Region:Global

Author(s):Rebecca

Product Code:KRAA2925

Pages:88

Published On:August 2025

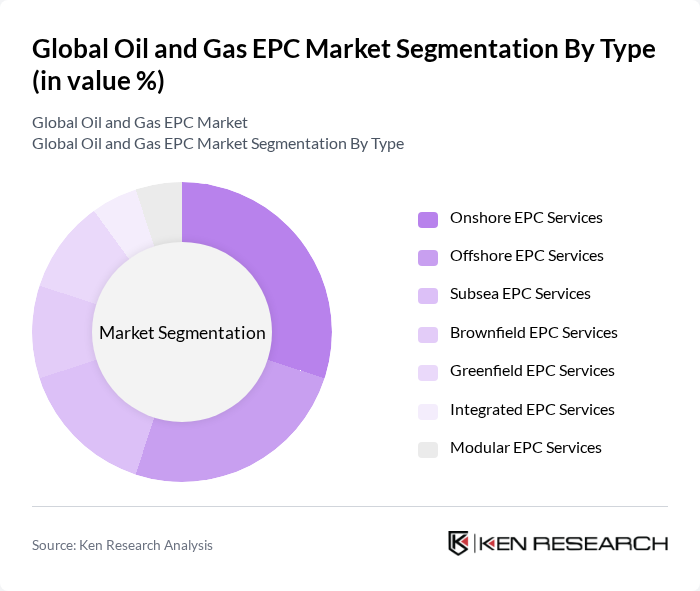

By Type:The market is segmented into various types of EPC services, including Onshore EPC Services, Offshore EPC Services, Subsea EPC Services, Brownfield EPC Services, Greenfield EPC Services, Integrated EPC Services, and Modular EPC Services. Each of these segments addresses different project requirements and operational environments, reflecting the diverse nature of the oil and gas industry. Onshore EPC Services constitute the largest segment, driven by the high number of onshore projects and the ability to leverage existing infrastructure, especially in North America and the Middle East. Offshore and subsea segments are also significant, supported by ongoing investments in offshore exploration and production.

The Onshore EPC Services segment is currently dominating the market due to the high volume of onshore oil and gas projects, particularly in North America and the Middle East. This segment benefits from lower operational costs and the ability to leverage existing infrastructure. The increasing focus on shale gas and tight oil production has further propelled the demand for onshore services, making it a critical area for EPC providers.

By End-User:The market is segmented by end-users, including National Oil Companies (NOCs), International Oil Companies (IOCs), Independent Oil & Gas Producers, Refining & Petrochemical Companies, and Government and Public Sector entities. Each end-user category has distinct needs and project scopes, influencing the overall demand for EPC services. National Oil Companies (NOCs) are the leading end-users, supported by substantial government investments and a focus on energy security. International Oil Companies (IOCs) and independent producers are also major contributors, especially in regions with active exploration and production activities.

National Oil Companies (NOCs) are the leading end-users in the market, primarily due to their substantial investments in oil and gas exploration and production projects. These companies often have the backing of their respective governments, allowing them to undertake large-scale projects that require extensive EPC services. The strategic importance of energy security further enhances their role in driving demand for EPC services.

The Global Oil and Gas EPC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bechtel Corporation, Fluor Corporation, KBR, Inc., Technip Energies NV, Saipem S.p.A., Jacobs Solutions Inc., McDermott International, Ltd., Worley Limited, Aker Solutions ASA, John Wood Group PLC, Samsung Engineering Co., Ltd., JGC Holdings Corporation, Chiyoda Corporation, Petrofac Limited, and Larsen & Toubro Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the oil and gas EPC market is poised for transformation, driven by the dual pressures of energy demand and sustainability. As countries strive to meet their emission reduction targets, the integration of renewable energy sources into traditional oil and gas operations will become increasingly vital. Additionally, the adoption of digital technologies, such as AI and IoT, will enhance operational efficiency and safety, positioning the EPC sector for growth amidst evolving market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore EPC Services Offshore EPC Services Subsea EPC Services Brownfield EPC Services Greenfield EPC Services Integrated EPC Services Modular EPC Services |

| By End-User | National Oil Companies (NOCs) International Oil Companies (IOCs) Independent Oil & Gas Producers Refining & Petrochemical Companies Government and Public Sector |

| By Application | Upstream (Exploration & Production) Midstream (Pipelines, Storage, LNG Terminals) Downstream (Refining, Petrochemicals) LNG Projects |

| By Investment Source | Private Investments Public Funding Foreign Direct Investment (FDI) Joint Ventures |

| By Project Size | Small Scale Projects ( |

| By Contract Type | Lump Sum Turnkey (LSTK) Contracts Cost-Plus Contracts Unit Price Contracts EPCM (Engineering, Procurement, Construction Management) Contracts |

| By Region | North America Europe Asia Pacific Middle East & Africa Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil and Gas Projects | 120 | Project Managers, Field Engineers |

| Midstream Infrastructure Development | 90 | Operations Managers, Pipeline Engineers |

| Downstream Refinery EPC Contracts | 60 | Procurement Officers, Plant Managers |

| Renewable Energy Integration in Oil & Gas | 50 | Sustainability Managers, R&D Directors |

| Global EPC Market Trends | 100 | Industry Analysts, Market Researchers |

The Global Oil and Gas EPC Market is valued at approximately USD 53 billion, driven by increasing energy demand, technological advancements, and significant infrastructure investments. This market reflects the industry's adaptation to evolving energy landscapes and the integration of renewable energy infrastructure.