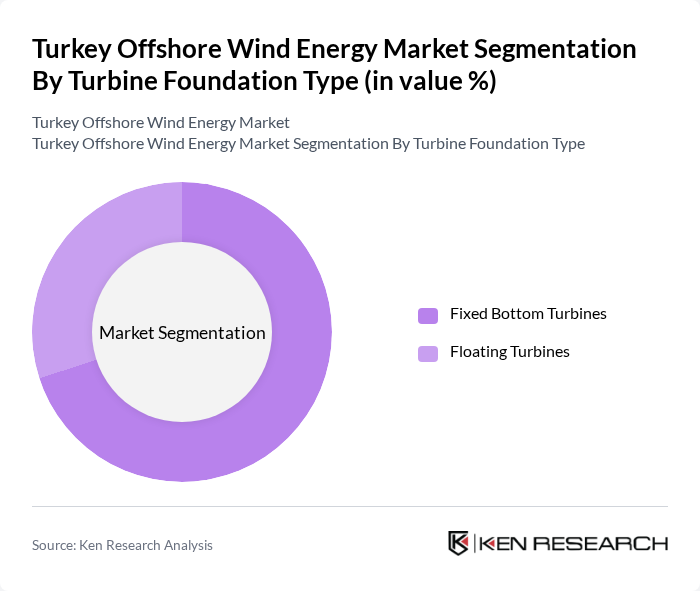

By Turbine Foundation Type:The market is segmented into Fixed Bottom Turbines and Floating Turbines. Fixed Bottom Turbines are primarily used in shallower waters and are currently the dominant technology due to their established design, lower installation costs, and technological maturity. Floating Turbines, while gaining traction globally, are still in the early stages of adoption in Turkey, primarily due to their higher costs and the technical challenges associated with deeper water installations. However, advancements in floating turbine technology and the need to access deeper, higher-wind sites are expected to drive gradual uptake in the coming years.

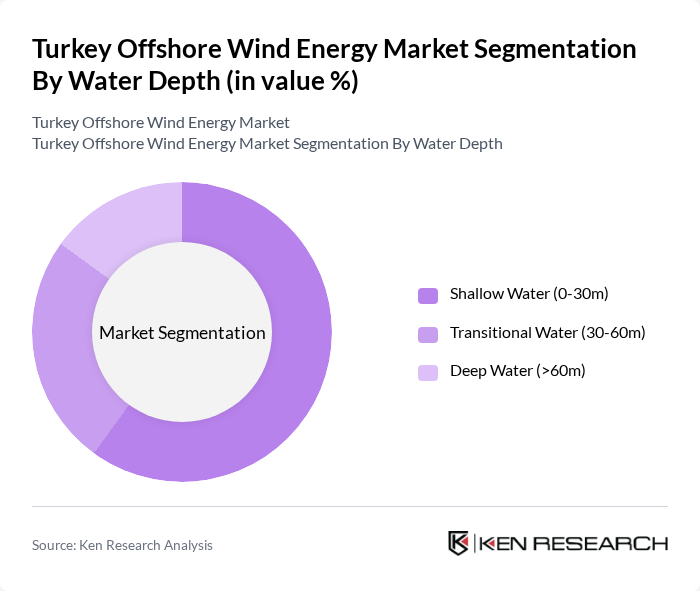

By Water Depth:The segmentation includes Shallow Water (0-30m), Transitional Water (30-60m), and Deep Water (>60m). Shallow Water installations dominate the market due to their cost-effectiveness and the maturity of fixed-bottom technology. Transitional and Deep Water segments are gradually developing, driven by the need for larger capacity installations and advancements in floating turbine technology, which enable projects in deeper, more exposed maritime zones with higher wind potential.

The Turkey Offshore Wind Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Gamesa Renewable Energy, Vestas Wind Systems A/S, GE Renewable Energy, Ørsted A/S, RWE Renewables, Enel Green Power, Iberdrola, EDP Renewables, Akfen Renewable Energy, Polat Energy, Borusan EnBW Enerji, Enerjisa Üretim, Kalyon Enerji, Zorlu Enerji, EÜA? (Elektrik Üretim A.?.) contribute to innovation, geographic expansion, and service delivery in this space. Partnerships between international technology providers and local firms are increasingly common, leveraging global expertise with domestic market knowledge to accelerate project development and technology transfer.

The future of Turkey's offshore wind energy market appears promising, driven by increasing energy demands and supportive government policies. In future, the market is expected to see significant advancements in technology, enhancing efficiency and reducing costs. Furthermore, the expansion of offshore wind farms is anticipated, with a focus on sustainable energy solutions. As public awareness of environmental issues grows, the sector is likely to attract more investments, fostering a robust renewable energy landscape in Turkey.

| Segment | Sub-Segments |

|---|---|

| By Turbine Foundation Type | Fixed Bottom Turbines Floating Turbines |

| By Water Depth | Shallow Water (0-30m) Transitional Water (30-60m) Deep Water (>60m) |

| By Geographic Location | Aegean Sea Mediterranean Sea Sea of Marmara Black Sea |

| By Turbine Capacity | Less than 3 MW 6 MW 10 MW Above 10 MW |

| By Project Development Stage | Planning and Permitting Under Construction Operational |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) |

| By End-User | Utilities Industrial Consumers Commercial Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Offshore Wind Project Developers | 50 | Project Managers, Business Development Executives |

| Energy Policy Makers | 40 | Government Officials, Regulatory Analysts |

| Technical Experts in Wind Energy | 40 | Engineers, Technical Directors |

| Investors in Renewable Energy | 40 | Investment Analysts, Fund Managers |

| Environmental Consultants | 40 | Sustainability Experts, Environmental Analysts |

The Turkey Offshore Wind Energy Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing demand for renewable energy, government incentives, and advancements in wind turbine technology.