Global Oncolytic Virotherapy Market Overview

- The Global Oncolytic Virotherapy Market is valued at USD 150 million, based on a five-year historical analysis. This growth is primarily driven by increasing investments in cancer research, rapid advancements in viral therapy technologies, and a rising prevalence of cancer worldwide. The market is further supported by a growing number of clinical trials, robust regulatory approvals, and the increasing acceptance of oncolytic viruses as a viable treatment option for various cancers. Advances in genetic engineering and biotechnology have enabled the development of more effective and targeted viral therapies, enhancing their therapeutic potential and clinical adoption .

- Key players in this market include the United States, Canada, Germany, and the United Kingdom. The dominance of these countries is attributed to their robust healthcare infrastructure, significant funding for cancer research, and a high concentration of biotechnology firms specializing in oncolytic virotherapy. Additionally, these regions have established regulatory frameworks that facilitate the development and approval of innovative therapies, with agencies such as the FDA and EMA actively supporting streamlined approval processes and orphan drug designations for oncolytic virus products .

- In 2023, the U.S. Food and Drug Administration (FDA) implemented new guidelines to expedite the approval process for oncolytic virus therapies. Specifically, the FDA's "Guidance for Industry: Expedited Programs for Serious Conditions – Drugs and Biologics" (2023) outlines accelerated approval pathways for therapies targeting serious conditions, including cancer. These guidelines enable earlier patient access to innovative treatments by allowing for approval based on surrogate endpoints and early clinical data, thereby fostering a more efficient development process for oncolytic virotherapy products .

Global Oncolytic Virotherapy Market Segmentation

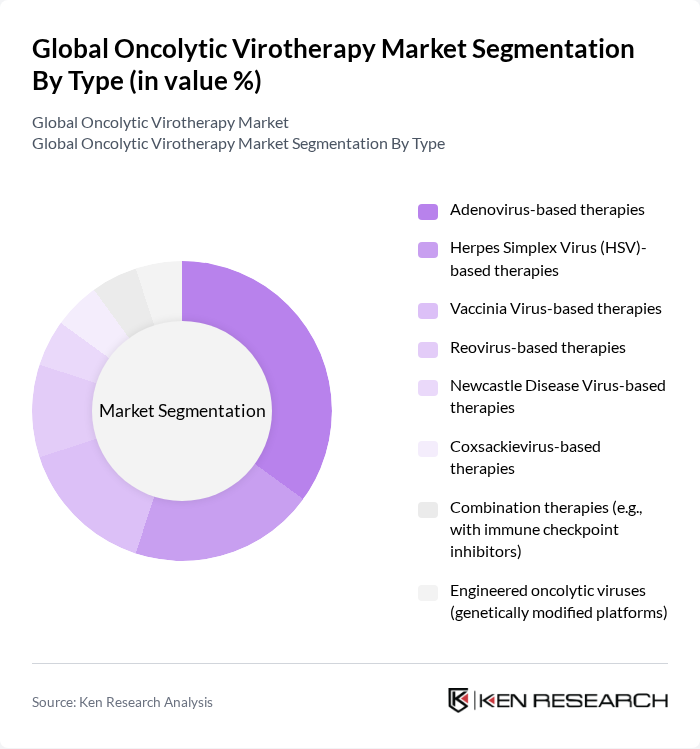

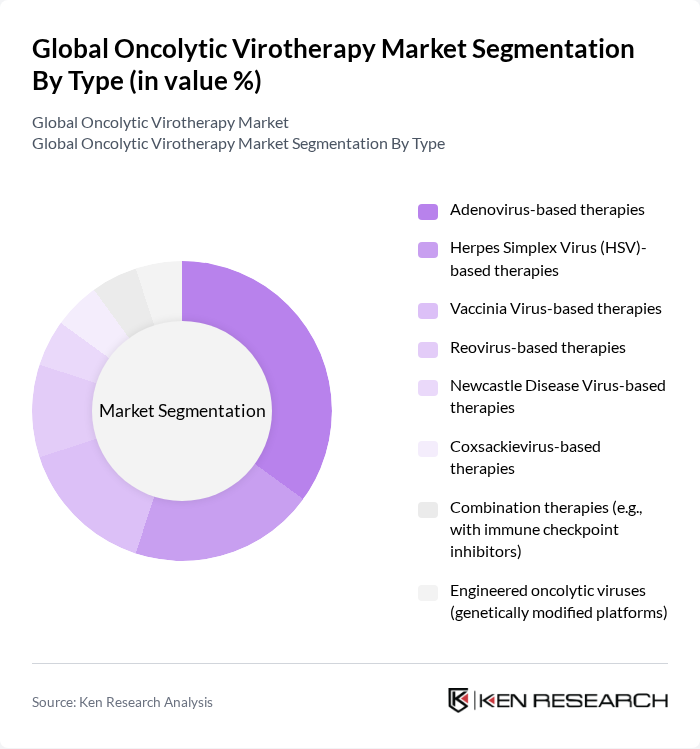

By Type:The oncolytic virotherapy market is segmented into various types, including adenovirus-based therapies, herpes simplex virus (HSV)-based therapies, vaccinia virus-based therapies, reovirus-based therapies, Newcastle disease virus-based therapies, coxsackievirus-based therapies, combination therapies (e.g., with immune checkpoint inhibitors), and engineered oncolytic viruses (genetically modified platforms). Among these,adenovirus-based therapiesare currently leading the market due to their effectiveness in targeting cancer cells and their established safety profile. The increasing number of clinical trials and successful outcomes have further solidified their position as a preferred choice in oncolytic virotherapy. Additionally, combination therapies with immune checkpoint inhibitors are gaining traction, reflecting the market's focus on synergistic approaches to cancer treatment .

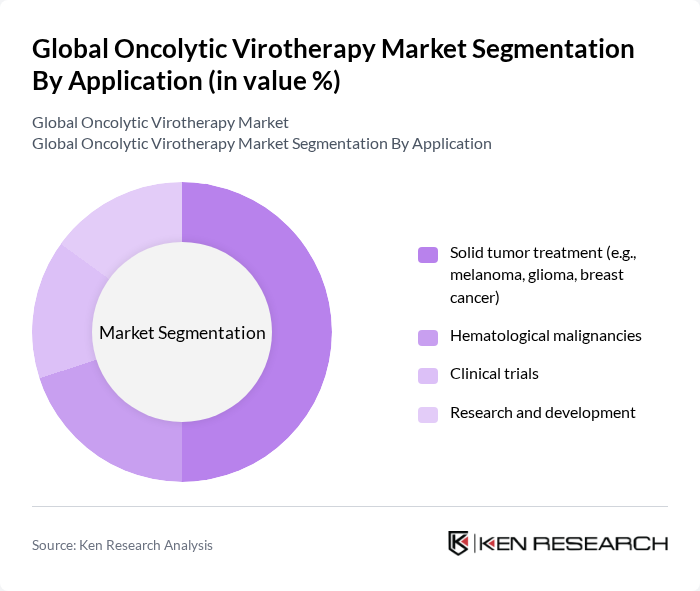

By Application:The applications of oncolytic virotherapy include solid tumor treatment (e.g., melanoma, glioma, breast cancer), hematological malignancies, clinical trials, and research and development.Solid tumor treatmentis the dominant application segment, driven by the high incidence of various solid tumors and the increasing demand for effective treatment options. The success of oncolytic viruses in clinical trials for solid tumors has led to a growing interest among healthcare providers and patients, further propelling this segment's growth. Hematological malignancies and research applications are also expanding, supported by ongoing innovation and clinical research .

Global Oncolytic Virotherapy Market Competitive Landscape

The Global Oncolytic Virotherapy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amgen Inc., Oncolytics Biotech Inc., Merck & Co., Inc., Bristol-Myers Squibb Company, AstraZeneca PLC, Pfizer Inc., Roche Holding AG, Novartis AG, Gilead Sciences, Inc., Regeneron Pharmaceuticals, Inc., Takeda Pharmaceutical Company Limited, Eli Lilly and Company, Sanofi S.A., Celgene Corporation, Genentech, Inc., SillaJen, Inc., Replimune Group Inc., CG Oncology, Inc., Transgene S.A. contribute to innovation, geographic expansion, and service delivery in this space.

Global Oncolytic Virotherapy Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Cancer:The global cancer burden is projected to reach approximately 29.5 million new cases in future, according to the World Health Organization. This alarming rise in cancer incidence drives demand for innovative treatments like oncolytic virotherapy. In future, the estimated number of cancer-related deaths is expected to exceed 10 million, highlighting the urgent need for effective therapies. This growing patient population creates a significant market opportunity for oncolytic virotherapy developers to address unmet medical needs.

- Advancements in Genetic Engineering:The global genetic engineering market size is estimated to be approximately USD 28 billion in future, driven by innovations in CRISPR and gene editing technologies. These advancements facilitate the development of more effective oncolytic viruses tailored to target specific cancer types. Enhanced precision in genetic engineering allows for the creation of virotherapies that can selectively destroy cancer cells while sparing healthy tissue, thus improving patient outcomes and expanding the therapeutic landscape for oncological treatments.

- Rising Investment in Cancer Research:Global funding for cancer research is estimated to exceed USD 200 billion in future, with significant contributions from both public and private sectors. This influx of capital supports the development of oncolytic virotherapy, enabling clinical trials and innovative research initiatives. Increased funding fosters collaboration among research institutions, biotech firms, and pharmaceutical companies, accelerating the pace of discovery and bringing new therapies to market more efficiently, ultimately benefiting patients worldwide.

Market Challenges

- High Development Costs:The average cost of developing a new cancer therapy can exceed USD 2.6 billion, according to the Tufts Center for the Study of Drug Development. These high costs pose a significant barrier for companies focusing on oncolytic virotherapy, as they must secure substantial funding to support research, clinical trials, and regulatory approvals. The financial burden can deter smaller firms from entering the market, limiting innovation and competition in this promising field.

- Regulatory Hurdles:Navigating the regulatory landscape for oncolytic virotherapy can be complex and time-consuming. The U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) have stringent guidelines for clinical trials and product approvals. The average time for drug approval is estimated to be around 10 years, which can delay the introduction of new therapies. These regulatory challenges can hinder market entry and slow the overall growth of the oncolytic virotherapy sector.

Global Oncolytic Virotherapy Market Future Outlook

The future of oncolytic virotherapy appears promising, driven by ongoing advancements in genetic engineering and increasing investments in cancer research. As the prevalence of cancer continues to rise, the demand for innovative therapies will likely grow. Additionally, the integration of personalized medicine and artificial intelligence in treatment planning is expected to enhance the efficacy of oncolytic therapies. These trends indicate a robust pipeline of new treatments that could significantly improve patient outcomes in the coming years.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets, particularly in Asia-Pacific and Latin America, are witnessing a surge in cancer cases, creating a substantial demand for oncolytic therapies. In future, these regions are expected to account for over 40 percent of global cancer cases, presenting lucrative opportunities for companies to introduce innovative treatments tailored to local needs and healthcare infrastructures.

- Collaborations with Biotech Firms:Strategic partnerships between pharmaceutical companies and biotech firms can accelerate the development of oncolytic virotherapy. Collaborations can leverage complementary expertise and resources, enhancing research capabilities. In future, such partnerships are projected to increase, fostering innovation and expediting the clinical development of new therapies, ultimately benefiting patients and stakeholders alike.