Region:Global

Author(s):Shubham

Product Code:KRAA3151

Pages:88

Published On:August 2025

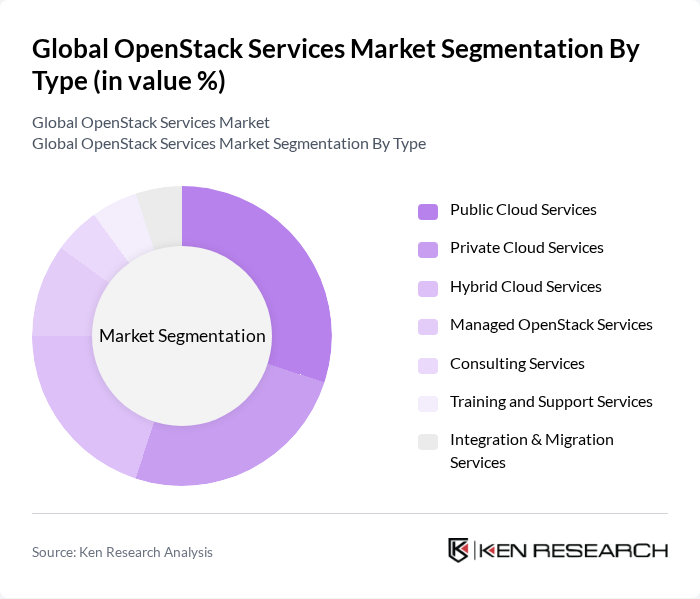

By Type:The market is segmented into various types of services that cater to different customer needs. The subsegments include Public Cloud Services, Private Cloud Services, Hybrid Cloud Services, Managed OpenStack Services, Consulting Services, Training and Support Services, and Integration & Migration Services. Each of these subsegments plays a crucial role in addressing specific requirements of businesses looking to leverage OpenStack technologies.

ThePublic Cloud Servicessegment is currently dominating the market due to its scalability, cost-effectiveness, and ease of access. Organizations are increasingly opting for public cloud solutions to reduce their IT infrastructure costs and enhance operational efficiency. The flexibility offered by public cloud services allows businesses to scale their resources according to demand, making it an attractive option for startups and large enterprises alike. Additionally, the growing trend of remote work has further accelerated the adoption of public cloud services, as they provide seamless access to applications and data from anywhere.

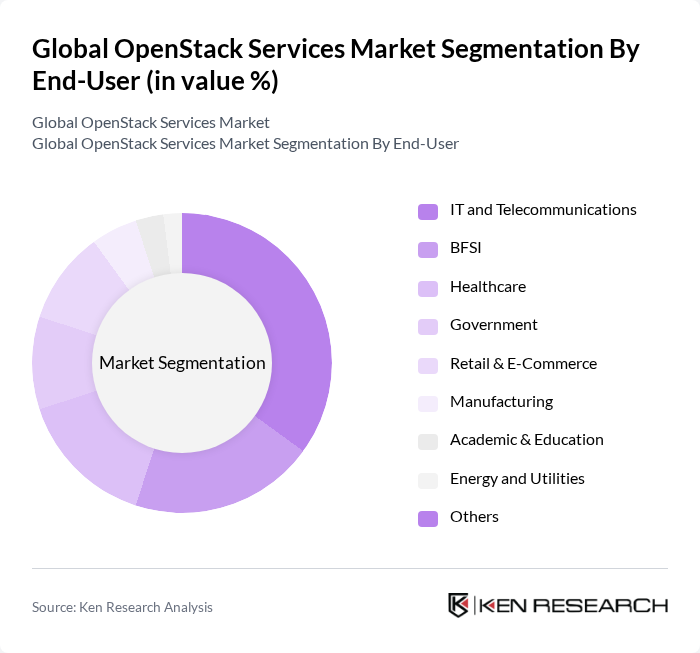

By End-User:The market is segmented based on various end-user industries, including IT and Telecommunications, BFSI (Banking, Financial Services, and Insurance), Healthcare, Government, Retail & E-Commerce, Manufacturing, Academic & Education, Energy and Utilities, and Others. Each of these sectors has unique requirements and challenges that OpenStack services can address effectively.

TheIT and Telecommunicationssector is the leading end-user of OpenStack services, driven by the need for robust and scalable infrastructure to support a growing number of applications and services. The rapid digital transformation in this sector has led to increased demand for cloud solutions that can provide flexibility and efficiency. Additionally, the BFSI sector is also a significant contributor, as financial institutions seek to enhance their IT capabilities while ensuring compliance with stringent regulations. The healthcare sector is increasingly adopting OpenStack services to manage patient data securely and improve service delivery.

The Global OpenStack Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Red Hat, Inc., Canonical Ltd., SUSE Linux GmbH, Mirantis, Inc., Rackspace Technology, Inc., IBM Corporation, Hewlett Packard Enterprise (HPE), VMware, Inc., Oracle Corporation, Cisco Systems, Inc., Atos SE, Fujitsu Limited, Wipro Limited, Infosys Limited, Tata Consultancy Services (TCS), Huawei Technologies Co., Ltd., NEC Corporation, Dell Technologies Inc., Accenture plc, Tech Mahindra Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of OpenStack services is poised for growth, driven by the increasing shift towards multi-cloud strategies and the demand for hybrid cloud solutions. As organizations seek to optimize their cloud environments, the integration of automation and orchestration technologies will become essential. Additionally, the focus on sustainability in cloud services will shape development, as companies aim to reduce their carbon footprint while leveraging OpenStack's capabilities for efficient resource management.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Cloud Services Private Cloud Services Hybrid Cloud Services Managed OpenStack Services Consulting Services Training and Support Services Integration & Migration Services |

| By End-User | IT and Telecommunications BFSI (Banking, Financial Services, and Insurance) Healthcare Government Retail & E-Commerce Manufacturing Academic & Education Energy and Utilities Others |

| By Deployment Model | On-Cloud Deployment On-Premises Deployment Hybrid Deployment |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Others |

| By Industry Vertical | IT & Telecom BFSI Healthcare Government Retail & E-Commerce Manufacturing Academic & Education Energy and Utilities Media and Entertainment Transportation and Logistics Others |

| By Geographic Presence | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Pricing Model | Subscription-Based Pricing Pay-As-You-Go Pricing Tiered Pricing Custom Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise OpenStack Deployments | 100 | IT Managers, Cloud Architects |

| Service Provider Offerings | 80 | Product Managers, Business Development Leads |

| Government Cloud Initiatives | 60 | Policy Makers, IT Directors |

| SME Adoption of OpenStack | 50 | Small Business Owners, IT Consultants |

| OpenStack Community Engagement | 40 | Developers, Community Managers |

The Global OpenStack Services Market is valued at approximately USD 20.5 billion, reflecting significant growth driven by the increasing adoption of cloud computing solutions and the demand for scalable, cost-effective IT infrastructure across various industries.