Region:Europe

Author(s):Rebecca

Product Code:KRAA6994

Pages:81

Published On:September 2025

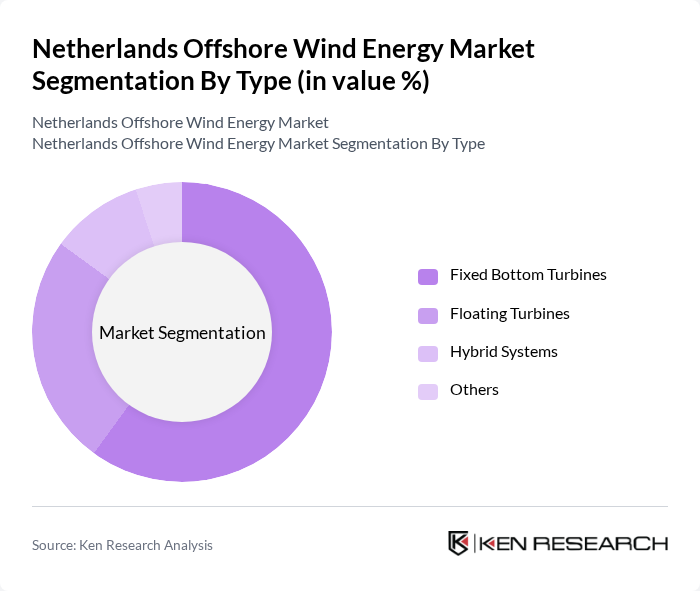

By Type:The market is segmented into various types, including Fixed Bottom Turbines, Floating Turbines, Hybrid Systems, and Others. Fixed Bottom Turbines dominate the market due to their established technology and cost-effectiveness in shallow waters. Floating Turbines are gaining traction as they allow for energy generation in deeper waters, expanding the potential for offshore wind farms. Hybrid Systems combine different technologies to optimize energy output, while the Others category includes emerging technologies that are still in the developmental phase.

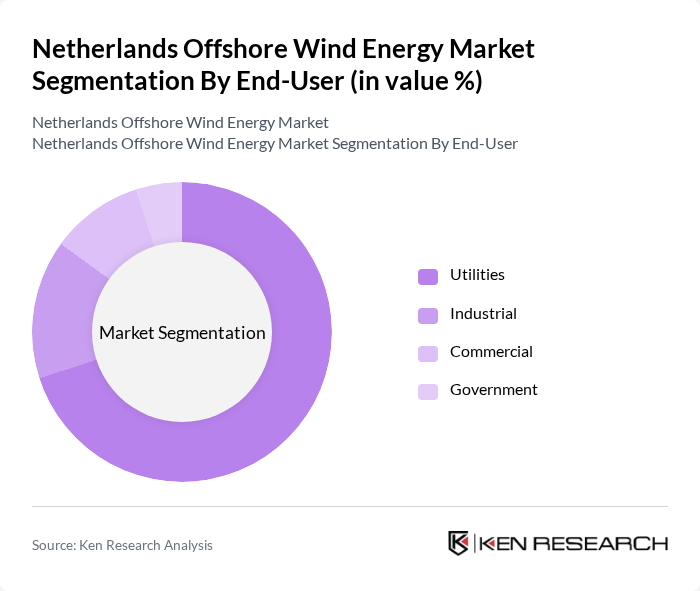

By End-User:The end-user segmentation includes Utilities, Industrial, Commercial, and Government sectors. Utilities are the largest end-users, driven by the need for renewable energy sources to meet regulatory requirements and consumer demand. The Industrial sector follows, as companies seek to reduce their carbon footprint and energy costs. The Commercial sector is increasingly investing in renewable energy solutions, while Government entities are focused on large-scale projects to achieve national energy goals.

The Netherlands Offshore Wind Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ørsted A/S, Siemens Gamesa Renewable Energy S.A., Vattenfall AB, RWE AG, EDP Renewables, Shell New Energies, Enel Green Power, GE Renewable Energy, Nordex SE, Senvion S.A., MHI Vestas Offshore Wind A/S, Equinor ASA, TotalEnergies SE, E.ON SE, Iberdrola S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands offshore wind energy market appears promising, driven by increasing energy demands and robust government support. In the future, the focus will shift towards enhancing grid connectivity and integrating energy storage solutions, which will facilitate the efficient distribution of generated power. Furthermore, the rise of floating wind farms is expected to unlock new areas for development, allowing for greater capacity and efficiency in harnessing wind energy, thus positioning the Netherlands as a leader in renewable energy.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed Bottom Turbines Floating Turbines Hybrid Systems Others |

| By End-User | Utilities Industrial Commercial Government |

| By Application | Power Generation Research and Development Infrastructure Development Others |

| By Investment Source | Private Investments Public Funding International Investments Others |

| By Policy Support | Subsidies Tax Incentives Renewable Energy Certificates (RECs) Others |

| By Technology | Direct Drive Technology Gearbox Technology Advanced Control Systems Others |

| By Distribution Mode | Direct Sales Partnerships Online Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Offshore Wind Project Developers | 100 | Project Managers, Business Development Leads |

| Energy Regulatory Authorities | 80 | Policy Analysts, Regulatory Affairs Managers |

| Utility Companies Engaged in Wind Energy | 90 | Energy Analysts, Operations Managers |

| Environmental Consultants | 70 | Sustainability Experts, Environmental Impact Assessors |

| Technology Providers for Wind Turbines | 60 | Product Managers, R&D Engineers |

The Netherlands Offshore Wind Energy Market is valued at approximately USD 25 billion, reflecting significant growth driven by increasing demand for renewable energy, government initiatives, and advancements in wind turbine technology.